If you're anything like me, you've got subscriptions coming out of your ears. Streaming services, software tools, news apps, maybe even a fancy coffee subscription. They're convenient, sure, but they have a sneaky way of piling up.

This is what I call ‘subscription creep’. Those small monthly charges don't feel like much on their own, but together they can quietly drain your bank account. It’s a huge, often unnoticed, expense for everyone from freelancers to small businesses.

Finally Get a Handle on Your Subscriptions

c05cb09b-be4d-42be-936a-bf1fbbc5a65a.jpg

We've all been there. You sign up for a free trial of some new design tool, use it for a week, and then completely forget about it. Three months later, you spot the charge on your bank statement and realise you've been paying for two similar platforms the whole time. It's frustrating, and those forgotten payments can easily cost hundreds of pounds a year.

The real problem is the lack of a single source of truth. With subscriptions scattered across different credit cards, PayPal, and bank accounts, it's almost impossible to get a clear picture of where your money is actually going.

MyMembers was literally built to fix this. Think of it as your command centre, pulling all those recurring payments into one clean, organised dashboard.

It turns the nightmare of managing subscriptions into a simple, almost automated process. No more reacting to surprise charges. Instead, you get proactive. You can finally:

- See every single active subscription in one place. No more guesswork.

- Find where you're overspending and identify opportunities to save.

- Control every renewal and cancellation with alerts that actually work.

It's all about bringing some order to the chaos. This way, you take back control of your finances and make sure you're only paying for the services you genuinely use and love.

Building Your Subscription Management Dashboard

Let’s be honest, taking control of your subscriptions starts with one thing: seeing them all in one place. Setting up your MyMembers dashboard is that first, crucial step. It’s how you go from financial guesswork to having a complete, unified view of every single recurring payment.

The first thing you’ll do is securely link your financial accounts. From there, MyMembers gets to work, automatically scanning your transaction history to sniff out and import every subscription it can find. This is often an eye-opening moment, as services you’d completely forgotten about are suddenly brought back into the light.

Once everything's imported, the real organisation can begin.

Categorise and Conquer Your Spending

This isn’t just about making a list of payments; it’s about actually understanding where your money is going. MyMembers lets you create custom categories that actually make sense for your life or business. Ditch the generic labels and build something that gives you genuine insight.

For instance, you might set up categories like:

- Entertainment: For all the usual suspects like Spotify, Netflix, and any gaming subscriptions.

- Work Tools: To keep track of software like Adobe Creative Cloud or your project management app.

- Wellness: A place to group your gym membership and meditation app fees.

This kind of segmentation is surprisingly powerful. All of a sudden, you get a crystal-clear picture of your spending habits. If you're a creator looking to build your own service, our guide on starting a subscription-based business offers some great tips for structuring your own offerings.

