Automated payment reconciliation is a fancy way of saying you’re using software to match up incoming payments with the invoices or sales they belong to. In our world, that means connecting your MyMembers subscriptions to your Stripe payouts without lifting a finger.

This isn’t just about saving a bit of time. It completely removes the soul-crushing task of manual data entry, slashing human error and freeing up countless hours for you and your team.

Why Manual Reconciliation Is Holding You Back

Before we get into the nuts and bolts of setting this up, we need to talk about why. For too many businesses, manual reconciliation feels like a necessary evil.

You know the drill. It’s that painful process of exporting your MyMembers sales, grabbing your Stripe payout reports, and then painstakingly matching them line by line in a spreadsheet that just gets bigger and more chaotic every month.

This isn't just a bit inefficient; it's a massive drain on your resources and a breeding ground for hidden financial risks.

31b9b93f-6900-4c10-8d10-3475efb79cac.jpg

If you’re still doing this by hand, you’re not alone. A recent survey found that a shocking 84% of UK payment firms are still bogged down by manual tasks and spreadsheets for their reconciliation.

Even worse, 63% of those firms admitted their operational costs were climbing right alongside their transaction volumes. That’s a direct link. The more you grow, the more expensive and painful the manual work becomes. You can dig deeper into these payment reconciliation trends and see the real-world impact they have.

The True Cost of Doing Things by Hand

The trouble with manual reconciliation goes way beyond just wasted hours. It creates very real problems that can hamstring your business’s financial health and stop you from scaling.

Sound familiar?

- Discrepancy Hunting: Burning hours trying to track down tiny mismatches. Was it a Stripe fee? A currency conversion? Maybe just a timing difference between when the payment was made and when it landed in your bank. It’s a frustrating game of hide-and-seek with your money.

- Data Entry Errors: A single typo in a spreadsheet cell can throw off an entire month's reporting. This kicks off a nightmare search for one wrong digit amongst thousands of correct ones.

- Delayed Financials: When your team is stuck matching transactions, closing the books becomes a slow, painful crawl. This means the crucial financial insights you need to make smart decisions are always late to the party.

- Growth Bottlenecks: A manual system that just about works for 50 members will completely fall apart when you hit 500. The transaction volume skyrockets, the chance of errors multiplies, and your whole process grinds to a halt.

To really see the difference, let’s put the two methods side-by-side.

Manual vs Automated Reconciliation: A Quick Comparison

The table below breaks down the real-world impact of sticking with spreadsheets versus letting a system handle the work. It’s not just about convenience; it’s about risk, cost, and your ability to grow.

| Metric | Manual Reconciliation (Spreadsheets) | Automated Reconciliation (MyMembers + Stripe) |

|---|---|---|

| Time Investment | 10-20+ hours per month, increasing with transaction volume. | Minutes per month for review and exception handling. |

| Accuracy & Error Rate | High risk of human error from typos, formula mistakes, and missed transactions. | Near-perfect accuracy. The system flags discrepancies automatically. |

| Operational Cost | High and unpredictable. Scales directly with staff hours and business growth. | Low and fixed. A predictable software cost, regardless of volume. |

| Financial Visibility | Delayed. Reports are only available after the manual process is complete (days or weeks late). | Real-time. Cash flow is visible instantly, enabling faster decisions. |

| Scalability | Poor. The process breaks down quickly as the business grows, creating bottlenecks. | Excellent. Easily handles thousands of transactions without extra effort. |

| Risk of Fraud | Moderate. Manual processes make it easier for fraudulent transactions to be missed. | Low. Automated systems instantly flag unusual activity and mismatches. |

As you can see, the contrast is stark. One path leads to more work, higher costs, and greater risk as you succeed, while the other provides a stable, scalable foundation for growth.

The real danger of manual reconciliation isn't just the time it eats up; it's the financial blind spots it creates. Without a clear, real-time view of your cash flow, you’re flying blind and making decisions based on old or incomplete data.

Ultimately, sticking with spreadsheets forces your team to spend its time looking backwards instead of forwards. Moving to an automated payment reconciliation system isn't just an upgrade; it’s a fundamental shift.

It’s about turning a reactive chore into a proactive, reliable business function that paves the way for accuracy, efficiency, and confident growth.

