Ever found yourself wondering how services like Netflix or Spotify bill you so seamlessly every month? That’s the magic of a subscription payment gateway. Think of it as an automated financial employee who works for you 24/7. Its entire job is to collect recurring payments from your subscribers, ensuring you get a steady, predictable cash flow without having to chase anyone down.

This specialised system is built to manage the unique rhythm of recurring billing, making it a total game-changer for any creator or business running on a membership model.

Understanding a Subscription Payment Gateway

Let’s break it down with an analogy.

A standard payment gateway is like a single-transaction tollbooth on a motorway. A customer pays once, the barrier lifts, and they pass through. Simple.

A subscription payment gateway, on the other hand, is like having an automated electronic pass. It securely saves the customer's payment details (with their permission, of course) and automatically charges them at set intervals—weekly, monthly, or yearly. This grants them continuous, uninterrupted access to your service or content.

That automation is everything. While a one-time gateway just processes a single sale, a subscription gateway manages the entire customer lifecycle. It handles initial sign-ups, takes care of all the scheduled recurring charges, and even helps recover failed payments when a card expires. This is absolutely vital for anyone building a business on memberships, from a creator’s private Telegram channel to a software-as-a-service (SaaS) platform.

Key Differences Between One-Time and Subscription Gateways

To really see the difference, it helps to put them side-by-side. A standard gateway is built for a single moment in time, while a subscription gateway is designed for an ongoing relationship.

| Feature | One-Time Gateway | Subscription Gateway |

|---|---|---|

| Primary Function | Process a single transaction. | Manage recurring billing cycles automatically. |

| Customer Data | Typically doesn't store payment details. | Securely stores payment info for future charges. |

| Billing Cycle | One-off purchase. End of story. | Handles weekly, monthly, annual, or custom intervals. |

| Failed Payments | The transaction just fails. | Often includes tools to automatically retry payments. |

| Customer Lifecycle | Manages a single point-of-sale. | Supports sign-ups, upgrades, downgrades, and cancellations. |

As you can see, they’re built for completely different jobs. Trying to run a subscription business with a one-time gateway is like trying to build a house with only a hammer—you’re missing most of the tools you need.

