Managing invoices manually is a drain on time and resources, pulling focus from what truly matters: growing your business. For creators, coaches, and small business owners, every minute spent chasing payments, correcting errors, or manually entering data is a minute lost. This guide is designed to cut through the noise and help you find the right invoice automation software for your specific needs, transforming a tedious chore into a streamlined, efficient process.

We have analysed the top platforms and marketplaces, from simple add-ons for Xero and QuickBooks to powerful, standalone accounts payable systems. Instead of generic descriptions, you will find a practical breakdown of each solution's core strengths, ideal use cases, and potential limitations. We will explore who each tool is best for, whether you are a fitness trainer managing client subscriptions or an online educator handling course enrolments.

Each entry includes screenshots and direct links to help you evaluate the user experience firsthand. This curated list focuses on providing clear, actionable information so you can make an informed decision and reclaim your valuable time. If you want to understand the foundational concepts before diving into the tools, our complete guide on how to automate invoice processing offers a deeper look at the mechanics and benefits. Now, let’s find the perfect software to put your invoicing on autopilot.

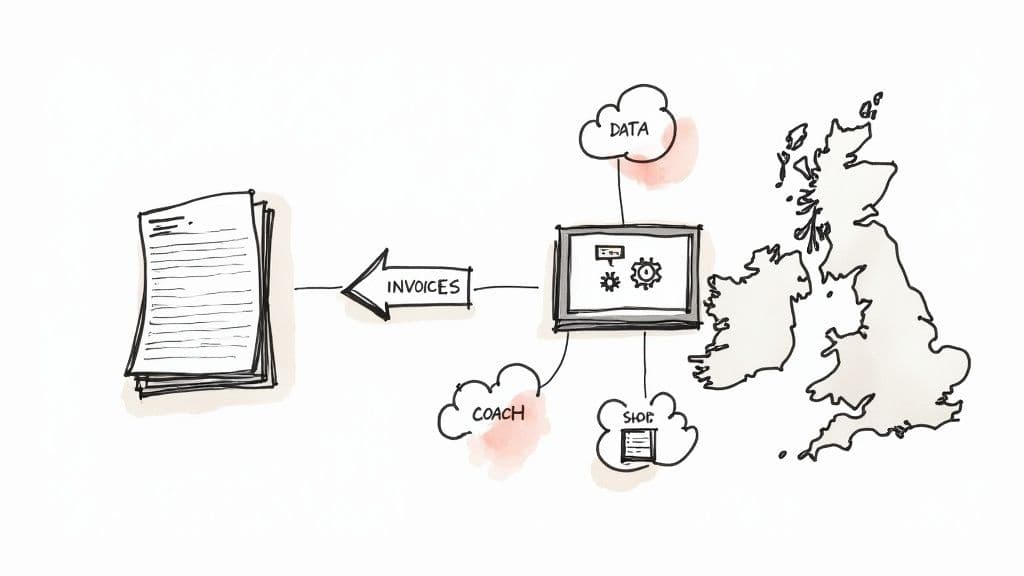

1. Xero App Store (UK)

For UK-based small businesses, creators, and coaches already using Xero for their accounting, the Xero App Store is the most logical starting point for finding powerful invoice automation software. Rather than being a single tool, it’s a curated marketplace of specialised applications designed to integrate seamlessly with your existing financial setup. This platform allows you to compare dozens of vetted solutions side-by-side, focusing on everything from automated data capture with OCR technology to complex approval workflows and purchase order matching.

02e0aa6b-a382-4579-b8f6-236af3df9248.jpg

The primary advantage is the deep, two-way sync between the apps and your Xero organisation, ensuring data consistency without manual entry. Many listings feature pricing in GBP and offer one-click trials, making it easy to test functionality. The user reviews are particularly valuable as they come from fellow UK Xero users, providing relevant insights. However, it requires an existing Xero subscription, and the quality of support can vary significantly between individual app developers. Exploring the options here is a crucial step for streamlining your invoicing process; you can learn more about how to choose the right automated invoicing software for your needs.

