Automated billing systems are the secret weapon behind any successful subscription-based business. Think of them as your own digital finance team, working around the clock to manage payments, invoices, and subscriptions without you having to lift a finger.

What Exactly Are Automated Billing Systems

Imagine for a second you had to manage hundreds of customer payments by hand. You'd be stuck tracking renewal dates, creating invoices one by one, sending endless payment reminders, and personally chasing down every single failed transaction.

It’s not just a headache; it’s a guaranteed way to make costly mistakes and give your customers a clunky, unprofessional experience.

Trying to handle billing manually is like trying to direct traffic at a busy city-centre intersection during rush hour all by yourself. You might handle a few cars just fine, but once the volume picks up, it's pure chaos. An automated billing system is the smart traffic light grid that syncs everything up, keeping the flow smooth and efficient, no matter how busy things get.

The Financial Backbone of Modern Business

These systems are way more than just invoice generators. For any creator or business relying on recurring revenue, they are the financial backbone of the entire operation. Their main job is to take care of the entire customer billing lifecycle, from the moment someone signs up to the day they cancel.

This covers all the critical stuff you don't want to do manually:

- Recurring Subscriptions: Automatically charging your members on a set schedule (monthly, yearly, etc.) for access to your private Telegram community. No more awkward "your payment is due" messages.

- One-Off Invoicing: Need to bill for a single product or a one-time service alongside regular subscriptions? The system handles that too, creating and sending invoices without messing up the recurring payments.

- Payment Failure Management: When a payment fails—and they always do—the system intelligently retries the charge and notifies the customer. This process, known as dunning, can recover up to 40% of payments that would otherwise be lost revenue.

- Revenue Recognition: It correctly logs when money is officially earned, which is a lifesaver for keeping your financial reports accurate and staying on the right side of the tax man.

At its core, an automated billing system turns a messy, manual chore into a reliable, hands-off operation. It makes sure you get paid on time, every time, while giving your community a seamless and professional experience.

For a creator running a growing Telegram channel, this is a game-changer. You no longer have to manually check if a member's payment has cleared before adding them to the group or kicking them out. The system links their payment status directly to their membership, freeing you up to do what you actually enjoy: creating amazing content for your community.

Key Features of Modern Billing Automation

14476c67-ec0e-424f-a667-6c597bcf2abf.jpg

To really get what makes automated billing systems tick, you have to look past a boring list of functions and see the core parts that actually do the heavy lifting. These aren't just fancy add-ons; they're the engines that drive your revenue, slash your manual workload, and keep your members happy.

Think about a creator with a booming Telegram community. They need a system that does more than just take money. It has to manage the entire member journey from sign-up to renewal. This is where the standout features of modern automation solve real, painful problems.

Recurring Billing and Subscription Management

Recurring billing is the absolute heart of any membership business. It's the bedrock of predictable income, automatically charging your members on a schedule—whether that's weekly, monthly, or yearly.

For a creator, this means you can set up tiered subscriptions, like a ‘Standard Access’ tier and a ‘VIP’ tier with exclusive perks, and the system handles it all without you lifting a finger.

The best systems even handle pro-rata calculations when a member upgrades or downgrades mid-cycle, making sure every charge is fair and accurate. That kind of flexibility is key for building pricing models that actually work.

Dunning Management for Revenue Recovery

So, what happens when a member's payment fails? Expired card, not enough funds... it happens all the time. This is where dunning management becomes your financial safety net.

Instead of just losing that customer and their cash, the system kicks into an automated recovery sequence.

Dunning is an automated process that retries failed payments and sends customised reminders to customers. This single feature can recover a significant portion of revenue that would otherwise be lost to involuntary churn.

This smart process is a total game-changer. It protects your cash flow by clawing back failed payments while giving your members a gentle, hassle-free way to update their details.

Essential Integrations and Analytics

A modern billing system can't be an island. It has to plug into the other tools you use every day, especially payment gateways. Having solid payment processing, like the kind seen in Splashaccess payment solutions, is non-negotiable. It ensures you can accept payments from different sources securely.