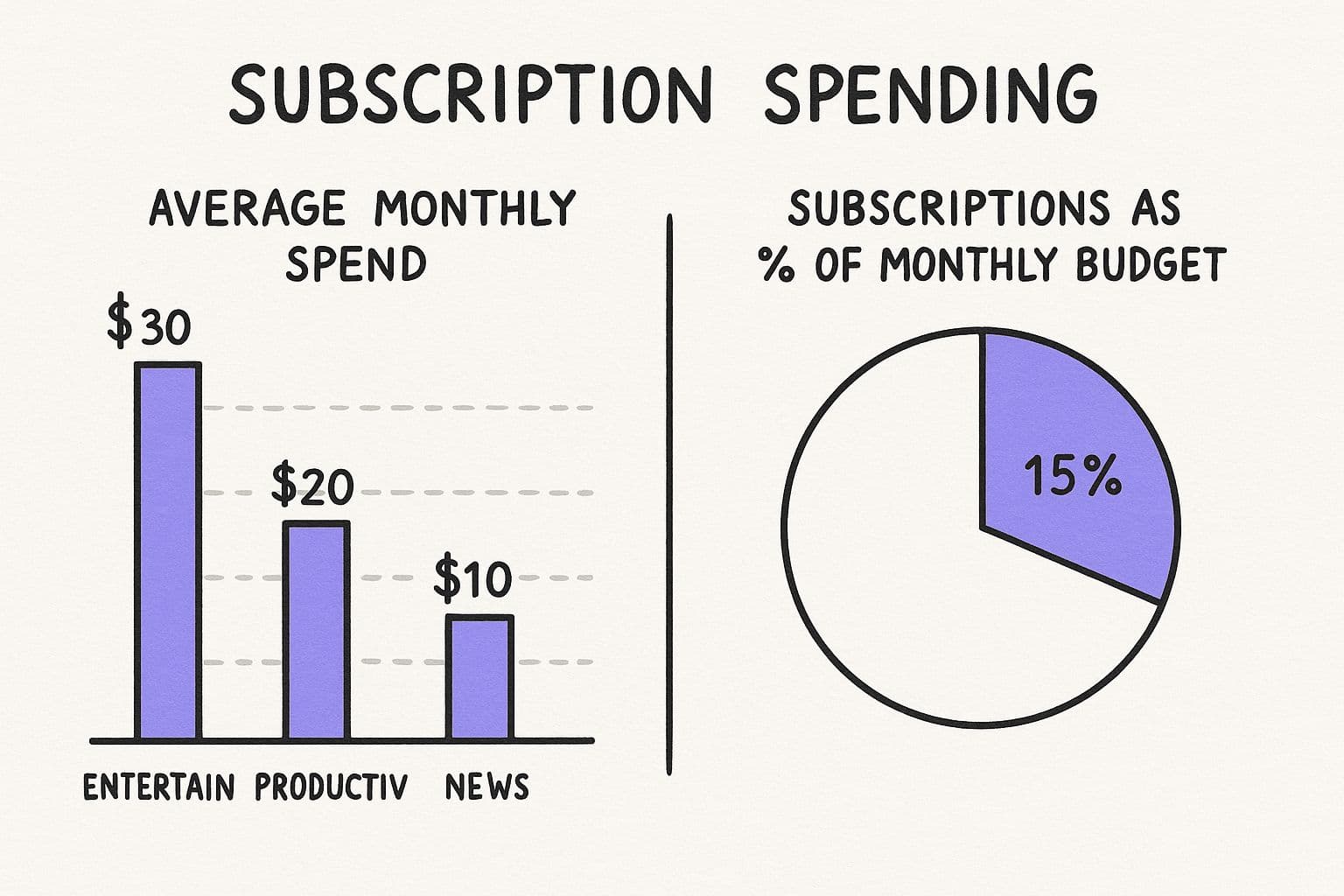

This is a pretty common breakdown of how monthly subscription spending can stack up across different areas.

3d47cd88-023c-43ee-b15d-bdc02359e47e.jpg

Seeing the data visualised like this really hits home. It shows how even those small, individual costs can quickly add up to become a significant chunk of your overall monthly outgoings. With the sheer growth in services, especially for entertainment, this kind of tracking has become essential.

A killer move is to set budget alerts for each category you create. For example, you could cap your 'Entertainment' spend at £50 a month and get a notification when you're getting close.

This simple, proactive approach stops you from overspending before it even happens. Just look at the explosion of streaming services to see why this matters. In the UK, a staggering 20.1 million homes had at least one video subscription in early 2025, and countless households are juggling several at once. By creating a specific category for streaming, you can instantly see the cumulative cost and make much smarter decisions about which services you truly need.

Streamlining Payments And Subscription Tiers

e62ed72d-2858-48da-bc88-8d05fabb2318.jpg

Seeing all your subscriptions in one place is a good start, but real financial control comes from actively managing the payments themselves. This is where you go from just tracking your spending to making strategic moves that protect your budget. MyMembers is built for this, with smart features designed for granular control.

One of the most powerful tools in your arsenal is the ability to create virtual cards. Think of them as unique, single-purpose debit cards for each subscription you have. Instead of handing over your main card details to every service, you just assign a dedicated virtual card.

Gaining Control With Virtual Cards

This one simple step has massive security benefits. If one service gets hit by a data breach, your main bank account is completely walled off and safe. Better yet, you can instantly pause or cap the spending on any virtual card straight from your MyMembers dashboard. It’s like having an immediate kill switch for any payment.

- Instantly Pause Payments: See a charge you don’t recognise? Just pause the card with a single click while you figure it out.

- Set Firm Spending Limits: Assign a strict monthly limit to a card to stop surprise price hikes or unwanted plan upgrades dead in their tracks.

- Enhance Security: By isolating each service, a breach at one company can’t compromise your entire financial setup.

This level of control is becoming essential as payment systems get more complex. If you're curious about how payment platforms are evolving, check out updates like Blockbee's new subscription features to see how the industry is tackling recurring billing.

The goal here is to shift from being reactive to proactive. You’re no longer just watching money leave your account; you're directing the flow and protecting yourself at every turn.

Actively Manage Your Subscription Levels

Beyond just the payments, MyMembers lets you get your hands on the actual service tiers you’re paying for. How many times have you signed up for a 'Premium' software package, only to realise you barely touch the advanced features? It’s an incredibly common money drain.

Just look at the UK's adoption of streaming services, which shot up by 230% between 2015 and 2024. It shows just how quickly these small costs can pile up into something significant.

Instead of wrestling with a confusing vendor website just to downgrade your plan, you can adjust your subscription level right from the MyMembers interface. Honestly, this feature alone makes it one of the most effective pieces of subscription management software out there. It turns your dashboard from a simple tracker into an active tool for saving money, making sure you only pay for what you actually use.

