A lifetime value calculator isn't just a spreadsheet for your finance team; it's more like a strategic compass for your entire business. It points you towards the real, long-term value of each customer. Once you get a handle on this number, your whole mindset shifts from chasing short-term sales to building sustainable, long-term profit. It's easily one of the most powerful metrics you can track for growth.

Why Customer Lifetime Value Is a Game Changer

56053d63-faf3-4a8d-8560-f2037ea30d42.jpg

It’s easy to get trapped in the hamster wheel of immediate revenue. We obsess over monthly sales targets or daily conversion rates. And look, those numbers are important. But they only show you a tiny snapshot of what’s really going on.

Customer Lifetime Value (CLV), on the other hand, gives you the full panoramic view. It forecasts the total revenue you can realistically expect from a single customer over their entire relationship with your brand.

This forward-looking perspective completely changes the game. It informs smarter decisions across your whole operation.

- Smarter Marketing Spend: When you know a certain customer type is worth £500 over their lifetime, you can confidently spend more to acquire them. This justifies a higher customer acquisition cost for clients who will bring in more value over time, rather than treating every lead the same.

- Improved Customer Retention: CLV shines a massive spotlight on your most valuable customers. This isn't about guesswork; it's data. You can then create loyalty programmes or deliver exceptional, tailored service to keep your VIPs happy and coming back.

- Data-Informed Product Development: By digging into the buying habits of your high-CLV customers, you can see which products or services are driving the most long-term loyalty. This tells you exactly where to double down.

The Core Variables of CLV

At its heart, CLV is calculated from three simple but powerful variables. For any UK business, the formula is a must-know. It represents the average revenue a customer generates throughout their time with you.

The standard formula is: CLV = (Average Purchase Value x Purchase Frequency) x Average Customer Lifespan.

Let's make that real. Say a UK clothing shop finds their average customer spends £40 per order, buys three times a year, and typically stays loyal for two years.

The CLV would be £40 x 3 x 2 = £240 per customer.

Suddenly, you know that acquiring a new customer who fits this profile is worth up to £240. This simple calculation helps you prioritise your marketing budget and service investments with way more confidence.

CLV isn’t just about calculating revenue; it's about understanding customer behaviour and building a business that people want to stick with for the long haul. It transforms your mindset from transactional to relational.

While CLV gives you incredible foresight, pairing it with other essential content marketing metrics gives you a complete health check for your business. Looking at these numbers together provides the full picture of your performance.