On top of that, these systems give you powerful analytics dashboards. You can see your monthly recurring revenue (MRR), churn rate, and customer lifetime value at a glance. This data is gold for figuring out which subscription tiers are killing it and making smart moves to grow your community.

The system also takes care of the mind-numbing complexities of financial reporting, a process you can get a better handle on by checking out automated payment reconciliation.

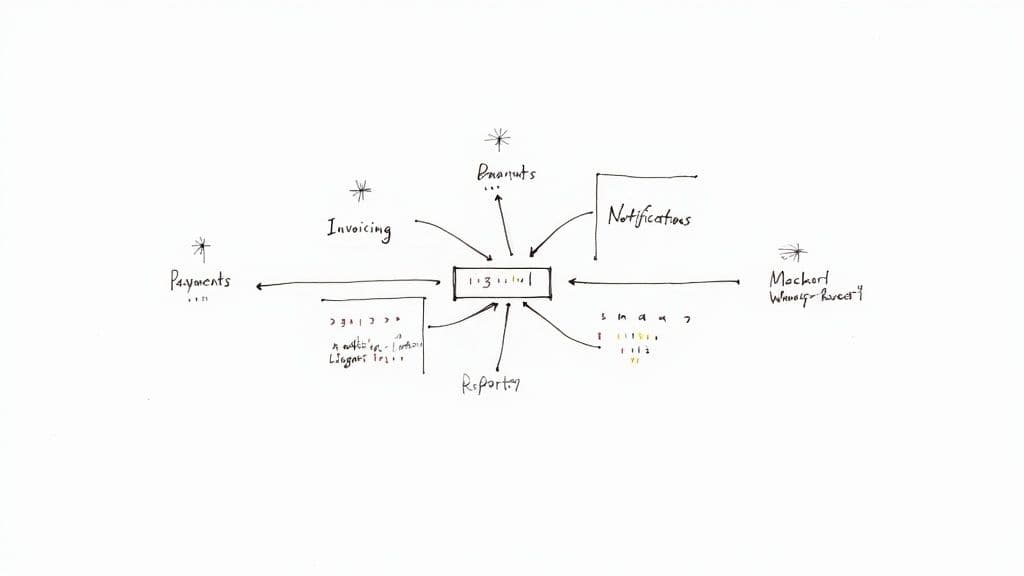

The Strategic Benefits of Automating Billing

7ec9660c-5905-4138-85b3-caf4ea6d24cb.jpg

Saving time is great, but that's not the real reason to automate your billing. The true power of an automated billing system is its strategic muscle. Thinking of it as just a time-saver is like using an iPhone only for calls — you’re missing the point entirely.

This isn’t about shortcuts. It’s about building a growth engine.

The first big win? You stop losing money. Manual billing is a leaky bucket. A typo on an invoice, a forgotten reminder email, a dodgy tax calculation — each one is a small hole draining your revenue. Research shows these little mistakes add up, costing some industries billions.

Automation plugs those leaks for good. It creates a rock-solid system that protects every pound you earn, all while making you look professional and trustworthy to your customers.

Unlocking Predictable Growth and Deeper Insights

Beyond just stopping the leaks, automation helps you build a more stable financial future. When you have a system that reliably processes recurring payments, your cash flow suddenly becomes predictable.

That stability is everything. It's the foundation you need to plan your next move, whether that’s investing in new content for your Telegram community or finally hiring some help.

Plus, these systems are basically treasure troves of data. They turn your payment history into a dashboard for your business, answering critical questions like:

- Which subscription tiers are killing it? This tells you what your members actually value, so you can double down on what works.

- What's my churn rate? You get a real-time look at how many members you're losing, which is the first step to figuring out why.

- What's the lifetime value of a subscriber? This number is gold. It helps you make smarter calls on how much to spend on marketing to get new members.

An automated billing system transforms your transaction history from a boring record of payments into a strategic asset. It gives you the hard data to forecast revenue, understand your customers, and make decisions that actually fuel growth.