- Best for: UK-based Xero users looking to extend their accounting platform’s capabilities.

- Key Feature: Vetted third-party apps with deep, two-way Xero integration.

- Access: Requires an active Xero subscription.

- Website: https://apps.xero.com/uk

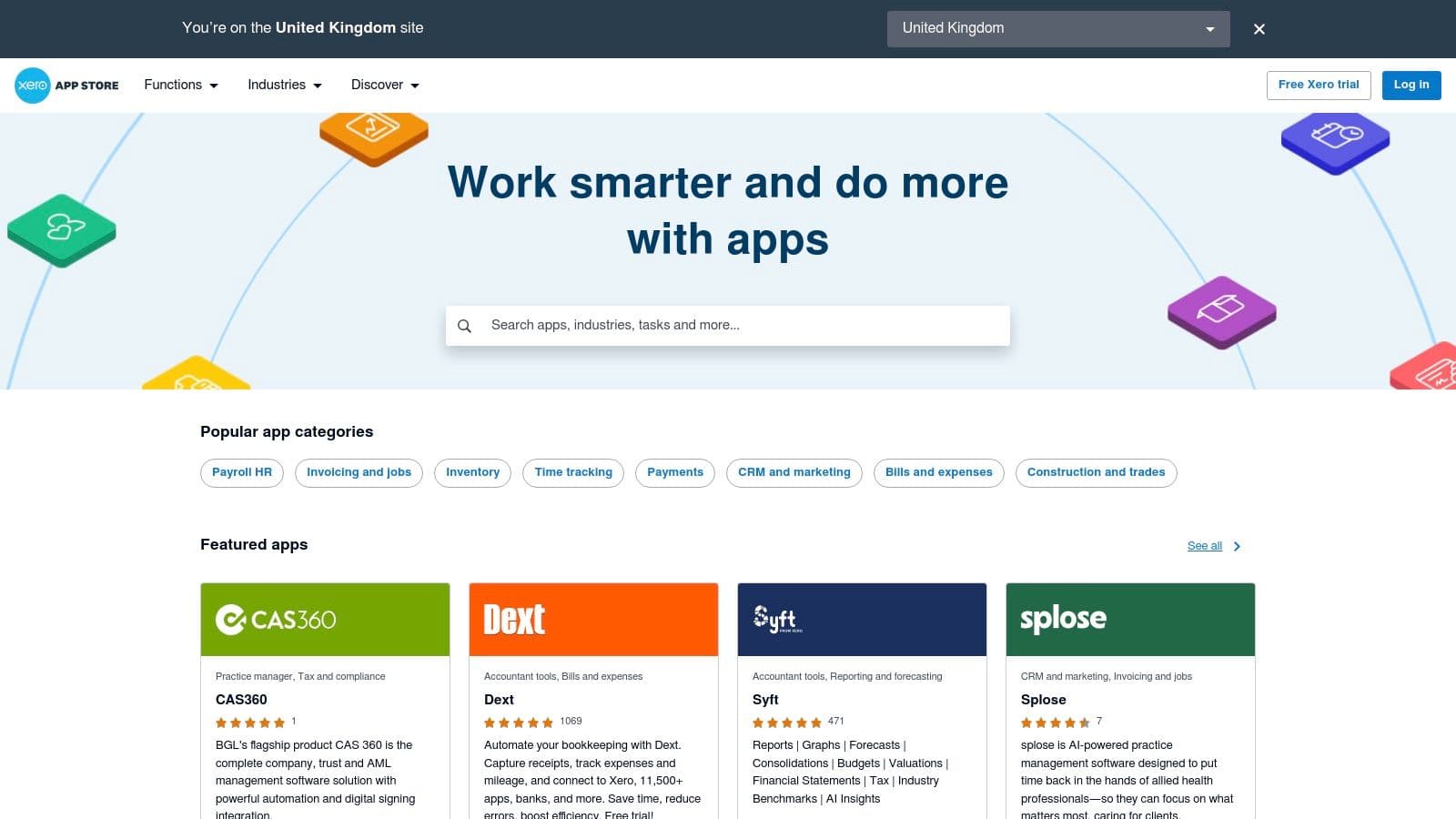

2. QuickBooks App Store (Global with UK support)

For the millions of small businesses, coaches, and creators who rely on QuickBooks Online for their accounting, the official QuickBooks App Store is the go-to destination for expanding its invoice automation software capabilities. Similar to Xero’s marketplace, it acts as a central, organised hub for third-party applications that are built to integrate directly with your QuickBooks account. This allows you to browse and compare a broad choice of tools for invoice capture, automated approval workflows, and bill payment management.

f644f8f8-3cae-467d-9ae4-c894671f8abe.jpg

The key strength here is the trust and familiarity of the Intuit ecosystem, with apps providing smooth, reliable integration into QuickBooks Online UK. The guided onboarding and integrated sign-in make trying new tools straightforward. However, a potential drawback is that some apps list their pricing in USD, and you may find that unlocking the most advanced AP automation features requires upgrading to a higher-tier QuickBooks plan. Despite this, it remains an essential resource for any UK business looking to build a powerful, customised invoice processing system around their existing accounting software.

- Best for: UK QuickBooks Online users wanting to add specialised invoice automation features.

- Key Feature: A wide range of vetted apps that integrate directly with the QuickBooks ecosystem.

- Access: Requires an active QuickBooks Online subscription.