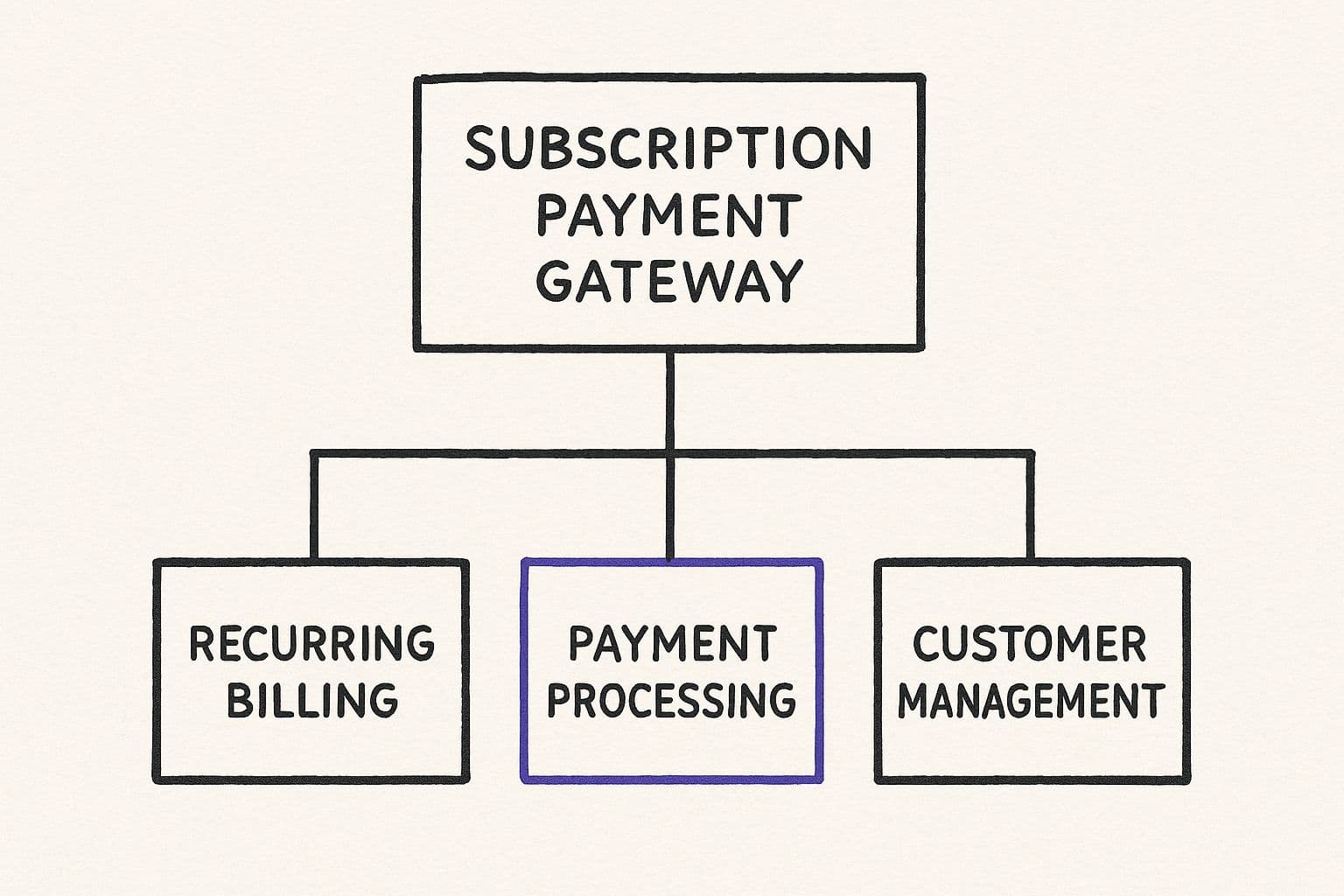

The Three Pillars of Subscription Management

A solid subscription payment gateway really stands on three essential functions that work together to put your revenue on autopilot.

efef0258-c6a1-455e-8d57-20cbc349bcf2.jpg

Each of these pillars is crucial for creating a smooth experience for both you and your subscribers. Get it right, and you can turn one-time buyers into loyal, long-term members who happily pay you every month.

The demand for systems that can do this is exploding. In the UK alone, the payment gateway market is valued at USD 2.64 billion in 2025 and is projected to nearly triple to USD 7.08 billion by 2030.

This growth is being fuelled by the massive shift to e-commerce, which now accounts for a whopping 27.9% of all retail sales. As more businesses move online and adopt recurring revenue models, the need for reliable, automated payment solutions has never been greater. You can dive deeper into the trends shaping the UK payment gateway market over at Mordor Intelligence.

Core Features Every Subscription Gateway Needs

To really get what makes a subscription payment gateway work, you need to look under the bonnet. It’s not just about taking money; it’s about building an automated revenue machine that runs without you having to constantly check on it. A few core features act as the engine, making sure everything ticks over smoothly.

The absolute heart of any subscription gateway is automated recurring billing. This is the non-negotiable bit. It’s the system that securely holds a customer's payment details and charges them on a set schedule—weekly, monthly, whatever you've set. Without this, you're just sending out manual invoices, which completely misses the point of having a subscription model in the first place.

Think of it like setting a bunch of financial alarms that you never have to hit snooze on. The gateway handles the whole cycle, from the first payment to every single one after, giving your business a predictable, stable cash flow.

Intelligent Dunning Management

But what happens when a payment bounces? A customer’s card might expire, or maybe they just don't have enough funds in their account. This is where dunning management becomes your financial safety net. A great subscription gateway doesn't just throw its hands up after one failed attempt.

Instead, it kicks off a smart recovery process. The system will automatically try the charge again at strategic times, massively upping the chances of it going through. It can also fire off automated, customisable emails to the customer, politely asking them to update their payment info. This one feature is an absolute powerhouse for cutting down involuntary churn—that’s customers who leave not because they want to, but because of a simple payment hiccup.

Robust Security and Compliance

Let’s be honest, security isn’t just a feature; it’s the price of entry for building trust. Any modern subscription payment gateway worth its salt must be PCI DSS (Payment Card Industry Data Security Standard) compliant. This is the gold standard for keeping card data locked down.

A key bit of security magic is tokenization. Instead of storing raw credit card numbers (a massive liability), the gateway swaps them for a unique, non-sensitive token. This means you never actually handle the card details yourself, which drastically cuts your risk and protects your customers from data breaches.

On top of the basics, leading gateways like Stripe also offer things like advanced Stripe's chargeback protection features, which are vital for protecting your recurring income. These systems help you handle and fight disputes, safeguarding the revenue you've worked so hard to build.