This isn't just a small-creator trend. The whole market is moving this way. The UK's cloud billing market—the tech that powers these platforms—is set to grow by around 12.8% a year between 2025 and 2035.

That’s a massive signal that businesses are ditching spreadsheets for smarter, flexible solutions that give them a real competitive edge. You can dig into more insights on how automation is changing UK finance over on Finextra.com.

Ultimately, getting an automated billing system isn't an expense. It's a strategic investment in your ability to scale and build a business that can handle whatever comes next.

Choosing the Right Billing System for Your Business

Picking the right engine for your billing is a massive decision. It’s not just about collecting cash; it’s a choice that shapes your budget, how nimble you can be, and your room to grow down the line. This isn't a one-size-fits-all situation. The best move depends entirely on what your business actually needs and the resources you have in your back pocket.

Essentially, you’re looking at two main paths: grab a ready-made platform or build your own from scratch.

SaaS vs. Custom Build: The Big Showdown

For most creators and small businesses, a Software-as-a-Service (SaaS) platform is the smartest place to start. Think of it like leasing a fully-equipped professional kitchen. It has all the high-end ovens, fridges, and tools you need, ready to go. You just show up and start cooking.

These solutions are pre-built, hosted in the cloud, and designed to get you up and running fast. We’re talking hours, not months. You can start monetising your community almost straight away. The trade-off? You’re working within their kitchen rules, which means less room for wild customisation.

On the other side of the ring, you’ve got the custom in-house build. This is like designing and building that professional kitchen from the ground up, brick by brick. You get total control over every single feature, every workflow, every little detail, making it a perfect fit for your unique model. Sounds great, right?

The catch is the colossal upfront investment. You need a mountain of time, a serious budget, and a skilled tech team to not only build it but also keep it running. For a massive company with weirdly specific needs, this often makes sense. For a creator trying to monetise a Telegram group? It’s almost always overkill.

Comparing Billing System Deployment Options

So, how do you actually decide between leasing that slick, ready-to-go kitchen (SaaS) and building your own five-star restaurant from scratch (Custom Build)? Let's break down the real-world trade-offs. The table below lays it all out, factor by factor.

| Factor | SaaS Platform (e.g., MyMembers) | Custom In-House Build |

|---|---|---|

| Upfront Cost | Low to none. Usually a monthly subscription. | £20,000 - £100,000+. Requires a full development team. |

| Time to Launch | Hours or days. You can start selling almost immediately. | Months, sometimes over a year. Long development cycles. |

| Technical Team | Not required. The platform handles all the tech. | Essential. You need developers, QA, and project managers. |

| Maintenance | Included in your subscription. No surprise costs. | Ongoing and expensive. You pay for every bug fix and update. |

| Customisation | Limited. You work within the platform's features. | 100%. Tailored perfectly to your exact business logic. |

| Security & Compliance | Handled for you. PCI compliance is usually built-in. | Your responsibility. A massive and continuous undertaking. |

| Best For | Creators, small businesses, and anyone wanting to start fast. | Large enterprises with unique, complex billing needs. |

Looking at the comparison, it’s pretty clear. If you’re a creator, a coach, or a small business owner, the speed and simplicity of a SaaS platform just makes more sense. It lets you focus on your community, not on becoming a software developer overnight.