Preparing Your Accounts for Flawless Integration

Look, successful automation doesn’t just happen. It’s built on a clean, organised foundation. Before you even think about connecting MyMembers and Stripe, a little prep work goes a long, long way.

Think of it as a pre-flight check. Getting your data lined up now prevents the classic sync errors and mapping problems that trip so many people up later. It’s like tidying your house before guests arrive—it just makes everything run smoother.

The whole point is to remove any guesswork between the two systems. If your "Gold Tier" subscription in MyMembers is called "gold-monthly" over in Stripe, the automation won't have a clue they're the same thing. That simple mismatch is one of the most common headaches I see, but it’s completely avoidable.

This is a peek inside the Stripe dashboard, showing how you can set up different products and pricing models.

95e5b83e-1f64-49c6-8390-52edcc986113.jpg

Making sure the names and IDs for these products perfectly mirror what you’ve got in MyMembers is ground zero for accurate, automated payment reconciliation.

Aligning Your Data for Accuracy

First things first: audit your subscription plans. The naming conventions you use have to be identical across both platforms. I’m not just talking about the plan name itself, but also any internal IDs or SKUs you might be using.

Next, take a look at your historical data. If you’ve got old, inactive members or defunct subscription plans cluttering up your accounts, now is the time to archive them. This cleanup stops the system from trying to sync irrelevant or outdated info, which can easily cause the initial connection to fail.

A quick checklist to run through:

- Standardise Plan Names: Make sure "Premium Monthly" in MyMembers is also "Premium Monthly" in Stripe, not something cryptic like "prem_month". Consistency is everything.

- Verify Currency Settings: Double-check that your default currency is the same in both accounts. This will save you a world of pain with conversion discrepancies down the line.

- Configure Tax Rules: If you're collecting VAT or other taxes, ensure your tax settings in Stripe are dialled in to match the rates you've set up in MyMembers.

A clean dataset is the single most important factor for a successful integration. Taking an hour to standardise names and clean up old records now can save you dozens of hours troubleshooting reconciliation errors later.

Final Technical Checks

With your data all lined up, there are just a couple of final technical checks to ensure a seamless connection. It's crucial to verify you have the right administrative permissions in both your MyMembers and Stripe accounts. Restricted access can block the API from fetching the data it needs, stopping the process before it even starts.

If you’re juggling more complex payment structures, like using different processors for different services, it's worth reviewing our guide on setting up recurring payments with PayPal. It gives some great insight into how various systems handle subscriptions differently.

And while you're automating your incoming payments, it's worth thinking about the other side of the coin. Many businesses are finding huge efficiency gains by implementing supplier payment automation to streamline their outgoing cash flow, too.

By ticking off these boxes, you’re basically creating the perfect environment for a powerful and reliable automated reconciliation process. You're setting yourself up for success from day one.

Alright, let’s get these two talking. Hooking up MyMembers and Stripe is the moment everything clicks into place for automated reconciliation. Don't worry, you won't need to write a single line of code. This is all about telling the two platforms how to communicate.

The whole point is to create a secure link using something called API keys. Think of an API key as a special password that lets MyMembers safely ask for and receive payment data from your Stripe account. Finding these keys is your first and most important job here.

You’ll find your API keys hiding in your Stripe dashboard, right under the "Developers" section. Stripe gives you two of them: a "Publishable" key and a "Secret" key. MyMembers needs both to work properly, so you'll just copy each one and paste it into the right spot in your MyMembers integration settings.

Kicking Off the First Data Sync

Once you've plugged in the keys and hit save, MyMembers gets to work on its initial data sync. This is where it pulls all the essential info from Stripe, building the foundation it needs to match payments later on. It's not instant, but you'll get a confirmation once the connection is live and kicking.

This first sync is a massive deal. It’s what populates your MyMembers account with the raw data required for dead-on accurate reconciliation. Here’s a look at what it pulls across:

- Transaction IDs: The unique fingerprint for every single payment.

- Customer Details: The info that ties a payment back to a specific member.

- Processing Fees: The exact amount Stripe takes from each transaction.

- Payment Status: A clear confirmation of whether a payment succeeded, failed, or was refunded.