- Website: https://quickbooks.intuit.com/global/app-store/

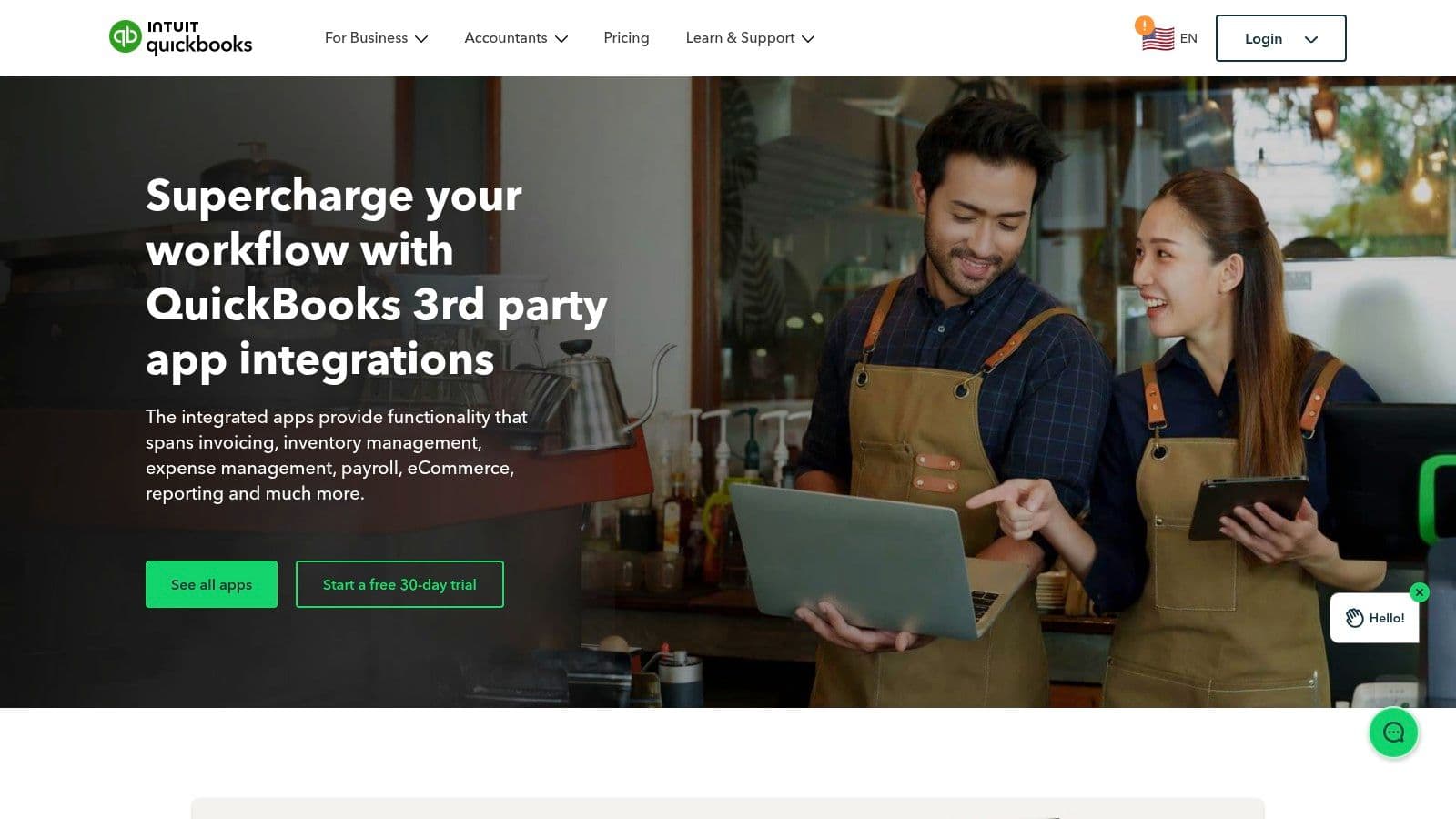

3. Sage Marketplace (UK)

For UK businesses, coaches, and creators embedded in the Sage ecosystem, the Sage Marketplace is the definitive source for finding proven invoice automation software. Similar to other accounting marketplaces, it acts as a central hub for third-party applications specifically designed to extend the functionality of products like Sage Accounting and Sage 50. The platform simplifies the process of discovering tools that automate everything from invoice data capture and coding to multi-step approval workflows, ensuring seamless integration with your core financial system.

79e6a436-2376-47e7-b154-d97e39757896.jpg

The key benefit lies in the guaranteed compatibility and tight integration with Sage products, reducing manual data entry and potential errors. You can find UK-centric solutions like AutoEntry and Agilico Verify, often with local support. The marketplace features helpful comparison tabs and suggests similar apps, aiding the decision-making process. However, a significant drawback is that pricing is often not transparent, requiring direct contact with the vendor. Additionally, some listings have a limited number of user reviews, making it harder to gauge real-world performance without a trial.

- Best for: UK businesses and sole traders using Sage for their accounting.

- Key Feature: Vetted third-party apps for both cloud and desktop Sage products.