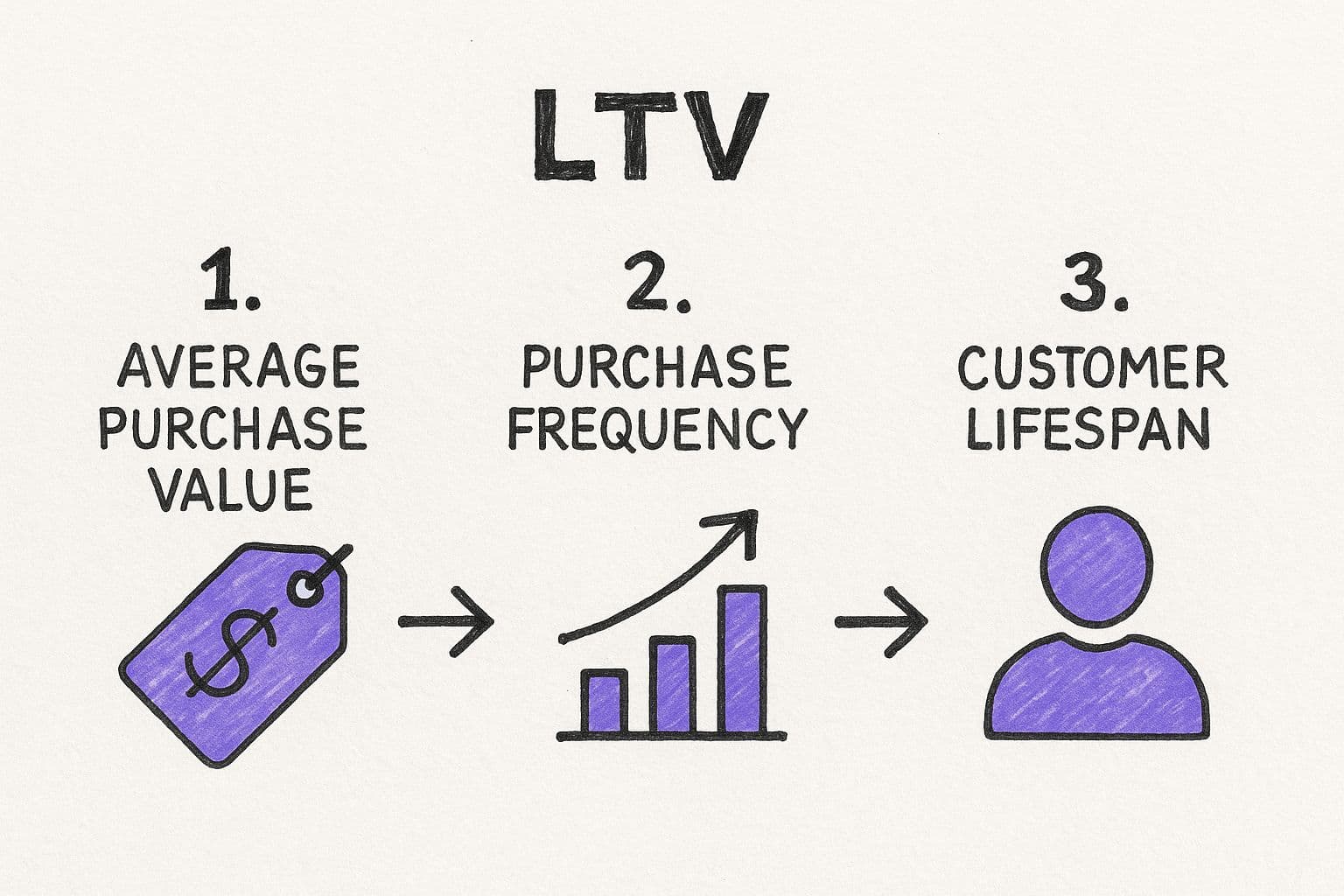

Before we dive into using a lifetime value calculator, let's quickly break down the core components that make it all tick.

Core Components of the Lifetime Value Formula

Here’s a quick summary of the essential inputs for any lifetime value calculator. Understanding these three pillars is the first step to mastering the metric.

| Metric | What It Measures | Why It's Important |

|---|---|---|

| Average Purchase Value (APV) | The average amount a customer spends in a single transaction. | Tells you how much each purchase is worth right now. Increasing this is a quick win for revenue. |

| Purchase Frequency (PF) | How often the average customer makes a purchase in a specific period (e.g., per year). | Shows customer loyalty and engagement. Higher frequency means they are more integrated into your brand. |

| Average Customer Lifespan (ACL) | The average length of time a customer continues to buy from you. | This is the long-term view. It measures retention and indicates the overall health of your customer relationships. |

Getting a solid grip on these three numbers is fundamental. They are the building blocks that not only allow you to calculate CLV but also identify which levers you can pull to increase it.

Sourcing Accurate Data for Your CLV Calculation

Look, a lifetime value calculator is a brilliant tool, but it's only as good as the numbers you feed it. As the old saying goes: garbage in, garbage out. It’s especially true here.

To get a CLV figure that actually means something, you need to pull accurate, clean data for those three core metrics. It might sound a bit intimidating, but you probably have all this information sitting in your systems already. You just need to know where to look.

Uncovering Your Average Purchase Value

First up is your Average Purchase Value (APV). This is simply how much a customer typically spends in a single transaction. Finding this is usually pretty straightforward.

If you’re using an e-commerce platform like Shopify or a payment processor like Stripe, this data is often right there in your sales or analytics dashboards. Just hunt for a report on "total sales" and "total orders" over a specific period, like the last 12 months.

To do it by hand, the formula is simple:

- Total Revenue (over a set period) ÷ Total Number of Orders (in the same period) = Average Purchase Value

So, if your business pulled in £100,000 in revenue from 2,500 orders last year, your APV would be £40. Easy.

Pinpointing Purchase Frequency

Next, we need Purchase Frequency (PF). This one measures how often an average customer buys from you within a year. It's a killer indicator of customer loyalty and how habit-forming your product is.