852fb7d1-15d6-4aed-a943-34e0d417798e.jpg

Flexible Payment Options

Finally, you’ve got to be flexible with how people can pay. Your customers have their preferences, and trying to shoehorn them into one option just creates friction they don't need. A top-tier gateway should handle a whole range of payment types, including:

- Debit and Credit Cards: The bread and butter of most online transactions.

- Direct Debit: A huge favourite in the UK for recurring bills.

- Digital Wallets: Absolutely essential for modern customers who want speed and convenience.

Mobile wallets like Apple Pay and Google Pay are completely changing the game in the UK. With 50% of UK adults now using at least one, and wallet payments making up 28% of e-commerce transactions, not supporting them is just leaving money on the table. Offering the right payment options is a massive part of a solid subscription pricing strategy and can directly boost your sign-up rates.

How To Choose The Right Subscription Payment Gateway

adbb3533-3cbf-41c7-a438-955416763b8b.jpg

Picking the right subscription payment gateway feels like a massive decision. Because it is.

Think of it less like choosing software and more like hiring a business partner. The right one saves you cash and headaches. The wrong one bleeds your profits with hidden fees and creates tech nightmares you didn't know existed.

Your first move? Get obsessive about the pricing. This is where most creators get burned.

Don't just glance at the advertised rate. Dig deeper. Ask about setup fees, monthly charges, and what happens with chargebacks or international payments. Knowing the full cost is non-negotiable when you’re just starting a subscription-based business and every penny counts.

Evaluate Costs and Pricing Models

Not all fee structures are created equal. Most gateways use one of two models, and the "best" one depends entirely on your business.

- Flat-Rate Pricing: Simple. Predictable. You pay a fixed percentage plus a small fee on every transaction (e.g., 2.9% + 30p). This is perfect for new businesses or anyone who values straightforward financial planning. No surprises.

- Interchange-Plus Pricing: More transparent, but way more complex. You pay the direct fee from Visa or Mastercard (the "interchange") plus the gateway's markup. It can be cheaper for high-volume businesses, but your costs will fluctuate every month.

Key Takeaway: For most creators and small businesses, the predictability of a flat-rate model is a massive win. It lets you forecast your expenses without needing a degree in finance.

Assess Integration and Scalability

A payment gateway should slot into your current setup like a puzzle piece, not force you to smash everything and start over. How easily does it connect with your website, app, or platform? Is it a simple, no-code solution, or will you need to hire a developer just to get paid?

Scalability is just as critical. The system that works for your first 10 members has to work flawlessly for 10,000. Ask potential providers how their tech handles growth. You don't want your payment system to be the reason your business stalls. When you're looking at options, it's always a good idea to compare payment gateways to see what the wider market offers.

Don't forget to check out their customer support, either. When money is on the line, you can't afford to wait three days for an email reply. Is their support available 24/7? Can you talk to a real human? Great support is the difference between a minor hiccup and a major revenue crisis.

To make this whole process a bit easier, I've put together a simple checklist. Use this to grill any potential payment gateway provider before you commit.

Your Subscription Gateway Evaluation Checklist

| Evaluation Criteria | Question to Ask | Why It Matters |

|---|---|---|

| Pricing Structure | Is it flat-rate or interchange-plus? What are all the hidden fees (setup, monthly, chargeback)? | You need predictable costs to manage your cash flow, especially when you're starting out. |

| Integration | How does this plug into my platform (e.g., Telegram)? Do I need a developer? | A clunky integration costs you time and money. It should be seamless. |

| Scalability | Can your system handle a 100x increase in my subscriber base without failing? | Your gateway shouldn't be the bottleneck that stops your growth. |

| Global Payments | Can I accept payments from members outside the UK? What are the currency conversion fees? | If you have a global audience, this is non-negotiable. Hidden fees here can kill your margins. |

| Dunning Management | Do you have automated tools to handle failed payments and update expired cards? | Manually chasing failed payments is a soul-crushing time sink. Automation is key for retention. |

| Security & Compliance | Are you fully PCI compliant? What fraud protection tools do you offer? | A security breach can destroy your business and your reputation. This is a must-have. |

| Customer Support | Is support available 24/7? Can I speak to a real person quickly if something goes wrong? | When payments stop, your business stops. You need fast, competent help. |

Treat this checklist like a job interview for your next business partner. A little due diligence now will save you a world of pain later. Choose wisely.