- Access: Requires a Sage software subscription to integrate apps.

- Website: https://uk-marketplace.sage.com

4. Microsoft AppSource

For businesses, creators, and coaches deeply embedded in the Microsoft ecosystem, AppSource is the go-to marketplace for discovering powerful invoice automation software. This platform functions as a centralised hub for applications that integrate natively with tools like Microsoft 365, Dynamics 365, and the Power Platform. It allows users to browse and compare solutions built to work seamlessly with their existing technology stack, from simple invoice processing flows in Power Automate to comprehensive accounts payable systems that connect directly with ERPs.

0964c41d-70c4-4597-9157-609f43c34329.jpg

The key benefit is the familiar user experience and trusted security standards that come with Microsoft-vetted solutions. Many apps leverage flexible building blocks like Power Automate and Document Intelligence, allowing for highly customised workflows. However, this tight integration means the platform is best suited for those already familiar with Microsoft's technology. Pricing details often require a direct enquiry or demo, making quick cost comparisons difficult. Exploring AppSource is essential for any organisation looking to automate invoicing while maximising its investment in Microsoft platforms.

- Best for: Businesses and creators using Microsoft 365, Dynamics 365, or Power Platform.

- Key Feature: Vetted third-party apps with native integration into the Microsoft ecosystem.

