Calculating CLTV isn't just about crunching numbers; it’s a total mindset shift. It moves your focus from quick, one-off sales to building long-term relationships, revealing the real profit hiding in your audience.

Why CLTV Is Your Most Important Growth Metric

0fdd8218-120b-42bf-9539-23154d2bb76c.jpg

Before we get into the formulas, it’s crucial to understand the why behind Customer Lifetime Value. Think of it less like an accounting task and more like a strategic compass for your business. It’s the metric that turns marketing from a cost centre into a profit driver, guiding every single decision you make.

When you know what a customer is truly worth over their entire relationship with you, you can make much smarter, data-backed choices. This one number brings incredible clarity to a few key areas of your business:

- Smarter Acquisition Spending: You’ll know exactly how much you can afford to pay for a new customer and still come out on top. No more guesswork.

- Identifying Your Best Customers: It helps you zero in on the high-value individuals who deserve your full attention and resources. These are your VIPs.

- Informing Product Development: CLTV data can shine a light on which products or services create the most long-term value, pointing the way for your next big idea.

- Enhancing Customer Retention: By focusing on what boosts CLTV, you naturally start improving the customer experience and building rock-solid loyalty.

A Real-World UK Business Scenario

Picture a UK-based subscription box service. For months, they were pouring cash into social media ads, bringing in hundreds of new subscribers. On the surface, the growth looked phenomenal. But when they finally ran their first CLTV calculation, they got a nasty shock. These new customers were churning at an alarming rate, giving them a painfully low lifetime value.

At the same time, they found something interesting. Customers who came from their blog and email newsletter—while fewer in number—had a CLTV that was three times higher.

This was a complete game-changer. They immediately reallocated their marketing budget, ditching the expensive, low-value sign-ups and doubling down on content that attracted loyal, high-value subscribers.

This strategic shift, all driven by a simple CLTV calculation, didn't just slash their acquisition costs. It massively boosted their overall profitability in less than six months.

Connecting CLTV to Broader Financial Strategy

The power of CLTV goes way beyond your marketing department. The insights you gain are most potent when they’re woven into your wider financial planning. Just as CLTV is vital for spotting growth opportunities, solid financial reporting is the bedrock of any sustainable business. If you're looking to strengthen your overall financial know-how, understanding essential financial reporting best practices is a great place to start.

Adopting a CLTV-centric mindset means you stop reacting and start planning for the long term. It becomes the key to unlocking sustainable growth and building a more resilient business.

To get a feel for your own numbers, you can start with a user-friendly lifetime value calculator. It's a great way to get a baseline understanding of where your business stands today.

Gathering the Data for an Accurate CLTV Calculation

4dabfe1f-cd64-4251-be8f-f45668f15854.jpg

Let's be honest, any CLTV calculation is only as good as the numbers you plug into it. Garbage in, garbage out. So, before we even touch a formula, we need to get our hands dirty and pull the right data.

The good news? You’re probably already sitting on this goldmine. This info lives in the tools you use every day—your CRM, your e-commerce platform like Shopify, or even your accounting software like Xero. The trick isn't finding the data; it's knowing what to look for.