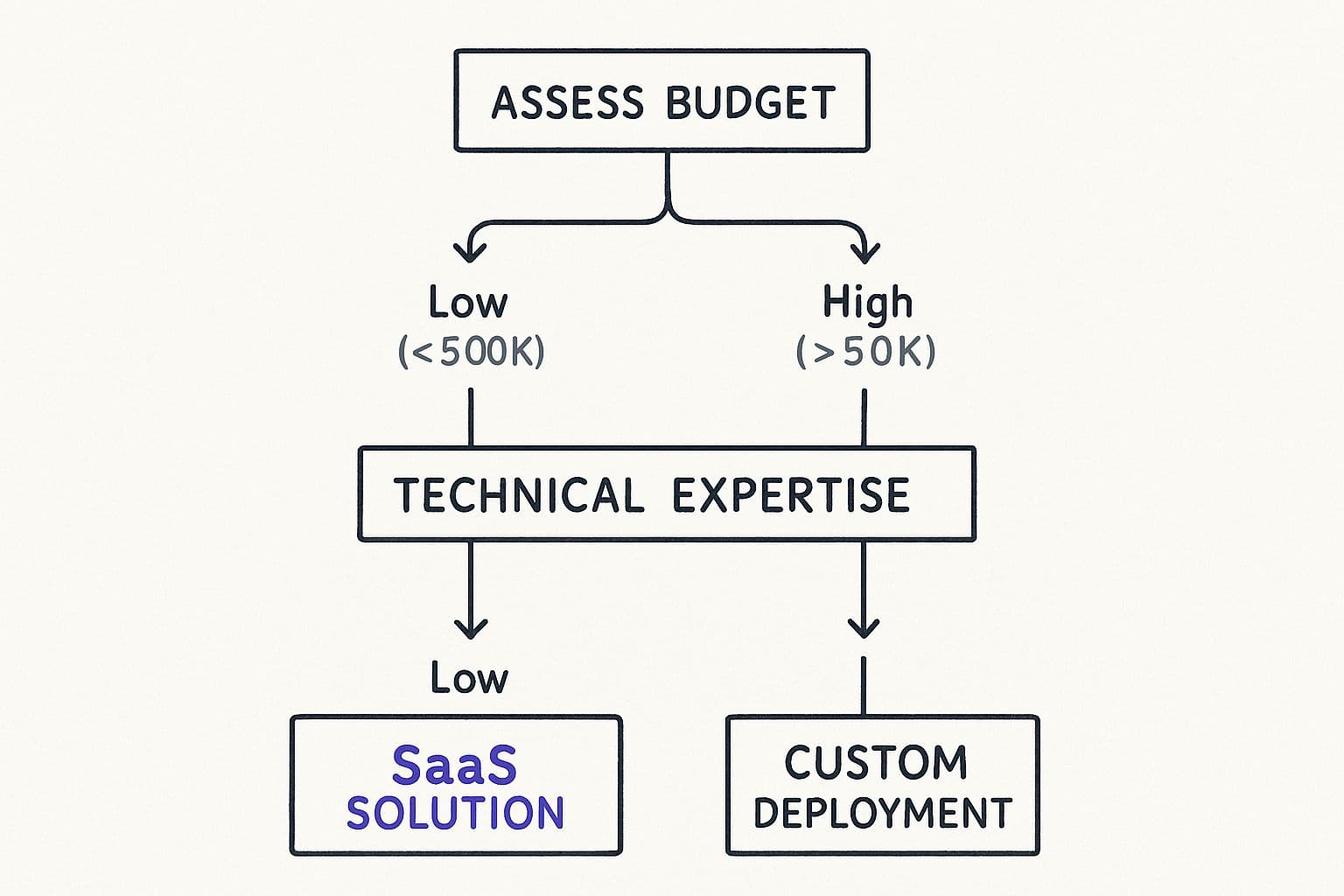

Making the Right Call for You

So, what’s the verdict? It really boils down to two things: your budget and your access to tech expertise. If you're working with limited capital and don't have a team of developers on speed dial, a SaaS solution is the clear winner. It gives you powerful, secure billing automation without the soul-crushing financial and operational weight of a custom build.

This decision tree cuts right to the chase.

8d0a4427-e5d8-409c-8634-fee9bd819bba.jpg

As you can see, if your budget is tight and your tech team is, well, you, a ready-made SaaS solution is the way to go.

Choosing your billing system is the first big step, but it’s just as vital to make sure it plays nicely with your financial tools. This is where payment gateways enter the picture, acting as the secure bridge between your business, your members, and your bank.

A crucial piece of this puzzle involves selecting the right subscription payment gateway to plug into your billing system. This choice impacts everything from transaction fees to the payment methods you can offer your community. A solid automated billing system is only as good as its connection to a reliable payment gateway, ensuring every transaction is smooth and secure.