Again, your CRM or e-commerce backend is your best friend. You'll need the total number of orders and the number of unique customers for the same period you used before.

Here’s the calculation:

- Total Number of Orders ÷ Total Number of Unique Customers = Purchase Frequency

Using our example, if those 2,500 orders came from 1,000 unique customers, your purchase frequency is 2.5. This means the average customer buys from you 2.5 times a year. For subscription businesses, this metric is everything, and tweaking your model with a few subscription model best practices can seriously boost this number.

Estimating Average Customer Lifespan

The final piece of the puzzle, Average Customer Lifespan (ACL), can be the trickiest to nail down, especially if your business is new. It represents how long a customer sticks around and keeps buying before they go dark.

For contractual businesses, like a membership site run through MyMembers, this is much simpler. You can just calculate the average subscription length before a customer cancels.

For businesses without contracts, you have to define what "inactive" actually means. A solid rule of thumb is to consider a customer churned if they haven't bought anything in a period that's double your average purchase cycle. For instance, if customers typically buy every three months, you’d probably count them as churned after six months of silence.

If you’ve been around for a while and have years of data, you can calculate the average time between a customer's first and last purchase. If not, don't sweat it. Just start with an educated guess (say, 2-3 years) and refine it as you collect more data. Pro tip: always lean towards a conservative estimate. It’s a much safer bet.

Putting CLV Into Practice: Real-World Examples

Alright, let's get our hands dirty. Theory is one thing, but seeing how customer lifetime value (CLV) actually plays out with real numbers is where the magic happens. This is the part where the abstract formula starts to feel like a powerful tool you can actually use.

The core idea we're working with is pretty straightforward:

(Average Purchase Value x Purchase Frequency) x Average Customer Lifespan

Think of it like three levers. Pull any one of them, and the whole machine gets more profitable.

33a03e92-78dd-44e0-8fd5-1c0ba337bb6f.jpg

Visualising it this way helps hammer home a simple truth: small improvements in any of these three areas don't just add up—they multiply.

The Simple Subscription Scenario

Let's imagine you run the "Artisan Coffee Club," a monthly subscription box. Subscription models are a great place to start because the numbers are usually clean and predictable.

- Average Purchase Value: Your box costs £25. Simple.

- Purchase Frequency: Customers get a box every month, so that’s 12 purchases a year.

- Average Customer Lifespan: You've looked at your data and see that, on average, a subscriber sticks around for 1.5 years.

Now, let's do the maths:

(£25 per box) x (12 boxes per year) = £300 Annual Customer Value

£300 Annual Value x 1.5-Year Lifespan = £450 CLV

Boom. Every new subscriber you sign up is worth, on average, £450 to your business. This number is your North Star. It tells you exactly how much you can afford to spend to acquire a customer and still be profitable. Getting a handle on value like this is a game-changer, and the logic applies to other areas too, like figuring out how to calculate SEO ROI.

The More Complex Retail Example

Now for a trickier one: an online fashion store called "Urban Threads." Here, customer behaviour isn't as neat. People buy different things at different times.

- Average Purchase Value: After crunching a year's worth of sales, they find the average order value (AOV) is £55.

- Purchase Frequency: Some shoppers buy once and disappear. Others come back for more. The average across everyone works out to 2.2 purchases per year.

- Average Customer Lifespan: They estimate that a customer typically stays active for about 3 years before they churn for good.

Let's plug these numbers in:

(£55 AOV) x (2.2 purchases per year) = £121 Annual Customer Value

£121 Annual Value x 3-Year Lifespan = £363 CLV

This insight is huge, especially now. The UK e-commerce scene is shifting—by 2025, pure acquisition is getting too expensive. Profitability is coming from retention, which is why CLV is becoming the metric that matters.

Key Takeaway: Even with messy, unpredictable behaviour, the CLV formula gives you a solid benchmark. For Urban Threads, knowing each customer is worth £363 gives them a powerful financial reason to invest in loyalty programmes or personalised marketing. If they can nudge that lifespan from three years to four, or get customers to make that third purchase, they directly boost the profitability of their entire business.

Turning CLV Insights Into Profitable Actions

embed

Calculating your customer lifetime value is like putting on a new pair of glasses. Suddenly, everything that was blurry comes into sharp focus. But numbers on a screen are just trivia. The real magic happens when you turn those numbers into smart, profitable business moves.