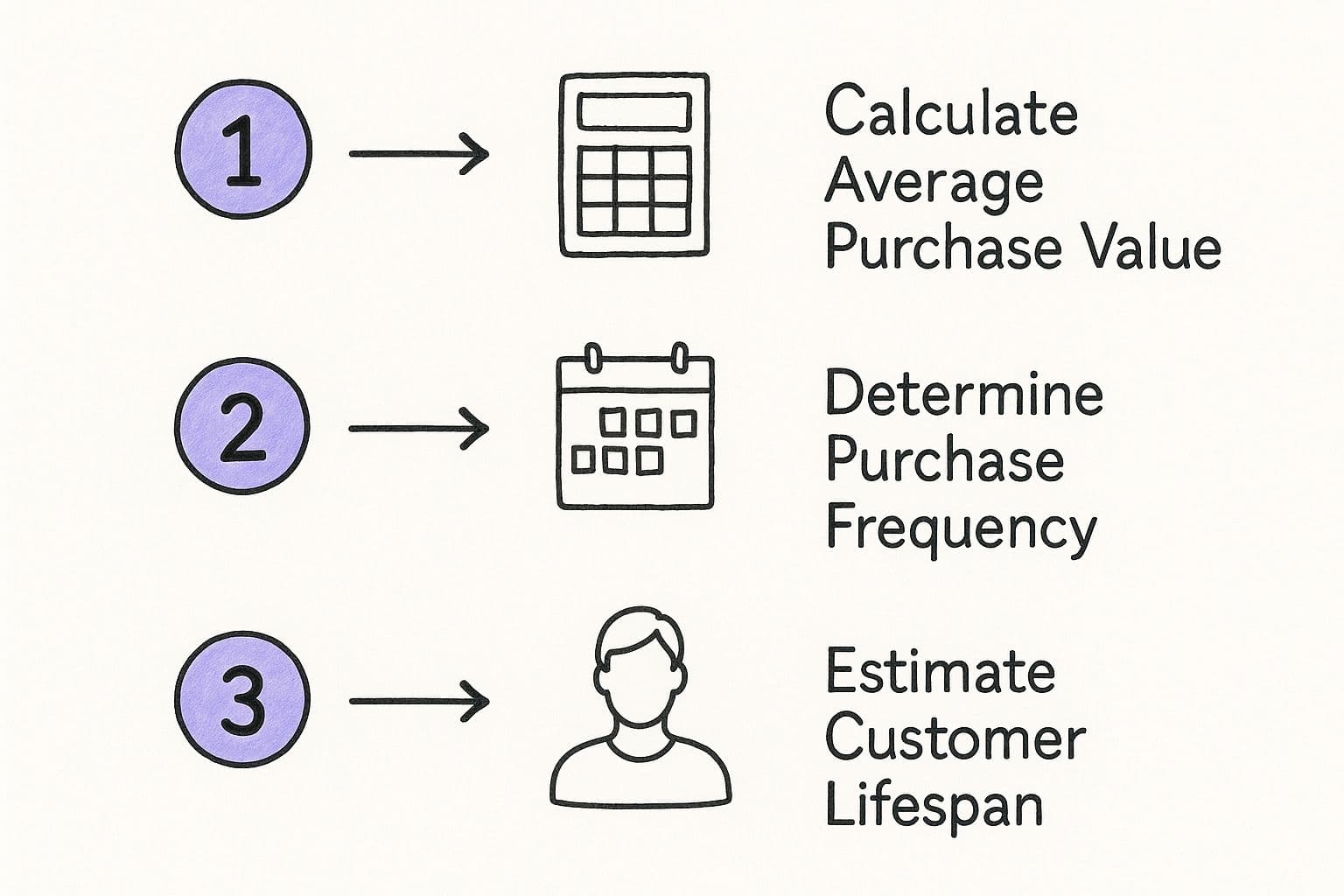

Pinpointing Your Core Metrics

To get a simple, powerful CLTV figure, you need to focus on three core metrics. Think of them as the three legs of the stool: Average Order Value (AOV), Purchase Frequency, and Customer Lifespan.

Each one tells a crucial part of the customer story. Nail these, and you've built a solid foundation for a CLTV you can actually trust.

- Average Order Value (AOV): This is just a fancy way of asking, "How much does a customer typically spend in one go?" It's a direct look at your pricing power and how good you are at upselling.

- Purchase Frequency: How often does the average customer come back for more within a set period (usually a year)? This is your loyalty metric. It shows you if you’re a one-hit-wonder or a habit.

- Customer Lifespan: This is the big one. How long does a person stick around as a paying customer? It’s what turns a single transaction into a long-term relationship.

Getting these right is especially critical for UK retailers trying to figure out who their most profitable customers really are. Imagine a UK business doing £1,000,000 in revenue from 40,000 orders. Their AOV is a tidy £25.

If they served 15,000 unique customers, their purchase frequency is about 2.67 (40,000 orders / 15,000 customers). That means the average customer is worth about £66.75 per year. For a deeper dive, Bloomreach has a great guide on how UK businesses are using these numbers.

Essential Data Checklist and Formulas

To get you started, here’s a quick-and-dirty summary of the metrics you’ll need to pull and how to calculate them.

Essential Metrics for CLTV Calculation

| Metric | What It Measures | How to Calculate It |

|---|---|---|

| Average Order Value (AOV) | The average amount spent per order. | Total Revenue / Total Number of Orders |

| Purchase Frequency | How often a customer buys in a period. | Total Number of Orders / Number of Unique Customers |

| Customer Lifespan | The average duration of the customer relationship. | (Sum of Customer Lifespans) / Number of Customers |

This table gives you the raw formulas, which is a great starting point.

One pro tip before you dive in: clean your data. Seriously. Take a minute to hunt down and remove any weird outliers or duplicate entries. That massive one-off corporate order from last Christmas? It's not a typical customer, and it will skew your numbers. A little data hygiene now saves you from making bad decisions based on a wonky CLTV later.

