With Stripe's automatic payments, you can set up recurring billing for your subscriptions or memberships, letting you charge customers automatically at set intervals. For any business running on a membership model, this isn't just a nice-to-have; it's the core of a predictable, hands-off revenue stream that stabilises cash flow and cuts down on soul-crushing admin work.

Why Stripe Is the Go-To for UK Payment Automation

17e135ea-49e5-48e9-93e7-18e44733bdba.jpg

Before we jump into the setup, let's get one thing straight: why are so many UK businesses choosing Stripe for this stuff? It’s not just another payment gateway. Think of it as a complete financial toolkit built for how we do business online today. Its reputation for being solid and developer-friendly makes it a favourite for everyone from fresh-faced tech startups to established companies.

The real magic is how Stripe makes complicated processes feel simple. When you implement Stripe automatic payments, you’re not just taking money; you’re hitting several key business goals at once.

- Better Cash Flow: Predictable, recurring revenue means your financial forecasts are no longer a wild guess. They become reliable.

- Less Admin Overload: Forget manually sending invoices and chasing people for late payments. That time is better spent growing your business.

- A Smoother Customer Journey: A frictionless payment process keeps your members happy, which is a massive win for retention.

A Strong UK Market Presence

Stripe’s scale is just massive. It handled a payment volume of $1.05 trillion in 2025, and its footprint in the UK is particularly huge. The United Kingdom is actually the second-biggest market for Stripe globally, with over 80,000 websites using its payment tools. That's way ahead of other major European players like France and Germany, which tells you just how deeply it's woven into the UK's business fabric. You can dig into more Stripe market share stats on coinlaw.io.

For any UK business, that widespread adoption is more than just a number—it’s a massive signal of trust. It confirms that Stripe’s features aren’t just powerful, but they’re also dialled in for our specific needs, from handling VAT properly to offering local payment methods like BACS Direct Debit. That kind of established presence gives you the confidence you need when picking a partner to handle your money.

Preparing Your Stripe Account for Automation

295c1aba-ea8e-4bd9-aeda-5e2d6b1bda12.jpg

Before you even think about creating your first subscription plan, let’s talk prep work. A little bit of housekeeping now saves you a world of headaches later.

Think of it as laying the foundations. Getting your Stripe account primed for Stripe automatic payments is the first real step toward a reliable, hands-off system that just works.

First up, you need a fully verified Stripe account. This goes beyond just signing up. Stripe needs all your proper business details—your company registration, VAT info, the lot. For UK businesses, it’s absolutely crucial to link a UK bank account. This ensures your payouts land smoothly without any annoying currency conversion fees eating into your profit.

Get Your Financials Straight

Once you're verified, take five minutes to actually understand Stripe's fee structure for recurring payments. For UK cards, it’s typically a small percentage plus a fixed fee for each transaction.

Knowing these numbers upfront isn't just "good practice"; it’s essential for pricing your subscriptions correctly. Trust me, you don’t want any nasty surprises when you’re looking at your monthly revenue reports.

Don’t just set it and forget it. I make it a habit to regularly check my transaction fees in the Stripe Dashboard. This simple check helps forecast net revenue accurately and makes sure my pricing stays profitable as the business grows.

The Essential Setup for Automation

With the basics sorted, it’s time to configure your account for the fun part: automation. This boils down to a few key moves:

- Your API Keys: You’ll find these in your Stripe Dashboard under the ‘Developers’ section. You need two keys to connect Stripe to other platforms like MyMembers: the ‘Publishable’ key and the ‘Secret’ key. Treat your Secret Key like your bank PIN—never, ever share it publicly.

- Compliance: The good news is that Stripe handles most of the heavy lifting for PCI compliance (the security standards for handling card info). By using their tools, you're already most of the way there. Still, it pays to familiarise yourself with the basics so you know what’s going on under the hood.

- Webhooks: This might sound super technical, but it’s a simple and incredibly powerful feature. Setting up a webhook endpoint allows Stripe to send real-time pings to your system (like MyMembers) when something happens—a successful payment, a failed charge, you name it. This is the engine that drives true, set-and-forget automation.

Nailing these elements from day one is a cornerstone of building an efficient operation. If you're looking to automate more than just payments, our guide on business process automation has some wider strategies for clawing back your time.

Building Your Subscription Plans in Stripe Billing

Alright, with your account ready to go, it’s time for the fun part: building the engine for your Stripe automatic payments. This is where you turn your services into a reliable, recurring revenue stream using Stripe Billing. Let's ditch the theory and get practical. Imagine we're setting up a tiered monthly membership for a software tool.

The whole process boils down to two key pieces in your Stripe Dashboard: Products and Prices. Think of it like this: a 'Product' is the what—say, "Premium Membership." A 'Price' is the how much and how often—like "£25 per month."

