Chasing overdue invoices is a delicate, yet crucial, task for any business. The challenge is clear: how do you secure prompt payment without damaging the customer relationship you've worked hard to build? A generic, one-size-fits-all reminder often fails, either coming across as too aggressive or being too passive to prompt action. This is where a strategic approach to communication becomes a financial necessity. A poorly timed or toned message can lead to delayed payments, strained client relations, and ultimately, a negative impact on your cash flow.

This guide moves beyond simple copy-and-paste text. We will dissect seven powerful payment reminder templates, each designed for a specific scenario and purpose. You will learn not just what to say, but why it works. We’ll break down the underlying psychology and strategy of each template, from gentle nudges to firm, final notices.

By the end of this article, you will have a versatile toolkit to:

- Recover revenue faster and more consistently.

- Systematise your collections process to save time.

- Maintain positive customer relationships, even when discussing overdue payments.

These are not just templates; they are structured communication strategies designed to get you paid while preserving your client base. Let's dive into the examples.

1. Progressive Tone Escalation Template Series

The Progressive Tone Escalation Series is a systematic, multi-stage approach to chasing overdue payments. Instead of sending a single, harsh demand, this method uses a sequence of payment reminder templates that gradually increase in firmness. This strategy is designed to preserve positive customer relationships while effectively recovering outstanding funds.

The core principle is to start with a gentle, polite nudge, assuming the missed payment is a simple oversight. If that doesn't yield results, subsequent reminders become more direct and formal, culminating in a final notice that clearly states the consequences of non-payment. This measured escalation is highly effective for subscription services, course creators, and digital coaches who rely on recurring revenue and long-term client loyalty.

How It Works: A Phased Approach

This method is popularised by accounting software like QuickBooks and FreshBooks because it automates a process that balances empathy with financial diligence. It acknowledges that most late payments are accidental, not malicious. By starting softly, you avoid alienating a good client who simply forgot.

Strategic Insight: The primary goal of the initial reminder is not just collection, but customer retention. A friendly tone protects the relationship, making the client feel valued rather than reprimanded. This is crucial for businesses with a recurring revenue model.

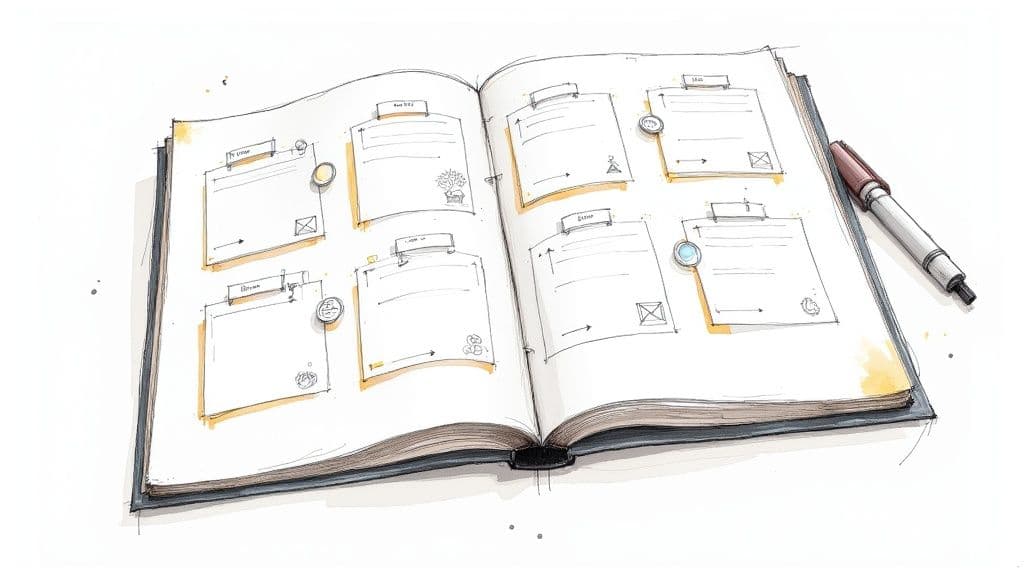

The following infographic illustrates the standard three-stage process flow, showing the shift in tone and timing at each step.

infographic-52956f53-0de6-4287-8bf4-8ac77e0f1adb.jpg

As the visualisation shows, the key is the structured progression, allowing the client multiple opportunities to pay before the relationship is jeopardised.