Your First CLTV Calculation: The Simple Model

Feeling swamped by predictive models and data science jargon? Don't be. You don't need a PhD in statistics to figure out customer lifetime value. Let's start with a dead-simple model that any business can use today to get a powerful baseline.

This first calculation is perfect because it only needs three pieces of data you probably already have. You'll get real insights without building complex algorithms. It's the perfect first step.

Breaking Down the Simple CLTV Formula

The simple model boils down to three core components. When you multiply them together, they reveal the average revenue you can expect from a customer over their entire relationship with your brand.

The formula is beautifully straightforward:

Average Purchase Value x Purchase Frequency x Customer Lifespan = CLTV

Let's unpack each part with an example. Imagine a UK-based online shop that sells artisanal coffee.

- Average Purchase Value (APV): This is just the average amount a customer spends in one go. For our coffee shop, this might be the cost of two bags of beans plus a pack of filters.

- Purchase Frequency: How often does a customer buy from you in a set period? Usually, we look at a year. Our coffee lover might grab new beans every single month.

- Customer Lifespan: This is the average time someone sticks around as an active customer. Maybe the typical coffee subscriber stays for about three years.

This infographic lays out how these three simple metrics combine.

2d051615-9f60-4ec3-9cff-c7d97b096f2f.jpg

As you can see, it's a logical flow. Each component builds on the last to create a complete picture of what a customer is really worth to you.

Putting the Calculation into Practice

Let's plug some real numbers into this using our UK coffee retailer. Let’s say their data shows:

- Average Purchase Value: £25 per order.

- Purchase Frequency: Customers buy, on average, 12 times per year (once a month).

- Average Customer Lifespan: Customers typically stay for 3 years.

Now, we just pop them into the formula:

£25 (APV) x 12 (Frequency) x 3 (Lifespan) = £900 (CLTV)

That means the average customer is worth £900 in revenue to the business over their lifetime. That’s a powerful number. It immediately tells you how much you can afford to spend to acquire a similar customer and still turn a profit.

This simple CLTV calculation is all about getting a crucial baseline. It's not about predicting the future with 100% accuracy; it's about making smarter decisions today based on how your customers have behaved in the past.

This approach works for almost any business. Take a UK company doing around £1,000,000 in annual revenue from 50,000 purchases. Their average purchase value is £20. If their customers buy 3 times a year and stick around for 5 years, their simple CLTV is £300 (£20 x 3 x 5).

You can learn more about calculating client lifetime value and see how these figures play out across different industries. It just goes to show how even basic data can produce a game-changing metric.

Leveling Up Your CLTV With Profitability

So, you’ve got a handle on the basic CLTV formula. That’s a fantastic starting point, giving you a solid baseline for revenue. But let's be real—revenue is a vanity metric. Profit is what actually keeps the lights on.

To get a truly sharp picture of what a customer is worth, we need to go deeper than just top-line sales. It's time to factor in the real costs of doing business.

embed

This is where the traditional, more robust CLTV model comes into play. It folds in metrics like gross margin and customer acquisition costs to show you the actual profit each customer brings to the table. This isn't just an upgrade; it's a fundamental shift in how you value your customer base.

Introducing Key Profitability Metrics

To elevate your CLTV from a simple revenue guess to a powerful profit indicator, we have to get real about costs. What does it actually cost you to win and keep a customer?

Let’s break down the essential components you'll need:

- Gross Margin: This is the percentage of revenue left after you've paid for the goods or services sold. It’s a raw measure of how profitable your core offering is.

- Customer Acquisition Cost (CAC): This is the total sales and marketing spend required to land one new customer. You absolutely cannot understand true CLTV without this number.

- Servicing Costs: These are the ongoing expenses to support a customer—think customer service chats, account management, or the cost of running your loyalty programme.

By layering these costs into your calculation, CLTV transforms from a number that looks good in a pitch deck into a genuine indicator of your business's health.

A common-sense approach in the UK combines annual customer revenue and lifespan with these costs to find a net value. For example, a customer spending £500 a year for 10 years brings in £5,000 in revenue. But if it cost £50 to acquire them and £50 per year to service them (another £500), your total cost is £550. The net CLTV is a much more realistic £4,450. For a deeper dive, Qualtrics.com explains how to calculate customer value pretty well.

A UK Subscription Box Example

Let's make this tangible. Imagine a UK-based subscription box service. Here are their numbers:

- Monthly Subscription Fee: £30

- Average Customer Lifespan: 18 months

- Gross Margin: 40% (meaning for every £30 box, £12 is profit before other costs)

- Customer Acquisition Cost (CAC): £45

First, let's figure out the total revenue over a customer's lifetime.

£30/month x 18 months = £540 in lifetime revenue. Not bad.