- Access: Open to browse, but individual app usage requires purchase or subscription.

- Website: https://appsource.microsoft.com

5. Salesforce AppExchange

For businesses heavily invested in the Salesforce ecosystem, the Salesforce AppExchange is the primary destination for sourcing powerful invoice automation software. It functions as a comprehensive marketplace for applications built natively on or integrated with the Salesforce platform. This centralisation allows organisations to discover, evaluate, and deploy solutions that manage the entire accounts payable lifecycle, from invoice capture and approvals to vendor portal management, all within their existing CRM environment. The key benefit is leveraging Salesforce’s robust automation tools, like Flow, to create sophisticated invoice routing and approval workflows tied directly to customer or project data.

899cd955-79e7-4ae4-8f81-3850e1f2b21f.jpg

This approach ensures a single source of truth and streamlines financial operations by keeping them connected to sales and service activities. Users can find a wide range of AP apps, OCR tools, and finance integrations tailored to specific industry needs. However, a significant drawback is the prevalence of quote-based pricing, which can lengthen procurement cycles compared to transparent subscription models. Additionally, accessing detailed information or demos for many applications often requires logging in or contacting sales teams, making initial comparisons less straightforward.

- Best for: Businesses standardised on Salesforce seeking to integrate AP automation directly into their CRM.

- Key Feature: Native and integrated apps that utilise Salesforce Flow for customised approval workflows.

- Access: Many app details and trials require a Salesforce login and direct vendor contact.

- Website: https://appexchange.salesforce.com

6. Capterra UK — Accounts Payable Software

For creators and small businesses at the beginning of their research journey, Capterra UK’s Accounts Payable Software directory is an invaluable, vendor-neutral resource. Instead of being a single tool, it’s a comprehensive comparison platform where you can filter and evaluate a wide array of invoice automation software solutions based on features, business size, and user ratings. This allows you to build a shortlist of potential candidates before committing to demos or trials, saving significant time. The site aggregates user reviews and provides detailed feature checklists, giving a broad market overview.

The primary benefit is its impartiality and breadth, helping you discover tools you might not have found otherwise. However, it's a starting point, not a final destination. While it is UK-focused, you must still verify that global vendors listed offer localised support and are fully compliant with UK regulations like Making Tax Digital. Pricing information can also be inconsistent or hidden behind lead capture forms, requiring direct contact with vendors for accurate quotes. Use it to build an initial list, then conduct your own deeper due diligence on the top contenders.

- Best for: Early-stage research and comparing a wide range of vendors neutrally.

- Key Feature: Extensive filtering options and aggregated user reviews for comparison.

- Access: Free to browse and use for research purposes.