Mastering the Subscription Lifecycle

https://www.youtube.com/embed/XQSS1qYWHN8

Let’s be honest, managing online subscriptions is a mess. The real trick isn't just signing up; it's getting ahead of renewals and cancellations before they drain your bank account.

We've all been there—that sneaky free trial that rolls over into a paid plan you completely forgot about. It's a frustrating, and expensive, part of modern life.

This is exactly where MyMembers steps in. Instead of juggling a chaotic mess of calendar alerts or relying on memory (which never works), you can automate the entire thing. Set up smart alerts that ping you days before a renewal hits. That gives you more than enough breathing room to decide if a service is still pulling its weight.

From Onboarding to Cancellation

The moment you sign up for a new service, your first move should be to get it into your management system. Onboard it straight into MyMembers and pop it into the right category. Making this a habit from day one means nothing ever gets missed or falls through the cracks.

A huge part of mastering this cycle is using smart strategies to reduce subscription churn, whether that’s for your own business or just getting your personal spending under control.

And when it’s time to say goodbye to a service? The process should be dead simple.

Lots of companies make cancelling a subscription a deliberate nightmare of confusing menus and support chats. MyMembers cuts through that noise. It offers a ‘one-click cancel’ feature for many popular services, basically handling the awkward breakup for you.

For those services that need a more personal touch to cancel, the platform still gives you clear, step-by-step instructions. No more hunting around for the hidden "cancel" button.

This whole approach flips the script. You’re no longer just passively getting billed every month. You become an active manager of your digital toolkit, making sure you only pay for what delivers real, measurable value. You're back in the driver's seat.

Using Data to Optimize Your Subscription Spend

Alright, you’ve got all your subscriptions neatly organised. Now for the fun part: turning that simple list into a powerful financial strategy.

42e30b94-99b1-44b8-b63d-9ee646d75b8d.jpg

This is where the MyMembers analytics dashboard really shines. It’s not just about tracking payments; it’s about turning raw spending data into smart, money-saving decisions.

Forget staring at a boring list of transactions. We're talking about visual reports that show you exactly where every pound is going. You can instantly spot your most expensive services or, even better, those subscriptions you barely even use. With nearly 68 million internet users in the UK as of January 2025, trying to track this stuff manually is a lost cause.

Turning Insights Into Savings

Imagine this: you pull up your monthly report and an immediate red flag jumps out. You’re paying for two different cloud storage services. One’s for personal files, the other for work, but their features almost completely overlap. The data makes this kind of redundancy impossible to ignore.

This is the perfect moment to:

- Compare Usage: Check which service you actually use more.

- Consolidate: Pick the better platform and move your files over.

- Cancel: Ditch the redundant subscription and instantly cut a recurring cost.

By making one simple, data-informed decision, you could save over a hundred pounds a year. This is the whole point of smart subscription management—it’s not just about tracking, it’s about optimising.

This process flips the script on how you manage online subscriptions. It goes from being a defensive chore to an offensive tool for your financial health.

For more deep-dive strategies, check out our guide to subscription model best practices. It's all about making confident, informed decisions that put money back in your pocket.

Still Got Questions About Managing Subscriptions?

Whenever you start digging into your online subscriptions, the same few questions always seem to pop up. Let's get them sorted, so you can stop wondering and start saving.

One of the biggest hang-ups? Security. And rightly so. Hooking up your financial accounts to a third-party app can feel a bit sketchy.

That's why tools like MyMembers use bank-grade, end-to-end encryption. But here’s the key bit: they operate with read-only access. This means the app can spot your recurring payments without ever seeing your login details or having any power to move your money. It’s like having a super-smart assistant who can read your bank statement but can't touch your cash.

What About Cancelling and Tracking?

We’ve all been there. Trying to cancel a service that feels like it was designed by Houdini. A good management tool should kill this headache for good.

For loads of popular services, MyMembers just gives you a "one-click cancellation" button. Job done. For the trickier ones, it hands you all the contact details and instructions you need on a plate. No more hunting through endless FAQ pages.

The only real way to manage subscriptions is with a system that sees everything—no matter how often it bills. It’s the difference between being in control and getting hit with expensive surprises.

This is especially true for those sneaky annual payments. You know the ones. They pop up once a year and always catch you off guard. MyMembers is built to sniff out these charges, stick them on your dashboard, and ping you with a reminder long before the renewal date.

This gives you plenty of breathing room to decide if you're still getting your money's worth before you’re locked in for another year. You only pay for what you actually use and value. Simple.

Ready to finally sort out your digital spending? With MyMembers, you can turn that subscription mess into organised calm. Start managing your subscriptions for free today.