This is where the data meets the road. Your CLV isn't just another metric to track; it's a roadmap. It shows you exactly who your most valuable customers are—your VIPs—so you can stop guessing and start treating them like royalty. This is how you move from generic marketing blasts to targeted campaigns that feel personal and actually work.

Justify Smarter Acquisition Spending

Knowing a customer's potential lifetime value completely changes how you think about acquisition costs.

Let's get real. If you know a certain type of customer has a CLV of £600, you can confidently spend more to get them in the door compared to a segment with a CLV of only £150. It sounds simple, but it’s a game-changer.

This data-driven approach lets you ditch the one-size-fits-all marketing budget. Instead, you can pour your resources where they’ll generate the biggest long-term returns, building specific campaigns to attract high-value lookalikes. You know the upfront investment will pay for itself many times over.

Design Loyalty Programmes That Actually Work

Why do so many loyalty programmes feel… lame? Because they’re generic. They try to reward everyone and end up rewarding no one.

With CLV insights, you can flip that script. Design a programme that genuinely resonates with your best customers. We’re talking exclusive perks, early access to new products, or even a dedicated support line for your highest-value segment.

In the UK market, retention is everything. Your top customers drive a disproportionate amount of your revenue. In fact, UK shoppers who feel an emotional connection to a brand have a 306% higher lifetime value, and 43% of them admit to spending more with brands they're loyal to. Since getting a new customer costs way more than keeping one, a solid retention strategy isn't optional.

A strong loyalty programme, guided by CLV data, isn't a cost centre. It's an investment in your most profitable asset—your existing customer base. It fosters a sense of appreciation that encourages them to stay longer and spend more.

Refine Your Entire Customer Experience

CLV's influence goes way beyond marketing. One of the most powerful things you can do with this data is implement effective strategies to improve customer retention, which directly boosts their lifetime value.

For instance, you can use CLV to fine-tune your customer service, making sure your most valuable clients always get priority support. Why wouldn't you?

You can also personalise their website experience, showing them products and content that vibe with their past purchases. These insights can even shape your product development. By seeing what your high-CLV customers actually buy, you discover what truly drives long-term value and can double down on those offerings.

Improving retention isn't just one tactic; it’s a whole business philosophy. Our guide to customer retention best practices is a great place to start building that mindset.

Common CLV Calculation Mistakes to Avoid

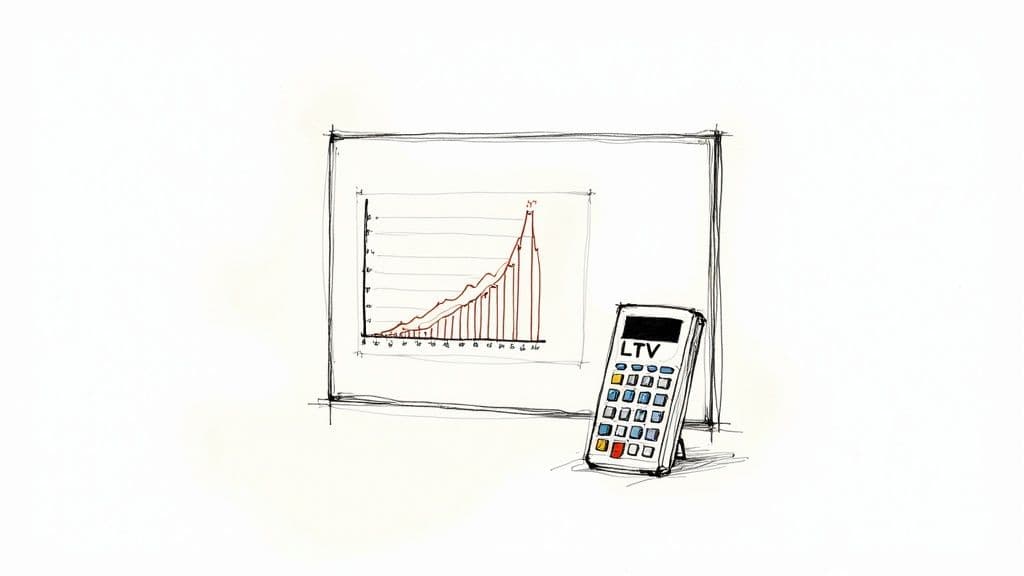

Calculating customer lifetime value feels like a superpower, I get it. But a few classic blunders can send your strategy off a cliff. Getting this right means your lifetime value calculator is a reliable guide, not just a source of bad data.

e2bc7e42-2c8c-4134-ad5a-459e08a67ced.jpg

One of the biggest face-palm moments is working with messy, inaccurate data. If your sales figures or customer histories are a disaster, your CLV will be pure fiction. Garbage in, garbage out. Always clean your data before you even think about the maths.