- Website: https://www.capterra.co.uk/directory/30520/accounts-payable/software

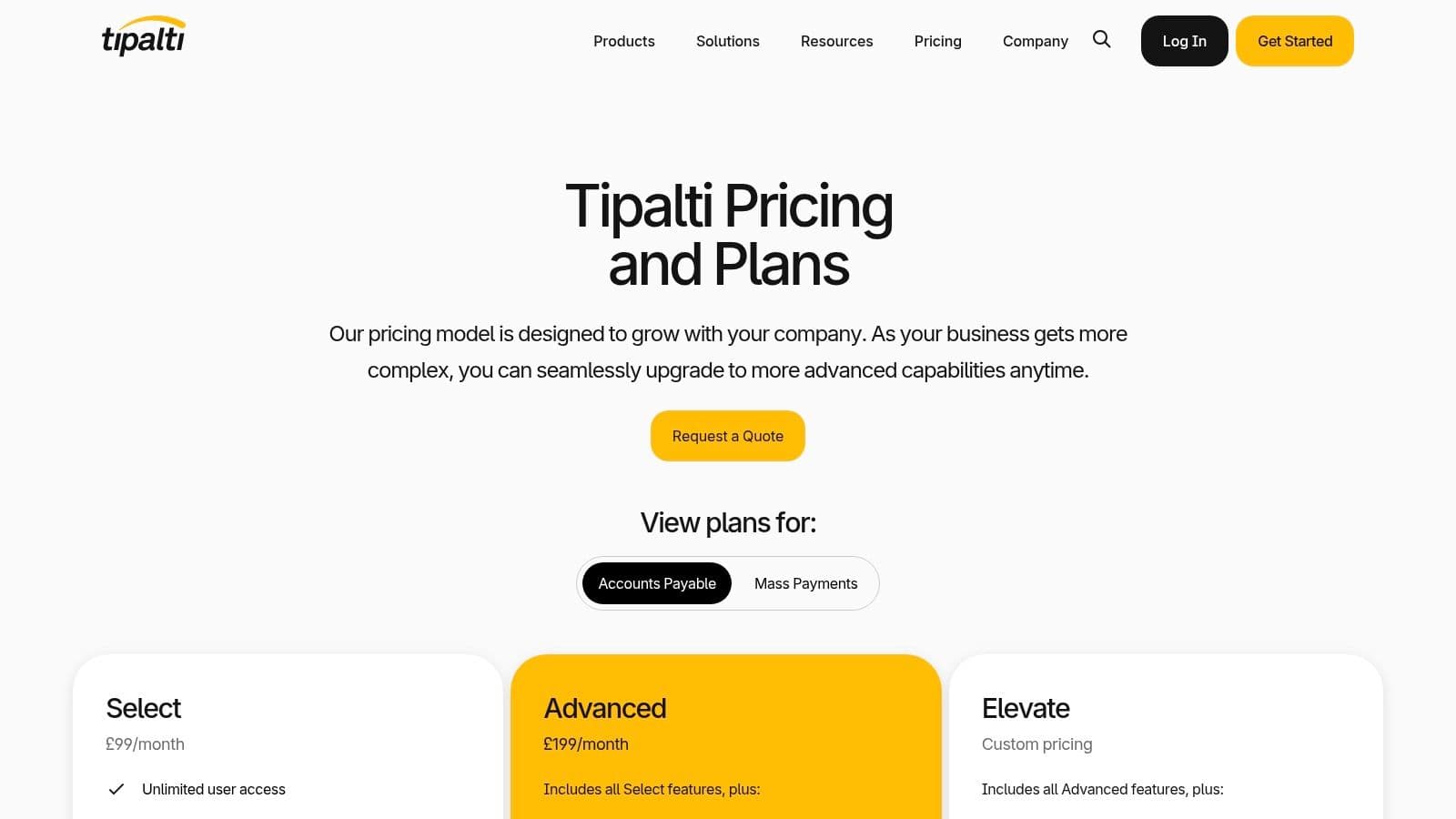

7. Tipalti (UK)

For UK businesses scaling globally, Tipalti offers a comprehensive, end-to-end accounts payable solution that goes far beyond basic invoice automation software. It is designed for companies managing complex payment operations, multiple entities, and international suppliers. The platform combines AI-powered invoice capture and coding with sophisticated approval workflows, 2- and 3-way purchase order matching, and a self-service supplier portal that handles VAT ID collection and validation, significantly reducing administrative overhead.

a21648f1-95c7-4e29-9a9a-d3bb40e1904d.jpg

Tipalti’s key differentiator is its integrated global payments infrastructure, supporting over 200 countries and 120 currencies while managing tax and regulatory compliance. This makes it an exceptionally strong choice for businesses with a diverse international supplier base. While its transparent starter pricing is a major advantage, the platform's extensive capabilities mean implementation can be more complex than simpler tools. The system also excels at simplifying financial close processes, which you can explore further by understanding the benefits of automated payment reconciliation.

- Best for: Medium-to-large UK businesses with complex AP processes and global payment needs.

- Key Feature: Unified invoice management, multi-entity support, and global mass payments in a single platform.

- Access: Starts at £99 per month, with advanced tiers requiring a custom quote.