But now, let's find the actual gross profit from that customer. We'll apply the gross margin.

£540 x 40% = £216 in lifetime gross profit.

Finally, we have to subtract what it cost to get them in the door in the first place.

£216 (Gross Profit) - £45 (CAC) = £171

So, the real, net CLTV for this customer is £171.

This number is far more useful than the initial £540 revenue figure. It tells the business owner exactly how much profit each new subscriber generates. Getting this granular is absolutely essential when you're trying to build a sustainable subscription pricing strategy.

Putting Your CLTV Insights Into Action

ab24fdcf-ea8f-4bf4-9a77-eb46e963047f.jpg

Let's be real. A CLTV number just sitting in a spreadsheet is totally useless. Its real power is unlocked when you actually use it to make smarter, more confident business decisions. The calculation is just the starting point; the magic happens when you turn that number into a growth strategy.

Just knowing your CLTV gives you an immediate advantage. It tells you exactly how much you can afford to spend to acquire a new customer and still stay profitable. That clarity is everything when setting marketing budgets and avoiding the trap of pouring money into expensive channels that don't deliver.

Segment Your Customers to Find Your VIPs

Not all customers are created equal. Your CLTV calculation proves it. Once you can calculate CLTV for different customer groups, you can start to identify your true VIPs—the ones who spend more, stay longer, and are genuinely the most valuable to your business.

This is where you can get into stuff like RFM (Recency, Frequency, Monetary) analysis to group customers into different segments. From there, you can tailor your marketing, support, and product offerings to what these high-value customers actually love.

For example, you might discover that customers who came from your blog have a 3x higher CLTV than those from paid ads. That's not just an interesting stat—it's a massive signal to double down on your content marketing and take a hard look at your ad spend.

Knowing who your best customers are allows you to stop marketing to everyone and start building deep, profitable relationships with the people who matter most. It’s about focus, not volume.

Optimise Your Marketing and Ad Spend

The CLTV to Customer Acquisition Cost (CAC) ratio is one of the most powerful metrics you have. A healthy ratio, typically 3:1 or higher, points to a sustainable business model where the value of a customer massively outweighs what you spent to get them.

By looking at this ratio across your different marketing channels, you can:

- Spot the winners: Pinpoint which campaigns are efficiently delivering high-value customers.

- Cut the dead weight: Stop pouring money into channels that bring in low-CLTV customers or have a crazy-high CAC.

- Refine your aim: Sharpen your ad creative and targeting to attract audiences that look just like your existing high-CLTV segments.

This strategic approach makes sure your marketing budget is working as hard as possible to drive long-term, profitable growth, not just chasing short-term sales.

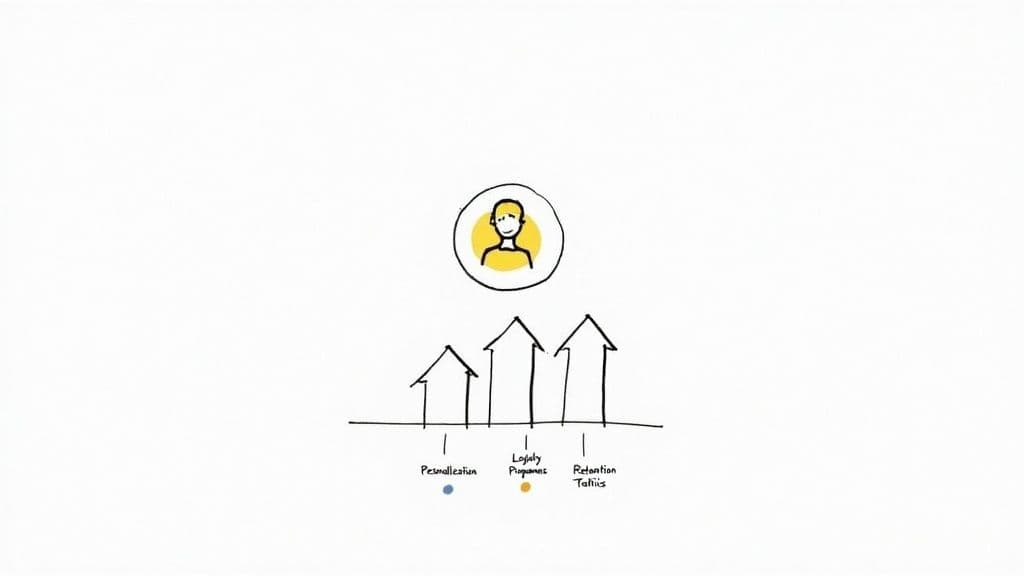

Increase CLTV with Targeted Retention Strategies

Your CLTV calculation is also a great diagnostic tool. It shines a light on weak spots in your customer journey. If your CLTV is lower than you'd like, that's your cue to get serious about retention and find ways to increase customer value over time.