Getting this data flowing directly into MyMembers is what makes automated payment reconciliation even possible. Without it, you’d be back to the bad old days of manually exporting spreadsheets and trying to match everything up by hand.

This one connection completely kills the need for manual data prep, a task that eats up a shocking amount of time. The sync creates a single source of truth, so you're no longer bouncing between two platforms trying to piece together your financial picture.

It’s easy to forget just how much time is wasted before reconciliation can even start. A survey of UK payments businesses revealed the average company spends around 3 hours daily just preparing data—chasing down missing fields and reformatting exports. That adds up to over 750 lost hours every single year. You sidestep that entire headache by letting the systems sync up on their own. You can get more insights on how data preparation impacts reconciliation and why getting this right is so critical.

By connecting these two platforms, you’re basically building a data pipeline. Every new subscription, one-off payment, and refund in Stripe will automatically flow into MyMembers, ready to be checked against your records without you lifting a finger. It’s a simple but incredibly powerful setup that turns reconciliation from a recurring chore into a background process you barely even have to think about.

So, you’ve got MyMembers and Stripe connected. Good start.

But the real magic happens when you nail your reconciliation settings. This is the stuff that saves you hours of manual work and prevents those annoying "why doesn't this balance?" headaches down the line.

Let's walk through how to set this up properly so it just works.

H3: Setting Your Automated Reconciliation Rules

Think of reconciliation rules as your financial traffic controller. They tell MyMembers exactly how to handle every single transaction that flows through your Stripe account. Get this right, and you'll have a crystal-clear view of your finances without lifting a finger.

First things first, you'll need to create a Payment Gateway inside MyMembers. This is just a fancy way of telling our system which Stripe account to talk to.

Once that's linked, head over to the Reconciliation Rules section. This is your command centre.

7d33991e-c7db-47de-bd12-54bf954d795e.jpg

Here, you’ll map different payment events from Stripe to specific actions in MyMembers. For example, when a charge.succeeded event happens in Stripe, you want MyMembers to automatically mark that invoice as Paid. Simple, right?

But it gets more detailed. You can set rules for refunds, chargebacks, and even those pesky failed payments. The goal is to automate every possible scenario so your financial records are always accurate and up-to-date.

We've covered the basics of setting up Stripe for automatic payments before, and this builds directly on that foundation. It's about taking that automation to the next level.

To give you a practical idea of how this works, I've put together a table showing some common scenarios and the rules you’d set up in MyMembers to handle them flawlessly.

| Scenario | MyMembers Rule Configuration | Expected Outcome |

|---|---|---|

| Standard Payment | Match Stripe's charge.succeeded event to the Paid status in MyMembers. | The member's invoice is automatically marked as paid. No manual intervention needed. |

| Full Refund | Map Stripe's charge.refunded event (where amount equals original charge) to the Refunded status. | The original invoice is updated to "Refunded," keeping your revenue numbers clean. |

| Partial Refund | Configure a rule for charge.refunded (where amount is less than original) to create a Credit Note. | A credit note for the partial refund amount is generated against the invoice. Perfect for accurate bookkeeping. |

| Chargeback/Dispute | Set Stripe's charge.dispute.created event to trigger the Chargeback status on the invoice. | The invoice is flagged as a chargeback, so you can track disputed revenue separately. |

| Failed Payment | Link Stripe's charge.failed event to an action like Send Dunning Email or tag the user for follow-up. | The system automatically starts the payment recovery process without you having to chase anyone. |

This table just scratches the surface, but you can see the power here. You're building a system that anticipates financial events and reacts accordingly.

Once your rules are in place, you’ll want to run a few test transactions. Create a test product, run a payment, issue a refund, and see how MyMembers handles it. This little bit of upfront testing will save you a world of pain later on. Trust me on this one.