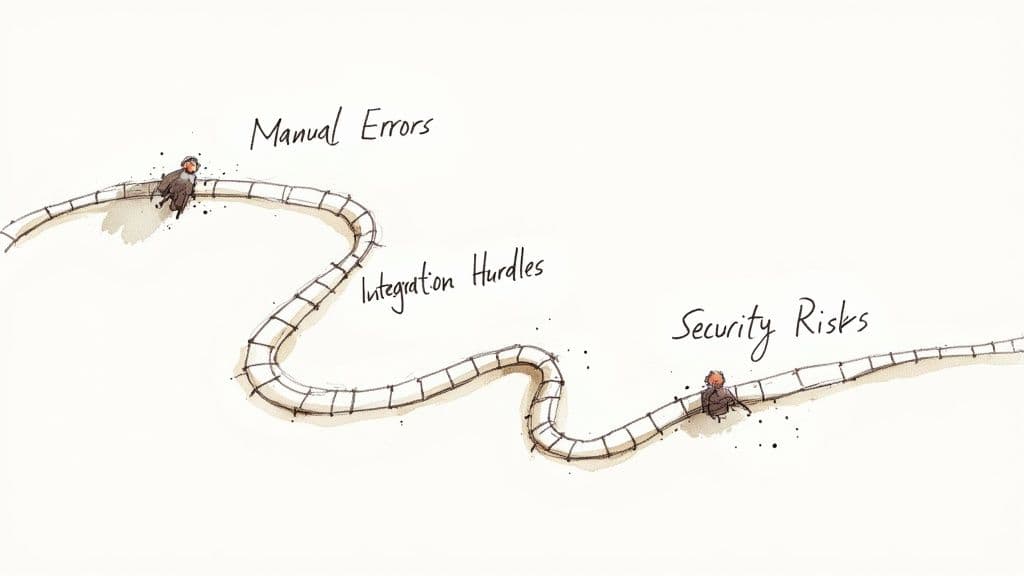

How Creators Monetise Communities with Automation

e60617fd-a9e1-4551-8937-d3c50f54433a.jpg

This dashboard from MyMembers isn't just a bunch of numbers. It’s a creator's command centre, showing you exactly who's active, how much you're earning, and where your business is heading. It turns messy data into clear, actionable intel.

So, how do you get from a buzzing Telegram community to a reliable income stream? The bridge is an automated billing system built for creators. Forget clunky software; this is a simple, powerful playbook.

Let’s walk through how a creator uses a tool like MyMembers to turn their passion into a real profession.

First thing’s first: you have to ditch the spreadsheets and awkward bank transfer requests. A creator connects their Stripe account to a platform like MyMembers, and instantly they have the professional setup to take payments securely.

This isn't just about looking professional. It’s about meeting your audience where they are. Consumer behaviour in the UK has shifted massively towards seamless digital payments. Contactless card use shot up from 53% in 2017 to 91% in 2022–23. People expect easy, digital transactions. You can read more on these trends in these insights provided by Airwallex.

Building Your Subscription Tiers

Once the payment plumbing is in place, you decide what you're actually selling. Instead of one flat price, you can create different subscription tiers to hit every part of your audience.

It might look something like this:

- Bronze Tier: A basic monthly fee for access to your main Telegram channel.

- Silver Tier: A step up in price for main channel access plus a weekly live Q&A session.

- Gold Tier: The premium option. Everything from Silver, plus exclusive content and maybe some one-on-one access.

This tiered model, all managed inside the billing system, lets you maximise your earnings by giving followers options that fit their budget and how much value they want. The platform even spits out a unique, shareable landing page for your tiers, making the sign-up process ridiculously simple for new members.

Automating the Member Journey

This is where the real magic happens. When someone subscribes through your landing page, the system does way more than just take their money. It kicks off a whole automated sequence:

- Instant Access: An invite link to the right private Telegram channel or group is sent out automatically.

- Ongoing Management: As long as their recurring payments go through, their access continues without a hitch.

- Access Revocation: But if a payment fails or they cancel? The system automatically boots them from the group. No awkward DMs needed.