Another trap? Treating every customer like they're the same person. They’re not. You've got your die-hard fans and your one-hit wonders. Lumping them all together hides the real gold in your business — your VIPs. You can't nurture them if you can't see them.

Ignoring Crucial Costs

It’s so easy to get mesmerised by revenue. But profit is what pays the bills, and that means you have to account for costs. Forgetting to subtract your Customer Acquisition Cost (CAC) is a rookie mistake I see all the time.

A massive CLV looks amazing on a slide deck, but if it costs you almost that much to get the customer in the door, your profit margin is toast.

Always compare your CLV to your CAC. You’re looking for a healthy ratio of at least 3:1 — meaning the customer is worth three times what you paid to acquire them. Anything less is a serious red flag.

This is non-negotiable for membership businesses. You can check out different subscription pricing examples to see how successful models do it, but the core numbers have to be solid.

Treating CLV as a Static Figure

And finally, please don't fall for the "set it and forget it" mindset. Your CLV is not a number you calculate once and frame on the wall. It’s a living metric.

Customer habits change. Markets shift. Your own prices and offers evolve.

If you don't update your calculations, you're flying blind. You might:

- Completely miss a drop in loyalty after a price hike.

- Fail to recognise the huge win from a new retention campaign.

- Base your entire marketing budget on figures from last year that are now totally irrelevant.

Think of your lifetime value calculator as a live dashboard for your business's health. You should be re-running the numbers at least quarterly. If you’re in a fast-moving space, do it monthly. This is how you make sure your decisions are based on what's happening now, keeping you on track for real, profitable growth.

Still Have Questions About Lifetime Value? Good.

Even after you get the hang of the formula, a few questions always crop up when you start plugging CLV into your real-world strategy. That's a good sign. It means you're moving past the theory and into practical application.

Let's clear up the common sticking points so you can use this metric with confidence.

How Often Should I Actually Run These Numbers?

This comes up a lot. You don't want to get obsessed, but you also can't just "set it and forget it."

For most businesses, running your CLV calculation every quarter or six months is the sweet spot. It's frequent enough to see how your customer behaviour is changing with the seasons or in response to your marketing, but not so often that it becomes a reporting nightmare.

Now, if you're in a super fast-paced industry or you've just rolled out something big—like a new pricing structure or a massive marketing campaign—you might want to check in monthly. The goal is to make sure the number is fresh enough to actually inform your next move.

What’s a “Good” Customer Lifetime Value, Anyway?

This is the million-dollar question, but the answer is… it depends.

There's no magic number that works for everyone. A "good" CLV for a SaaS company selling enterprise software is going to look completely different from a great CLV for a local coffee shop. The real answer is tied directly to your customer acquisition cost (CAC).

The rule of thumb I always come back to is aiming for a CLV-to-CAC ratio of at least 3:1. In simple terms, for every £1 you spend to get a new customer, you should be making at least £3 back over their lifetime. If your ratio is dipping below that, it’s a red flag you’re either overspending on ads or your retention game needs work.

I’m a New Business. Can I Even Calculate CLV Without Much Data?

Yes, absolutely. Don't let a lack of history stop you. It’s a common misconception that you need years of data to get started.

When you're new, you create a predictive CLV model. It sounds complicated, but it's not.

You start by using published industry benchmarks for things like average customer lifespan or how often a typical customer buys. Then, as your own data starts rolling in over the first 6-12 months, you just swap out the benchmarks with your actual numbers.

This lets you make smart, data-backed decisions from day one, and the model just gets more accurate as your business grows.

Ready to turn your Telegram community into a predictable revenue stream? MyMembers automates payments, member management, and gives you the analytics you need to grow. See how easy it is to get started at https://mymembers.io.