Navigating the UK Payments Landscape

a74aee6d-eded-4d5f-80d3-6a0cb9734064.jpg

Running a subscription business in the UK? Slapping a generic payment system on your checkout page is a rookie mistake. You need a subscription payment gateway that speaks the local financial language, because success here hinges on one simple thing: making it dead easy for British customers to pay how they want to pay.

Failing to offer the right payment methods is like putting a locked door between you and your subscribers. It creates friction right at the finish line, the single most important step in the entire sign-up process.

To build trust and get people to actually click "subscribe," you have to meet them where they are. For most Brits, that means keeping it simple and familiar. The right gateway makes the decision to join feel like a no-brainer.

The Dominance of Debit Cards and Direct Debit

In the UK, two payment methods absolutely own the recurring payment game: debit cards and Direct Debit. It's not even close.

Debit cards are the default choice for pretty much every online purchase, and that habit bleeds right into subscriptions. They're straightforward, everyone has one, and they’re trusted. Simple.

Direct Debit, on the other hand, is the undisputed king of automated, recurring bills – think gym memberships, phone contracts, and utilities. It’s a system built on reliability, and offering it signals that your business is legit, stable, and professional.

A top-tier subscription payment gateway for the UK market must handle both of these flawlessly. If you ignore either one, you’re basically telling a huge chunk of your potential audience, "Sorry, we don't want your money." You're leaving predictable revenue on the table.

The numbers are staggering. The UK payment market processed a mind-boggling 48.1 billion payments in a single year. Debit cards made up half of all transactions, clocking in at 24.5 billion. For subscriptions specifically, the Direct Debit system is a beast, recording 4.8 billion transactions. You can dive deeper into the stats in the latest report from UK Finance.

Adapting to Modern Payment Trends

While the old guard is still in charge, the UK payments scene is also jumping on new tech. A modern gateway has to be forward-thinking, because customer expectations are changing fast. The rise of digital wallets is impossible to ignore.

Here’s what a modern gateway needs to stay in the game:

- Digital Wallet Integration: Support for Apple Pay and Google Pay isn't a "nice-to-have" anymore. It's a baseline expectation for a quick, painless checkout.

- Contactless Mentality: While this is mainly an in-person thing, the demand for speed and convenience it created has absolutely shaped online expectations.

- Open Banking Solutions: Newer methods like "Pay by Bank" are gaining serious ground, offering super-secure, real-time payments straight from a customer's bank account.

Picking a provider that gets this unique mix of ingrained habits and new trends is non-negotiable. A gateway properly optimised for the UK market ensures you’re not just catering to today’s customers, but you're ready for tomorrow’s, keeping your business competitive and subscriber-friendly.

A Gateway Built for Telegram Creators? Finally.

Okay, let's be real. The theory behind a good payment gateway is one thing, but making it work for a specific community is a whole different ball game. For the thousands of creators, coaches, and experts building actual businesses on Telegram, the right payment tool isn’t just a nice-to-have. It’s the engine that turns a group chat into a career.

This is where a specialised tool, built for Telegram, changes everything.

Trying to bolt on a traditional gateway is a nightmare. They're clunky, disconnected, and force you to manually manage every single member. Picture this: cross-checking Stripe payments against a spreadsheet, sending individual invite links, and then hunting down members whose payments failed. It's an admin death spiral that steals all your time from what you're actually good at: creating content.

MyMembers was built to kill that exact problem. It’s the subscription payment gateway designed from the ground up for the Telegram world, solving the headaches that only Telegram creators truly understand.

Made for the Creator Workflow

Forget needing to hire a developer or untangle complex APIs. MyMembers is refreshingly simple. No code required.

It hooks directly into your Stripe account, letting you accept recurring payments almost instantly. This means you’re focused on your members, not stuck wrestling with tech.

The whole platform is designed to automate the entire subscriber journey, fixing the biggest pains for channel owners:

- Automated Member Management: A new person subscribes? Boom. MyMembers automatically shoots them an invite link to your private channel or group.

- Airtight Access Control: If someone cancels or their payment bounces, the system boots them out for you. Your exclusive content stays exclusive. No awkward DMs needed.

- Zero Manual Work: This hands-off approach means you can finally delete that chaotic spreadsheet you’ve been using to track who's paid and who hasn't. The gateway does all the heavy lifting.

This dashboard from MyMembers shows just how clean and simple managing your community can actually be.