Actionable Takeaways

To implement this strategy effectively:

- Set Clear Intervals: Schedule reminders to go out automatically at set intervals, such as 7 or 14 days after the due date. Consistency is key.

- Personalise the First Touch: The initial email should be highly personalised. Use the client's name and reference a specific invoice to show it's not a generic blast.

- Embed Payment Links: Make it easy for them to pay. Include a direct, one-click payment link in every single reminder to remove friction.

2. Visual Invoice Attachment Template

The Visual Invoice Attachment Template prioritises clarity and convenience by placing the original invoice front and centre. Rather than simply reminding a client about an outstanding balance, this approach attaches the invoice directly to the email, often as a PDF or an embedded image. This removes any ambiguity about what the payment is for, making it one of the most effective payment reminder templates for preventing customer confusion.

This method immediately answers the client's most common questions: "Which invoice is this?" and "What were the charges?" It's particularly useful for businesses that issue multiple invoices to the same client or for project-based work where costs can vary. By providing all necessary information upfront, you reduce the back-and-forth communication that often delays payment.

8a26c50a-9f63-4da5-b117-90f59c266ac3.jpg

How It Works: A Friction-Free Approach

This strategy is a cornerstone of modern financial software, popularised by payment processors like Stripe and cloud accounting platforms such as Xero. The core idea is to eliminate any "search cost" for the client. Instead of making them dig through their inbox for the original invoice, you present it to them again, attached to a polite reminder. This simple act removes a significant barrier to immediate payment.

Strategic Insight: The primary goal is to make the payment process frictionless. By attaching the invoice, you centralise all the necessary information, enabling the client to verify the charge and click "Pay Now" in a single, seamless action.

The effectiveness of this template is rooted in its straightforward, no-nonsense design. It assumes the client is willing to pay but may have lost track of the specific details. By resupplying those details, you empower them to settle the account quickly. This is where automated invoicing software becomes invaluable, as it can generate and attach these invoices automatically.

Actionable Takeaways

To implement this strategy effectively:

- Optimise File Size: Ensure any attached PDF invoices are optimised for email. Large files can be blocked by spam filters or take too long to download, defeating the purpose of convenience.

- Include Clear Payment Terms: Don't rely on the invoice alone. Reiterate the due date, invoice number, and outstanding amount in the body of the email for quick reference.

- Test Across Email Clients: Check how the reminder appears on different platforms like Gmail, Outlook, and mobile email apps to ensure the attachment is always visible and easy to access.

3. Personalized Relationship-Based Template

The Personalized Relationship-Based Template prioritises goodwill and partnership over simple transaction recovery. Instead of a generic alert, this approach uses highly personalised language to frame the overdue payment as a collaborative issue to be solved. This method is built on the premise that preserving a strong client relationship is as valuable, if not more so, than the immediate collection of an outstanding invoice.

This strategy is particularly effective for professional services firms, creative agencies, and B2B SaaS companies where long-term partnerships are the cornerstone of the business model. The reminder often references specific projects, shared successes, or future collaborations, reminding the client of the value the relationship brings. It transforms a potentially awkward financial conversation into a touchpoint for strengthening the business connection.

How It Works: A Partnership-Centric Approach

This method succeeds by appealing to mutual respect and shared goals. It assumes the late payment is an anomaly in an otherwise healthy partnership and opens the door for a supportive conversation rather than a demand. This is crucial for retaining high-value clients who might be facing temporary cash flow issues.

Strategic Insight: This template is less about chasing a debt and more about checking in on a partner. By proactively offering flexibility, such as a payment plan or a quick call to discuss, you demonstrate empathy and reinforce your role as a trusted advisor, not just a vendor.

For example, a marketing agency might reference the success of a recent campaign before gently mentioning the outstanding invoice for that work. This contextualises the payment within the value already delivered, making the request feel more reasonable and less confrontational.