This hands-off management is the entire point. It frees you from the soul-crushing admin of manually checking payments against a list of members. You get to focus 100% on creating great content, knowing the billing and access control is completely sorted.

The Future of Billing and Invoicing in the UK

embed

Let's look ahead for a moment. The way businesses in the UK handle billing and invoicing is about to get a serious upgrade, thanks to smarter tech and a big push from the government.

Automated billing systems are no longer just about sending invoices out on time. They're evolving into predictive, proactive financial tools that can actually protect your revenue.

The next wave is all about artificial intelligence (AI). Imagine a system that doesn't just chase a failed payment but actually predicts which customers are likely to churn based on how they pay. This lets you step in before you lose a customer, completely changing the game.

This shift from simple automation to intelligent forecasting is what will separate the winners from the losers. AI algorithms can sift through massive amounts of payment data to figure out the perfect time and method to contact a customer to recover a payment, bumping up recovery rates in a big way.

The Push for Digital Tax and E-Invoicing

Another huge driver of change is the UK government's move towards digital-first financial reporting. They're actively laying the groundwork for a nationwide electronic invoicing (e-invoicing) system as part of a much bigger digital shake-up.

While it's not mandatory just yet, a public consultation is slated for early 2025, which is a massive signal that change is on the horizon. You can get the full rundown on the UK's e-invoicing roadmap on Pagero.com.

What does this actually mean for you? It means your business will need a system that can create, send, and process invoices in a standardised digital format that talks directly to the tax authorities.

The whole point is to:

- Boost productivity by killing off manual data entry.

- Improve cash flow because invoices get delivered and paid faster.

- Simplify tax reporting by automating how data is submitted.

The future isn't about just automating what you do today; it's about having a system that can adapt to the rules of tomorrow. An adaptable billing platform is the only way to future-proof your finances against these shifts.

Ultimately, picking the right automated invoicing software is all about getting ready for this new reality. It’s about making sure your business stays compliant, runs efficiently, and is ready to use the data-driven insights that modern financial tech offers. An adaptable system isn't just a nice-to-have anymore—it’s becoming a non-negotiable asset for any UK business.

Got Questions About Billing Automation?

Thinking about automating your billing always sparks a few questions. How much is this really going to cost me? Can I trust it with my members' data? What happens when my community blows up?

Let's cut through the noise. Here are the straight answers to the questions we get all the time.

How Much Is This Going to Cost Me?

The price tag on these systems is all over the place. If you're thinking about building one from scratch, get ready to open your wallet—a custom in-house system can easily hit tens of thousands of pounds just to get it off the ground, and that's before you even think about maintenance costs. Ouch.

For most creators, that's just not realistic. This is where SaaS platforms come in. They work on a simple monthly subscription, usually with a tiny fee per transaction. This completely flips the script, getting rid of that scary upfront investment and making top-tier automated billing systems something you can afford, even if you're just starting out.

The bottom line? You don't need a massive budget anymore. Modern tools have made billing automation accessible for everyone, turning what used to be a huge capital expense into a small, predictable monthly bill.

Is My Customer Data Actually Secure?

100%. Security isn't just a feature; it's the entire foundation of any billing platform worth its salt. Any provider you look at should be fully compliant with the Payment Card Industry Data Security Standard (PCI DSS), which is the gold standard for handling sensitive payment info.

This means they’re using heavy-duty encryption and airtight security to protect both your business and your members' details. By using a compliant system, you're basically hiring a team of security experts to handle the scary stuff, so every payment is safe and you don't have to lose sleep worrying about it.

Will This Thing Actually Scale With My Community?

Yep, that’s one of their superpowers. It doesn't matter if you have ten members or ten thousand—a good automated system handles growth without even blinking.

As your community gets bigger, the platform just keeps on ticking, managing all the new subscriptions, invoices, and payments without you having to lift a finger. It lets you put all your energy into growing your community, knowing your payment setup can handle whatever you throw at it.

Ready to stop chasing payments and start growing your community? MyMembers provides a simple, powerful automated billing system designed for creators. Start monetising your Telegram community in minutes.