This could mean:

- Improving the onboarding experience so new customers see value faster.

- Launching a loyalty programme to reward repeat business and give your best customers some love.

- Developing upselling and cross-selling strategies that offer more value to customers who are already engaged.

When you actively work to improve the customer experience, you naturally increase how much they spend and how long they stick around. And that directly boosts your overall CLTV.

To get a clearer picture of how these insights translate into real-world action, let's break it down by business area. Different departments can use CLTV in surprisingly different ways to hit their goals.

CLTV Application Strategies

| Business Area | How to Apply CLTV | Expected Outcome |

|---|---|---|

| Marketing | Allocate budget to channels with the highest CLTV:CAC ratio. | Improved marketing ROI and more profitable customer acquisition. |

| Sales | Prioritise leads from sources that historically produce high-CLTV customers. | Shorter sales cycles and a higher percentage of long-term, valuable customers. |

| Product | Use feedback from high-CLTV segments to guide the product roadmap. | Increased customer satisfaction and retention among your most valuable users. |

| Customer Support | Offer premium or proactive support to high-value customer segments. | Reduced churn and increased loyalty from VIP customers. |

| Finance | Use CLTV projections for more accurate revenue forecasting and business valuation. | Better financial planning and a stronger case for investors. |

Ultimately, CLTV isn't just a marketing metric—it's a company-wide tool for sustainable growth. By integrating it into different parts of your business, you create a unified focus on acquiring and retaining the right customers, which is the secret sauce for long-term success.

Got Questions About CLTV? We’ve Got Answers.

Jumping into any new metric is going to bring up a few questions, and a beast like CLTV is no different. It’s one thing to understand the theory, but it’s another to actually put it into practice.

Let's walk through some of the most common sticking points we see UK businesses hit. Think of this as your personal FAQ for getting your CLTV calculations dialled in.

How on Earth Do I Predict Customer Lifespan?

This is usually the trickiest piece of the puzzle, especially if you’re a newer business without years of customer data to look back on. Don't worry, you don’t need a crystal ball—just a bit of simple maths.

The quickest way to get a solid estimate is by using your churn rate. If you lose 15% of your customers every year, your annual churn rate is 0.15.

From there, the formula is straightforward:

Customer Lifespan = 1 / Churn Rate

So for our example, it's just 1 / 0.15, which gives you an average customer lifespan of about 6.67 years. This gives you a data-backed number to plug into your main CLTV formula. It’s a great starting point.

Pro tip: This number is just an average. The real magic happens when you segment your customers. Calculating the lifespan for different groups—like customers from your Google Ads campaign versus those from organic search—will give you much sharper, more actionable insights.

What’s a Good CLTV to CAC Ratio?

This is the big one. This question gets right to the heart of whether your business is actually profitable and sustainable. Your CLTV to Customer Acquisition Cost (CAC) ratio tells you if the money you're spending to get customers is worth it in the long run.

A healthy, sustainable business should be aiming for a 3:1 ratio. This means for every £1 you spend to acquire a new customer, you’re getting £3 back in lifetime value. Simple as that.

- A 1:1 ratio means you're just breaking even. Not a great place to be.

- Anything below 1:1 is a red flag. You're losing money on every single customer you bring in.

- Hitting 4:1 or 5:1? That’s fantastic. It’s a strong signal that you have room to get more aggressive with your marketing spend and fuel faster growth.

Getting this balance right is absolutely fundamental. If you're not sure how to calculate the other side of this equation, our guide on customer acquisition cost calculation breaks it all down for you.

How Often Should I Be Recalculating CLTV?

CLTV is not a "set it and forget it" metric. Your business is always evolving, customer behaviour changes, and market conditions shift. Your CLTV will move right along with them.

There’s no single correct answer here, but a good rule of thumb is to recalculate your CLTV either quarterly or bi-annually. This cadence is frequent enough to spot important trends without getting you bogged down in analysis paralysis.

You’ll want to recalculate it more often if you make any big moves, like:

- Launching a major new product or service.

- Making significant changes to your pricing.

- Rolling out a new customer loyalty programme.

Events like these can directly impact how your customers spend and how long they stick around, so updating your CLTV calculation will show you the real effect on your bottom line.

Ready to turn your Telegram community into a thriving membership business? MyMembers makes it easy to manage subscriptions, process payments, and automate member access without any code. Start monetising your audience today with MyMembers.