The big idea here is simplicity and deep integration. It makes the money side of things feel like a natural part of running your Telegram channel, not some separate, soul-crushing chore.

From Community to Recurring Revenue

At the end of the day, a payment gateway for a Telegram creator has one job: turn followers into paying members with zero friction.

MyMembers nails this by letting you spin up custom landing pages in minutes. You can set up one-time fees, recurring subscription plans, and even offer free trials to get new people in the door.

For a creator, predictable income is freedom. A specialised gateway like MyMembers provides the financial backbone for that freedom, transforming a passion project into a reliable business by automating revenue and removing the administrative burden.

By handling the entire payment and access dance from start to finish, it empowers you to build a real, recurring revenue stream directly from your Telegram community. You can finally stop stressing about the logistics of getting paid and pour all that energy back into creating amazing content for your people.

That’s how you build a creator business that actually lasts.

Automating Your Recurring Revenue

https://www.youtube.com/embed/5v4v-MPoEOs

The journey to a stable, predictable income stream starts with picking the right tools. We've seen that a subscription payment gateway is more than just a piece of software—it's a strategic partner in your business's growth. By automating your payment process, you're buying back your freedom to focus on what actually matters: delivering incredible value to your subscribers.

We've covered the core features to look for and the checklist for choosing the right fit. We’ve also seen how a purpose-built solution like MyMembers can completely change the game for Telegram creators. The path to securing your revenue and ditching the administrative headache is clear, whether you’re running a small community or a fast-growing enterprise.

Choosing the right gateway automates your income and frees you from the manual grind of chasing payments, managing access, and handling expired cards. This gives you back your most valuable asset: time.

To really dial in your operations, you might also look at comprehensive subscription management platforms like Outseta for broader business needs. For those just starting out with simpler tools, just getting the setup right is half the battle. Our guide on setting up PayPal for recurring payments can offer a solid foundation as you begin your automation journey.

Got Questions? We've Got Answers

Diving into recurring payments can feel like learning a new language. Let's clear the fog. Here are some straight-up answers to the questions we hear all the time about subscription payment gateways.

What’s the Difference Between a Payment Gateway and a Processor Anyway?

Think of it like this: the gateway is the slick, secure credit card terminal on an online checkout page. Its main job is to grab the payment info, lock it down with encryption, and pass it on. Simple.

The processor is the one doing the heavy lifting behind the scenes. It takes that encrypted data and actually talks to the banks—your customer's and yours—to see if the funds are there and move the money.

In a subscription business, the gateway gets a promotion. It also becomes the scheduler, telling the processor when to charge the card each month. It’s the brains of the recurring payment operation.

What Happens When a Subscription Payment Fails?

This is where a good gateway really earns its keep. It’s a process called dunning management, and it’s way smarter than just sending a "payment failed" email.

When a card is declined—maybe it expired or there aren't enough funds—the system doesn't just give up and cancel the subscription. That would be crazy.

Instead, it automatically retries the charge at smart intervals over a few days or weeks. At the same time, it can fire off a series of polite, automated emails asking the customer to update their details. This little dance recovers a ton of revenue you'd otherwise lose.

It’s an automated process that saves you from the super awkward job of chasing down customers for money. A total lifesaver for reducing involuntary churn.

Can I Switch to a Different Gateway Later On?

You can, but it can be a real headache if you pick the wrong partner upfront. The tricky part is moving your subscribers' payment data, which is stored as secure "tokens."

Some gateways play nice and make it easy to export this data, a concept known as data portability. They understand you might need to move as you grow.

Others? Not so much. They can make it incredibly difficult to get your data out, essentially locking you into their system. Before you sign up with anyone, always ask about their data export and portability policies. A good partner wants to see you succeed, not hold your data hostage.

Are These Subscription Gateways Actually Secure?

Absolutely. Security is pretty much their entire reason for existing.

Any reputable gateway has to be PCI DSS (Payment Card Industry Data Security Standard) compliant. That’s the global gold standard for protecting card information.

They use clever tech like tokenization, which swaps out sensitive details like a full credit card number for a unique, meaningless string of characters (a "token"). This means you never actually store raw card data on your own servers, slashing your security risk and liability if a breach ever happens.

Ready to stop worrying about the tech and start building a predictable income from your Telegram community? MyMembers is the no-code answer. It handles all the member management and payment headaches automatically, so you can get back to creating. Start your free trial today and see how easy it can be.