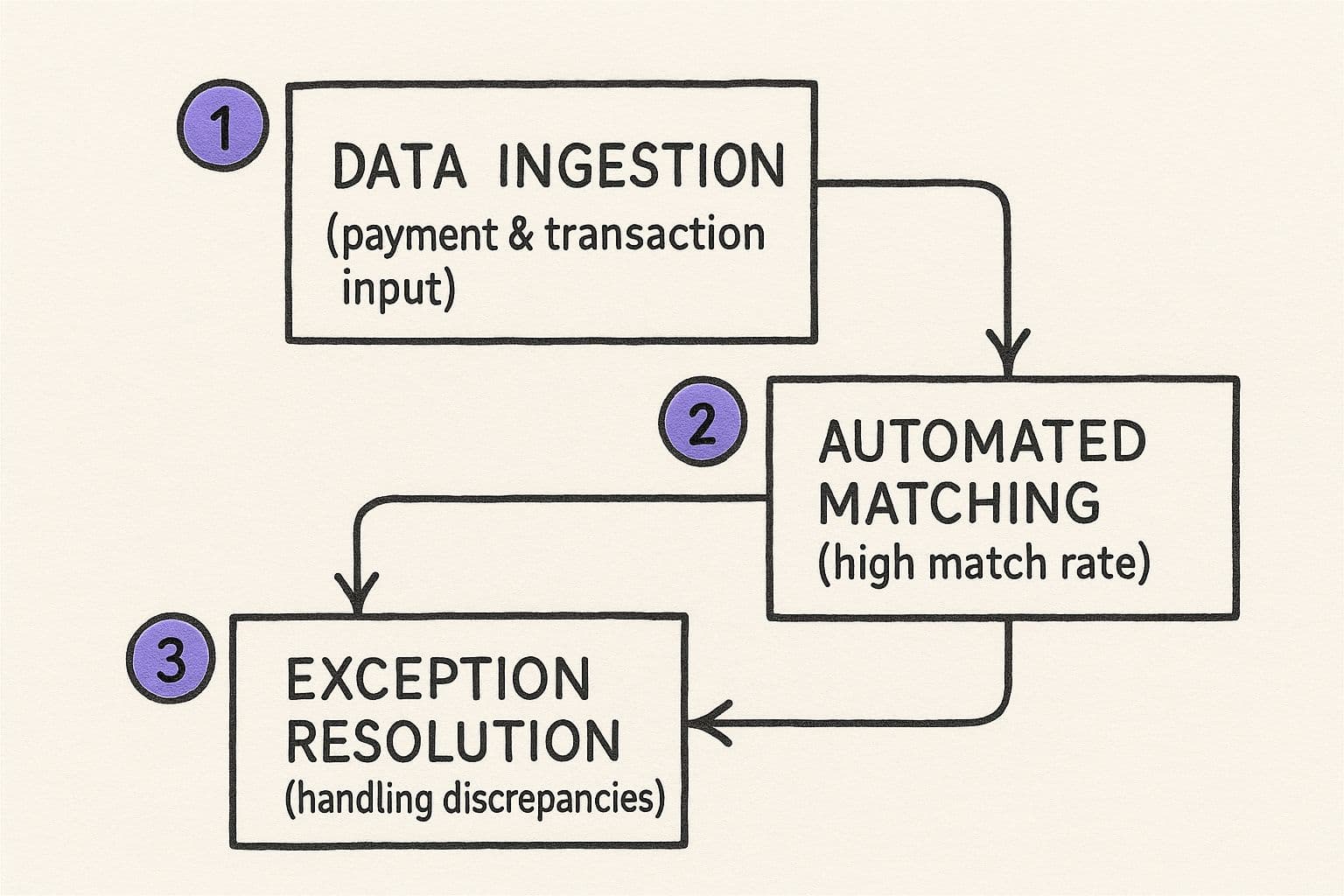

Managing Exceptions and Keeping Your System Healthy

50dff446-e1c5-412d-955a-db75e2752ade.jpg

Look, even the slickest automated system will eventually hit a transaction it can't figure out. This isn't a bug. It’s just a normal Tuesday in the world of finance. Your goal isn’t to build a system that never has exceptions—it’s to build one that handles them so smoothly they barely make a ripple.

Think of these exceptions as your system asking for a little help. MyMembers will flag transactions that don’t perfectly match your rules, like a payment with an unexpected fee or a payout that lands on a weird schedule. This is where a quick, human touch turns messy data into perfectly accurate records.

Honestly, this is why so many businesses drown without automation. A recent UK survey found that a staggering 56% of payment professionals are still wrestling with spreadsheets for reconciliation. That old-school approach turns every tiny exception into a massive headache, especially when you start juggling different currencies or payment methods.