- Website: https://tipalti.com/en-uk/pricing/

8. SAP Concur Invoice (UK)

For larger businesses and enterprises in the UK, SAP Concur provides an enterprise-grade invoice automation software solution designed for scalability and control. It moves beyond simple invoice processing to offer a comprehensive spend management platform. The system excels at capturing invoices from any source, automating complex, multi-level approval workflows, and ensuring every payment aligns with internal policies and regulatory requirements. This focus on compliance and auditability makes it a powerful tool for organisations with stringent financial controls.

e672a23f-cc2b-420d-901e-32c37b3ce0e6.jpg

The platform’s key advantage lies in its deep integration capabilities with major ERP systems, creating a unified financial ecosystem. While its extensive feature set may be overly complex for a solo creator or a small coaching business, it is ideal for companies managing high volumes of invoices and requiring robust audit trails. Pricing is quote-based and requires a consultation, reflecting its tailored, enterprise-level approach. The direct UK sales and support presence ensures localised assistance for implementation and ongoing management.

- Best for: UK-based enterprises and scaling businesses needing robust compliance and ERP integration.

- Key Feature: Automated invoice capture with advanced, multi-level approval workflows and audit trails.

- Access: Requires a consultation to receive a quote-based subscription plan.

- Website: https://www.concur.co.uk/invoice-management

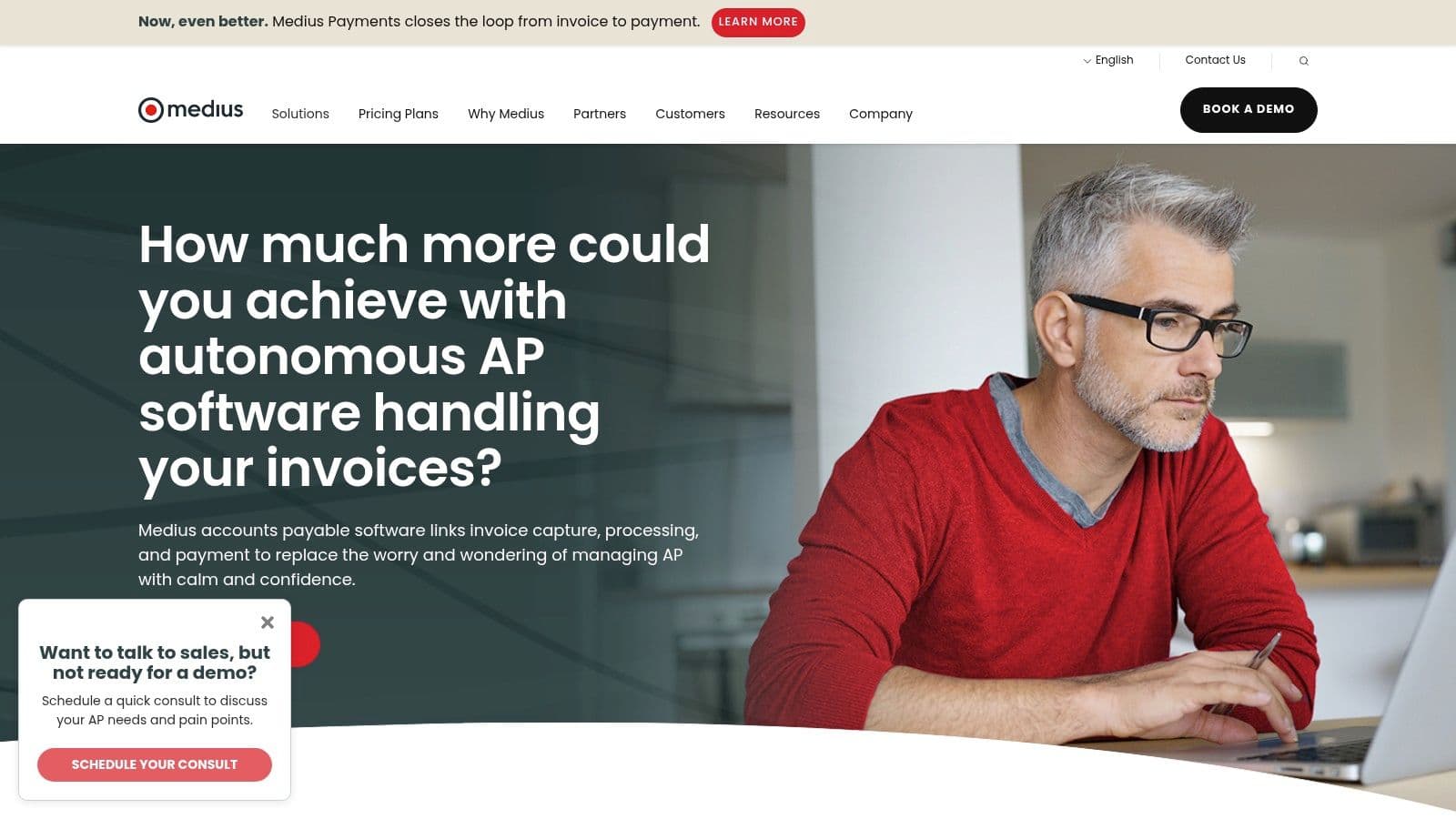

9. Medius — Accounts Payable Automation

For mid-market and enterprise-level UK businesses seeking a robust, AI-driven solution, Medius offers a comprehensive invoice automation software suite focused on accounts payable. This platform moves beyond simple invoice processing to provide an end-to-end system that includes intelligent data capture, automated matching and approvals, and integrated payment processing. Its key differentiator is a strong emphasis on fraud and risk detection, using AI to spot anomalies and provide actionable insights, which is crucial for larger organisations managing high volumes of transactions.

042ba4f8-2d84-437f-90bc-2bc6d8fd9616.jpg