Actionable Takeaways

To implement this strategy effectively:

- Reference Shared History: Mention a specific project, milestone, or positive interaction in your reminder. Personalisation is key to making this approach feel genuine.

- Offer Proactive Solutions: Don't wait for the client to ask for help. Suggest a call to discuss the payment or offer a potential payment plan to show flexibility and a commitment to partnership.

- Segment Your Audience: This highly personalised approach works best when targeted. You can learn more about how to group clients effectively by exploring customer segmentation best practices to tailor your messaging.

4. Urgency-Driven Action Template

The Urgency-Driven Action Template is a direct and firm communication method designed to compel immediate payment by highlighting deadlines and the specific consequences of continued non-payment. Unlike gentler reminders, this approach is less about maintaining a relationship and more about prompting a necessary financial action. It is typically reserved for final notices or when an account is significantly overdue.

This strategy leverages psychological principles like loss aversion, where the fear of losing a service or incurring a penalty motivates a faster response. These types of payment reminder templates are frequently used by utility companies, financial institutions, and subscription services where service continuity is at stake. The tone is formal, direct, and leaves no room for ambiguity.

3353407d-6dd2-4c06-bcaa-a896e15cccb8.jpg

How It Works: A Phased Approach

This template is the final stage in a collection process, often following several unsuccessful, softer attempts. Its effectiveness comes from its clarity and the tangible repercussions it presents. For digital coaches or course creators, this might mean losing access to course materials or community groups, a powerful motivator for a committed user.

The communication clearly outlines what will happen if the payment is not made by a specific date. This includes potential service suspension, late payment fees, or even referral to a collections agency. The goal is to make the cost of inaction higher than the cost of immediate payment.

Strategic Insight: Urgency is most effective when it is specific and credible. Vague threats are easily ignored, but a clear statement like "Your access will be suspended on 15 October" creates a concrete deadline that drives a user to act.

This method, popularised by industries with high-volume, low-margin accounts, has been adapted by SaaS and subscription businesses to manage churn caused by payment failures. It is a necessary tool for drawing a line under a protracted overdue account.

Actionable Takeaways

To implement this strategy effectively:

- Be Explicit with Dates: Use a specific date (e.g., "by 5 PM on 25th November") instead of a vague timeframe like "in the next few days". This removes any guesswork.

- State Consequences Clearly: Clearly itemise the consequences of non-payment, such as service termination, late fees, or account deactivation.

- Provide a Simple Solution: Despite the firm tone, make it incredibly easy to resolve the issue. Include a prominent, one-click payment link to remove all friction.

5. Incentive-Based Payment Template

The Incentive-Based Payment Template flips the traditional collection script from a penalty-focused model to one of positive reinforcement. Instead of warning about late fees, this approach offers a reward for prompt payment. These payment reminder templates are structured to encourage customers to settle their invoices early or on time by providing a tangible benefit, such as a small discount or a future credit.

This strategy is particularly effective for businesses that want to improve cash flow without damaging customer relationships. It transforms the payment process from a transactional necessity into an opportunity to build loyalty. The core idea is to make the client feel they are gaining something by paying on time, which is a powerful psychological motivator. This is widely used by e-commerce platforms, subscription services, and professional service providers who want to foster goodwill.

How It Works: A Positive Reinforcement Approach

This method is popular because it gamifies the payment process and reframes it as a positive interaction. Rather than chasing a debt, you are offering an opportunity. For example, a subscription service might offer a bonus month, or a service provider could apply a 2% discount if the invoice is paid within 10 days. The key is making the incentive attractive enough to motivate action but sustainable for the business.

Strategic Insight: The primary goal is to accelerate payment cycles and reduce the number of overdue accounts proactively. By offering a reward, you are not just collecting a payment; you are training your clients to prioritise your invoices to receive a benefit, improving their payment habits over time.

This approach is highly customisable. The incentive can be a direct discount, loyalty points, a free upgrade, or early access to new products, depending on what your customers value most.

Actionable Takeaways

To implement this strategy effectively:

- Define Clear Terms: State the incentive, the conditions for earning it (e.g., "pay within 7 days"), and the exact deadline clearly in your reminder email. Ambiguity will reduce its effectiveness.