This setup is deceptively simple but incredibly powerful. You can create a single Product (e.g., "Pro Plan") and then attach multiple Prices to it. You could have a monthly option, a discounted annual one, and maybe even a quarterly price. This gives you the freedom to experiment with different pricing strategies without having to rebuild your entire setup from scratch.

Defining Your Billing Models

Stripe isn't just about flat monthly fees; it supports a bunch of different billing models to match how your business actually works. This is where you can really tailor your pricing to the value you provide. For instance, a "pay-as-you-go" or metered billing model is brilliant for services where customers pay based on what they use, like API calls or data storage.

To help you figure out what makes sense for your business, here’s a quick comparison of the main models Stripe offers.

Stripe Recurring Billing Models Compared

| Billing Model | Best For | Example Use Case |

|---|---|---|

| Flat-Rate Subscription | Predictable, simple services with consistent value. | A weekly newsletter, a software-as-a-service (SaaS) tool, or a monthly content membership. |

| Tiered Subscription | Offering different levels of features or access at different price points. | A 'Basic', 'Pro', and 'Enterprise' plan for a project management tool. |

| Metered (Usage-Based) | Services where cost is tied directly to consumption. | Charging per gigabyte of cloud storage, per API call, or per user seat. |

| Per-Seat (User-Based) | Software or services sold to teams where each user needs a licence. | A collaboration tool like Slack or Figma where you pay for each active team member. |

| Hybrid Model | Combining a base subscription fee with usage-based charges. | A marketing platform with a flat monthly fee plus extra charges for sending over a certain number of emails. |

Choosing the right model is about aligning your revenue with the value your customers receive. A tiered model, for example, is fantastic for giving customers a clear upgrade path as their needs grow.

A key takeaway here is to think beyond flat fees. We’ve found that offering a tiered model with different feature sets—a 'Basic' tier and a 'Pro' tier—dramatically increases overall sign-ups. It gives customers a choice and a clear upgrade path, which is fantastic for long-term value.