Creating an Exception Handling Workflow

When MyMembers flags something for review, resist the urge to just patch it and move on. What you need is a simple, repeatable process to dig in and solve the root cause. A solid workflow doesn't just fix today's problem; it makes your entire system stronger for tomorrow.

Your process should look something like this:

- Isolate the Issue: First up, figure out why the transaction got flagged. Is it a mismatched amount? A delayed payout from Stripe? Maybe a chargeback you weren't expecting? The exception report in MyMembers will give you the breadcrumbs.

- Investigate in Stripe: Pop open your Stripe dashboard and cross-reference the transaction ID. Nine times out of ten, this reveals the culprit instantly—maybe a specific processing fee or a partial refund that your rules didn't account for. If you need a refresher on how those fees break down, our guide on understanding payment processing fees is a great place to start.

- Resolve and Document: Once you know the "why," you can manually reconcile the transaction in MyMembers. The key here is to jot down a quick note about the cause. This creates a priceless log you can review later.

Turning Exceptions into Intelligence

The real magic isn't just in fixing one-off errors. It's about using this data to make your automated payment reconciliation smarter over time.

Make a habit of reviewing your exception log. Are you seeing the same kind of mismatch pop up again and again?

Treat every exception as a data point. A recurring issue isn't a problem—it's a clear signal that one of your reconciliation rules needs a small adjustment to make your system more robust.

For example, let's say you notice international payments are constantly getting flagged because of tiny currency conversion differences. You could simply tweak your rules to allow for a small tolerance. That one change might automatically resolve 90% of those exceptions going forward, saving you a chunk of time every single month.

By constantly refining your rules based on real-world exceptions, you build a system that gets more accurate and more hands-off over time. It starts learning, and you start getting your time back.

Got Questions About Automated Reconciliation?

Switching to an automated system is a big move, and it’s totally normal to have questions. When it comes to your money, you want to know exactly how things work. Let's run through some of the most common questions we hear from creators setting up automated reconciliation between MyMembers and Stripe.

Think of this as the practical, no-fluff FAQ. These are the real-world concerns that pop up when you're ready to ditch the spreadsheets for good.

How Fast Does This Actually Happen?

This is always the first question, and for good reason. The magic of the MyMembers and Stripe integration is that reconciliation happens in near real-time.

When Stripe processes a payment, it fires off the data to our system, and your reconciliation rules kick in almost instantly.

This means you’re not waiting for a month-end report to see where your finances stand. You get an up-to-the-minute picture of your cash flow, which is a massive advantage for making quick business decisions. You'll see invoices marked as paid just moments after a member's card is successfully charged.

What Happens When a Payment Fails?

Failed payments are just a part of running a subscription business, but automation makes them a minor blip instead of a major headache.

When a payment fails, Stripe immediately tells MyMembers what happened. From there, your pre-set rules take over automatically:

- Automatic Retries: Stripe can be configured to retry the payment on a schedule you define. No manual follow-ups needed.

- Dunning Emails: MyMembers can instantly send a "payment failed" email to the member, prompting them to update their card details on file.

- Access Control: If the payment issue isn't sorted out after a certain period, the system can automatically revoke the member's access to your Telegram group or channel.

This creates a completely hands-off process for recovering revenue that you'd otherwise have to chase down yourself.

Can It Handle Refunds and Chargebacks?

Absolutely. Trying to manually track refunds and chargebacks is a classic reconciliation nightmare. Automation makes it dead simple.

When you process a refund in Stripe, the charge.refunded event pings MyMembers. Your rule then instantly updates the original invoice to "Refunded" or generates a credit note if it was a partial refund.

Chargebacks are handled just as cleanly. A dispute filed in Stripe automatically flags the transaction in MyMembers, pulling it out of your active revenue reports. This gives you a much truer picture of your financial health without you having to lift a finger.

By setting up these rules, you make sure every financial event—good, bad, or ugly—is recorded accurately and instantly. This is the level of detail in your automated payment reconciliation that gives you total confidence in your numbers, freeing you up to focus on your members, not your spreadsheets.

Ready to stop wrestling with spreadsheets and get your time back? MyMembers offers a seamless, no-code solution to automate your entire member payment lifecycle. Start your free trial today and see how easy it is to manage your community.