- Keep Incentives Sustainable: Calculate the cost of the incentive. A small discount of 2-5% is a common starting point that can significantly improve cash flow without heavily impacting your profit margins.

- Segment Your Audience: Avoid offering discounts to clients who consistently pay late. Reserve this strategy for new clients you want to train or for all customers as a general policy, but track its impact to ensure it isn't being exploited.

6. Multi-Channel Notification Template

The Multi-Channel Notification Template is a comprehensive system for chasing overdue payments by reaching customers across multiple platforms. Instead of relying solely on email, this strategy deploys coordinated payment reminder templates via SMS, in-app notifications, and sometimes even automated phone calls. This approach ensures your message is seen, maximising the chances of a prompt payment.

This method is particularly effective for businesses whose customers engage with them on various devices and platforms throughout the day, such as telecommunications services, SaaS companies, and healthcare providers. The core idea is to create a seamless and persistent reminder experience that is hard to ignore, without being overly intrusive.

a7161e82-a397-4a5f-ac7c-59f126d09371.jpg

How It Works: A Coordinated Approach

This strategy is popularised by services where constant connectivity is key, like mobile phone providers or subscription software. The system typically starts with a low-friction channel, like an email, and escalates to more immediate channels like SMS or a push notification if the invoice remains unpaid. The messaging stays consistent, but the delivery method changes to capture the customer's attention. For a comprehensive approach to customer engagement and collecting payments, consider how to build a powerful omnichannel communication strategy that integrates various touchpoints.

Strategic Insight: The strength of this method lies in its adaptability. By using multiple channels, you meet customers where they are most active, significantly increasing the visibility of your reminder. An email might go unread, but an SMS or in-app pop-up is much harder to miss.

Automating this process is key to its success, and it can be a core part of a wider business process automation strategy. By setting up triggers, you can ensure the right message is sent on the right channel at the right time without manual intervention. You can discover more about business process automation to see how it can streamline your collections.

Actionable Takeaways

To implement this strategy effectively:

- Maintain Consistent Messaging: The tone and core message should be identical across all channels. This reinforces the urgency and legitimacy of the reminder.

- Space Out Notifications: Avoid overwhelming customers. Stagger your reminders across different channels over several days to be persistent but not annoying.

- Allow Channel Preferences: Give customers the option to choose their preferred communication channel in their account settings. This respects their preferences and increases engagement.

7. Self-Service Resolution Template

The Self-Service Resolution Template is a customer-centric approach that empowers clients to resolve payment issues independently. Instead of a simple reminder, this method directs them to a secure online portal where they can update card details, set up a payment plan, or log a dispute without needing manual intervention. This strategy reduces administrative workload and gives customers control over their finances.

This approach is highly effective for businesses with a high volume of transactions, such as utility companies, banking institutions, and SaaS platforms. The core principle is to provide clear, accessible tools that guide the customer through common payment problems. These payment reminder templates act as a gateway to a solution, rather than just a notification of a problem.

How It Works: An Empowering Approach

This method has been popularised by cloud service providers and e-commerce giants because it streamlines the collections process while enhancing the user experience. By automating resolution pathways, businesses can handle failed payments at scale without increasing headcount. It puts the customer in the driver's seat, which can reduce the frustration associated with billing errors.

Strategic Insight: The primary goal is to minimise friction and support overheads. By providing a self-service portal, you transform a potentially negative interaction (a payment demand) into a positive, empowering experience where the customer solves their own issue quickly and securely.

A typical self-service reminder provides a direct link to a billing dashboard. Within this portal, users can usually perform actions like updating an expired credit card, switching to a different payment method like a direct debit, or even selecting a pre-approved payment plan for larger outstanding invoices. This autonomy is highly valued by modern consumers.

Actionable Takeaways

To implement this strategy effectively:

- Ensure Portal Security: Your self-service portal must be secure and reliable. Clearly communicate security measures like SSL encryption to build customer trust.

- Provide Clear Instructions: The email and the portal itself should have simple, step-by-step instructions. Use visuals or short tooltips to guide users through updating their information.