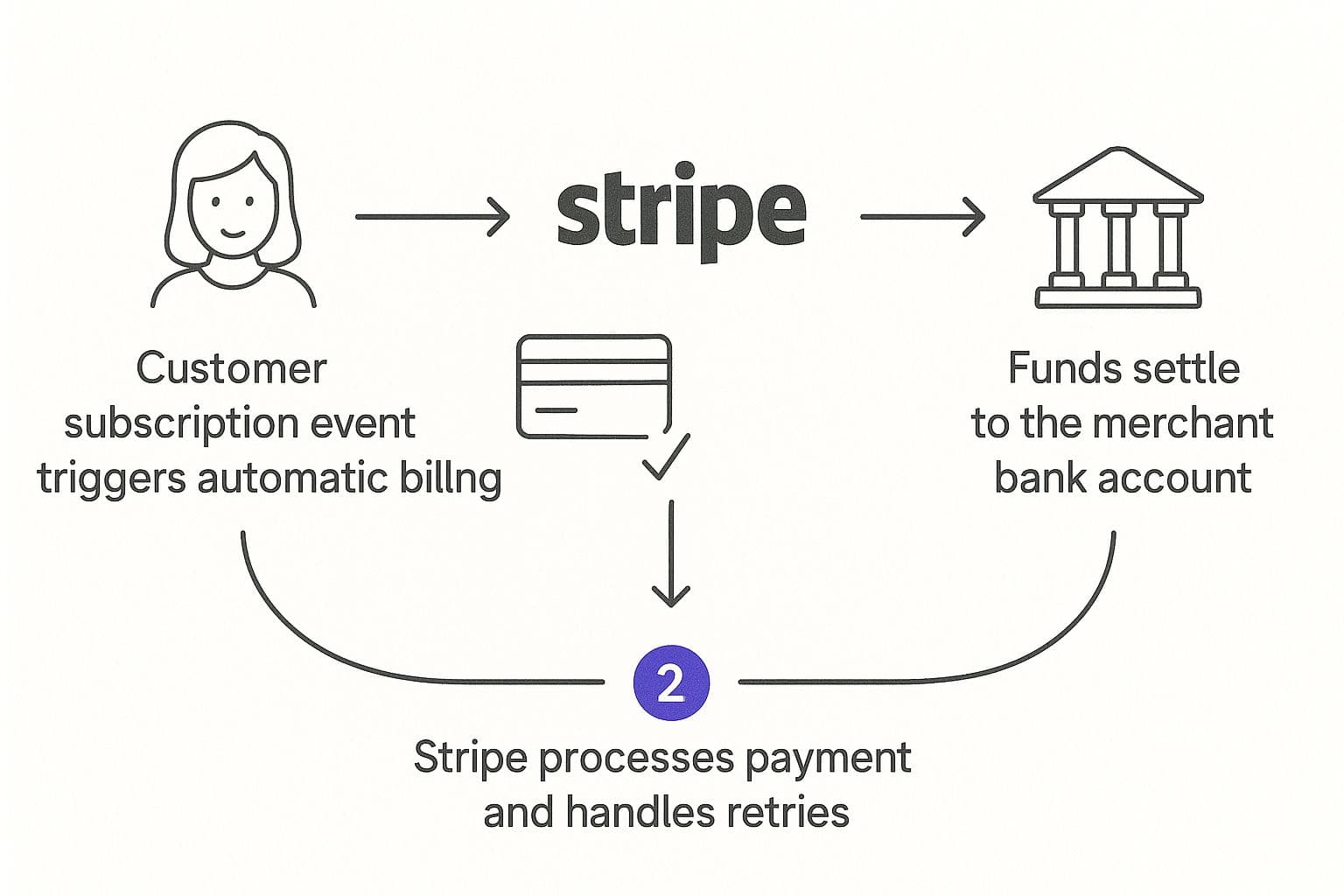

To get a clearer picture of how this works, the flow below illustrates the automated process from the moment a customer subscribes.

ca637b6a-d152-4208-9b4f-5e9259d87af6.jpg

This visual really highlights the hands-off nature of the system. Once it's set up, Stripe handles the payment collection, retries any failed transactions, and makes sure the funds land securely in your account.

Powering Up with Smart Retries

One of the most valuable, yet often overlooked, features inside Stripe Billing is Smart Retries. Failed payments are a silent killer of subscription revenue. Instead of just blindly retrying a failed charge, Smart Retries uses machine learning to analyse billions of data points. It then intelligently re-attempts the charge at the optimal time, significantly boosting your payment recovery rate without you having to lift a finger.

It’s no surprise that Stripe Billing is a go-to for UK businesses, with over 300,000 companies globally using it to manage their subscriptions. Features like Smart Retries are why; they help businesses recover millions in what would otherwise be lost revenue from involuntary churn.

If you want to go deeper into setting up your products and prices, our complete guide on Stripe recurring payments walks you through the entire process step-by-step. And if you're still weighing your options, you can check out some of the best subscription billing software solutions to see how Stripe stacks up against the competition.

Right, you've got your subscription plans dialled in on Stripe. Now for the magic bit: making those plans actually do something. This is where you connect Stripe to a member management platform like MyMembers and turn a simple payment system into a hands-off, automated machine for your community.

The goal here isn't just to take money. It's to build a seamless flow where Stripe automatic payments grant or revoke access to your private groups without you ever lifting a finger. This is what frees you up to actually create great content instead of drowning in spreadsheets and sending manual invites.

Connecting Your Platforms

First things first, you need to get your platforms talking to each other. Inside a tool like MyMembers, you’ll find a spot dedicated to Stripe integration. This is where you’ll paste in the API keys we talked about earlier to securely link your accounts.

Think of this as giving MyMembers permission to listen to Stripe. Once authorised, it gets real-time pings about everything happening with your customers and their subscriptions.

But linking them is just the start. The real power move is what you do next.

This is the moment it all clicks. You start "mapping" the Stripe subscription plans you built to specific membership levels. For example, your “Gold Tier” plan in Stripe gets directly linked to your exclusive “Gold Members” Telegram group.

This simple mapping is the foundation for everything. It tells your management system, "when someone pays for this, they get access to that."

Automating Member Access and Workflows

With your plans mapped out, you can start setting the rules for your community. This is where the power of Stripe automatic payments really shines, creating a smart system that manages members based entirely on their payment status.

Here are a few a-ha moments you can set up in minutes:

- Successful Payment: The second Stripe confirms a new subscription payment, the system springs into action. If you're running a Telegram community, this could mean instantly firing off an invite link to the new member, giving them immediate access to your exclusive group. No waiting. No manual work.

- Failed Payment: If a recurring payment bounces, Stripe tells your system immediately. You can set it up to automatically email the member with a gentle nudge. If they don't sort it out after a few tries, the system can automatically boot them from the group, revoking their access until the subscription is back on track.

- Subscription Cancellation: When a member decides to cancel, the system knows. It will automatically remove their access, but only at the end of their current paid billing period. Fair for them, zero admin for you.

This kind of integration keeps your community exclusive to paying members, which protects your revenue and adds a layer of professionalism to your whole operation. You end up with a robust, self-managing system that handles the entire member lifecycle for you.

Keeping Your Payment System Sharp and Secure

cda53245-df26-461b-8728-a8961fc3595b.jpg

Alright, so you’ve got your Stripe automatic payments set up. That’s a huge first step, but the real work starts now. Think of it less like a "set it and forget it" task and more like tending a garden; a little regular attention keeps it healthy and thriving for the long run.