- Include an Escape Hatch: Always provide clear contact information, such as a phone number or support email, for customers who encounter complex issues or prefer to speak with a person.

7 Payment Reminder Template Comparison

| Template | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Progressive Tone Escalation Series | Medium – requires timing management and customization | Moderate – scheduling tools and templates | Gradual increase in collection rates with maintained customer relationships | Businesses needing structured reminders without damaging relationships | Systematic escalation reduces manual work; preserves customer goodwill |

| Visual Invoice Attachment Template | Medium – integration with invoice systems needed | Moderate to High – attachment support and responsive design | Higher payment clarity and conversion rates | Businesses wanting to minimize customer confusion on payment details | Clear invoice visibility; reduces communication back-and-forth |

| Personalized Relationship-Based | High – needs CRM data and personalized content | Moderate – requires customer data and manual input | Better response from valued customers; relationship retention | B2B service providers and firms prioritizing long-term partnerships | Personalized and collaborative tone encourages dialogue |

| Urgency-Driven Action Template | Medium – includes visual urgency elements and compliance checks | Moderate – legal checks and design work | Fast payment action; shortened collection timelines | Final overdue notices and critical payments | Strong urgency drives quick responses; clear consequences communicated |

| Incentive-Based Payment Template | Medium – managing offers and limits | Moderate – tracking incentives and redemption | Increased voluntary payments and customer loyalty | Businesses promoting early payments with rewards | Positive reinforcement improves customer satisfaction and future sales |

| Multi-Channel Notification Template | High – requires multi-platform integration | High – managing various communication channels | Increased reach and response rates | Large customer bases with varied contact preferences | Broad visibility; supports customer channel preferences |

| Self-Service Resolution Template | High – robust technical infrastructure needed | High – portal development and maintenance | Reduced service workload; enhanced customer control | Businesses enabling independent issue resolution | Scalable and efficient; available 24/7, improving satisfaction |

Automating Your Way to Better Cash Flow

We've explored a comprehensive toolkit of seven distinct payment reminder templates, each designed to address specific scenarios in the collections process. From the gradual intensity of the Progressive Tone Escalation series to the proactive, user-empowering approach of the Self-Service Resolution template, the core lesson is clear: effective communication is both an art and a science. It's not about sending a single, generic demand for payment; it's about deploying a strategic sequence of messages that respects your client relationship while firmly protecting your cash flow.

The true power of these templates is realised when they are combined into a cohesive, automated system. A well-organised workflow ensures that no invoice slips through the cracks and that every communication is sent at the optimal time without manual intervention. This systemisation is what transforms a collection of good templates into a great accounts receivable strategy.

Key Takeaways for Immediate Action

To synthesise the strategies discussed, remember these foundational principles:

- Clarity is Paramount: Every reminder, from the first gentle nudge to the final notice, must be crystal clear. Ambiguity about the amount owed, the due date, or the payment methods available is the biggest barrier to prompt payment.

- Empathy Drives Results: Always frame your communications from a place of professionalism and understanding. A personalised, relationship-based approach often resolves issues faster than an aggressive one, preserving goodwill for future business.

- Automation is Your Ally: Manually tracking and sending reminders is inefficient and prone to error. Automating the sequence frees up your time, ensures consistency, and allows you to focus on delivering value to your clients and members.

Turning Templates into a Reliable System

The ultimate objective is to build a collections engine that operates reliably in the background. By implementing the payment reminder templates we've covered, you are not just chasing payments; you are refining a critical business process. You are creating a predictable financial environment for your business, one where outstanding invoices are methodically converted into revenue.

This proactive stance on collections is a hallmark of a mature and sustainable business. For digital coaches, course creators, and community managers, this stability is essential for growth. It allows you to invest your energy back into what you do best: creating exceptional content and fostering a vibrant community, confident that your financial operations are secure. Mastering these templates is a direct investment in the long-term health and success of your enterprise.

Ready to stop chasing payments and start automating your revenue? The templates in this article provide the blueprint, but MyMembers provides the engine. Our platform is built specifically for creators on platforms like Telegram, automating everything from subscription billing to sending strategic payment reminders and managing access. See how MyMembers can implement these strategies for you and secure your cash flow today.