Your best friend here is the Stripe Dashboard. It’s so much more than just a place to watch the money roll in. It’s a powerful analytics hub where you can track the vital signs of your subscription business: monthly recurring revenue (MRR), customer lifetime value (LTV), and the big one—your churn rate.

Keeping a close eye on churn (the rate at which customers cancel) is non-negotiable. A sudden spike is often the first red flag that something’s off with your product, pricing, or even your customer service.

Let Stripe Handle the Heavy Lifting on Security

When you’re handling other people’s money, security is everything. Honestly, one of the biggest perks of using Stripe is that it shoulders the immense weight of security and compliance for you. That’s a massive responsibility lifted from your shoulders.

For UK businesses, Stripe’s setup is particularly solid. It boasts top-tier PCI DSS Level 1 certification, which is the highest security standard available for payment processing. On top of that, it's authorised by the FCA (Financial Conduct Authority), adding a critical layer of regulatory trust. This framework means you can confidently tell your customers their data is locked down by industry-leading security.

You’re not just protected from hackers, either. Stripe’s built-in fraud detection tools, like Radar, use machine learning to analyse every transaction and block suspicious activity in its tracks. This actively protects your revenue from fraudulent chargebacks—a crucial benefit many people overlook.

Build Relationships, Not Just a Subscriber List

Beyond the technical stuff, proactive management is all about optimising the customer experience to keep your revenue flowing. This boils down to clear communication and offering payment options that actually work for your audience.

Here’s what I focus on:

- Handle disputes with grace. Even with a perfect product, disputes happen. The key is to respond quickly and professionally right from the Stripe Dashboard. A clear, easy-to-find refund policy on your website can also head off many disputes before they even start.

- Offer payment methods UK customers actually use. Cards are standard, but they aren't the only option. Enabling BACS Direct Debit through Stripe can slash payment failures for recurring bills. Why? Because it’s tied to a bank account, not a credit card that can expire or get cancelled.

- Talk to your customers. Use automated emails for key moments. A friendly heads-up before a subscription renews or a polite nudge about an expiring card can prevent accidental churn and genuinely builds trust.

These small, consistent efforts are what transform a basic payment system into a resilient business asset. If you’re looking for more ideas on how to keep subscribers happy, check out our guide on subscription model best practices.

Got Questions? We’ve Got Answers.

When you're diving into setting up Stripe automatic payments, a few questions always seem to pop up. It’s totally normal. Let's tackle the big ones so you can move forward with total confidence.

What Happens If A Customer's Automatic Payment Fails?

First off, don't panic. A failed payment isn't the end of the world.

Stripe is smart about this. It doesn't just try once and give up. Their "Smart Retries" feature uses machine learning to figure out the best times to try the charge again, which seriously boosts the odds of it going through.

You can actually go into your Stripe settings and tweak the retry schedule to fit your business. It's also a great idea to set up automated emails that let your customers know what’s happened. A quick nudge is often all it takes for them to update their card details.

If all the retries fail, you have control. You can set the subscription to automatically cancel or just mark it as unpaid. This way, your business is always protected.

Can I Offer Both One-Time And Recurring Payments?

Yes, and you absolutely should.

Stripe is built for flexibility. You can handle one-off charges and recurring subscriptions from the same account, no problem. This is perfect if you sell, say, an e-book as a one-time purchase alongside your main monthly membership.

It lets you bring all your revenue streams under one roof. No more juggling different systems. You get a single, clear picture of your income, which makes life a whole lot easier.

A lot of people think you have to pick a side: subscriptions or one-off sales. Honestly, a hybrid model is where the magic happens. It lets you capture cash from different types of customers at the same time.

How Do I Handle Subscription Refunds In Stripe?

Issuing a refund is refreshingly straightforward.

Just hop into your Stripe Dashboard, find the payment linked to the customer's subscription, and you can process a full or partial refund right there. You can refund the latest charge or even go back and refund several previous payments if you need to.

The most important thing here? Have a crystal-clear refund policy for your subscriptions. Make sure it's easy for your customers to find. It’ll save you a ton of headaches and potential disputes down the line.

Is Stripe Suitable For A Small UK Business?

Stripe is an excellent choice for small businesses in the UK. I'd even say it's one of the best.

Its "pay-as-you-go" pricing means you don't get hit with setup fees or monthly charges on standard plans. You only pay for what you use, which means the platform can grow with your business without costing you a fortune upfront.

Plus, Stripe is fully authorised by the FCA here in the UK and their security is top-notch. For a small business owner, that kind of peace of mind is priceless.

Ready to turn your Telegram community into a hands-off revenue stream? With MyMembers, you can connect your Stripe account and start accepting automatic payments in minutes. Build your membership site today and let us handle the admin while you focus on your members.