Medius is engineered for complexity, offering managed connectors for major ERP systems to simplify integration and ensure data flows smoothly. This focus on compliance, security, and scalability makes it a powerful tool for businesses aiming to optimise their entire financial operations. While it may be too comprehensive for sole traders or very small businesses, it represents a significant step in business process automation for growing companies. Pricing is customised and requires a consultation, reflecting its tailored, enterprise-grade nature.

- Best for: Mid-market and enterprise businesses in the UK needing an advanced, secure AP automation solution.

- Key Feature: AI-powered fraud and risk anomaly detection with managed ERP system connectors.

- Access: Requires a scheduled demo and a customised quote; pricing is not publicly available.

- Website: https://medius.com/solutions/medius-accounts-payable-automation/

10. Basware - AP Automation & Touchless Invoice Processing

For larger organisations and enterprises with complex, multi-national accounts payable requirements, Basware provides a robust and highly scalable invoice automation software solution. It moves beyond simple invoicing to offer a comprehensive procure-to-pay platform, focusing on touchless invoice processing powered by AI and machine learning. Its strengths lie in managing high volumes of both purchase order (PO) and non-PO invoices, ensuring global compliance across more than 60 countries, and integrating deeply with over 250 different ERP systems. This makes it a powerful choice for businesses operating on a global scale.

54cce826-4f1f-4c19-b2db-8ccabdab4ad9.jpg

The platform’s SmartPDF and AI-powered SmartCoding features are designed to achieve high automation rates, minimising manual intervention and reducing errors. With over 40 years of experience, Basware excels in navigating complex VAT and tax regulations, making it a reliable partner for compliance. However, its enterprise focus means pricing is quote-based and significantly higher than SME-focused tools. The implementation process is also more involved, often requiring considerable planning and stakeholder engagement, which may be prohibitive for smaller businesses or creators looking for a simple, out-of-the-box solution.

- Best for: Large, multi-national enterprises needing a comprehensive, compliant AP automation and procure-to-pay solution.

- Key Feature: AI-driven touchless processing with extensive ERP integrations and global compliance capabilities.

- Access: Quote-based enterprise pricing; implementation requires significant project planning.

- Website: https://basware.com/en/solutions/ap-automation/

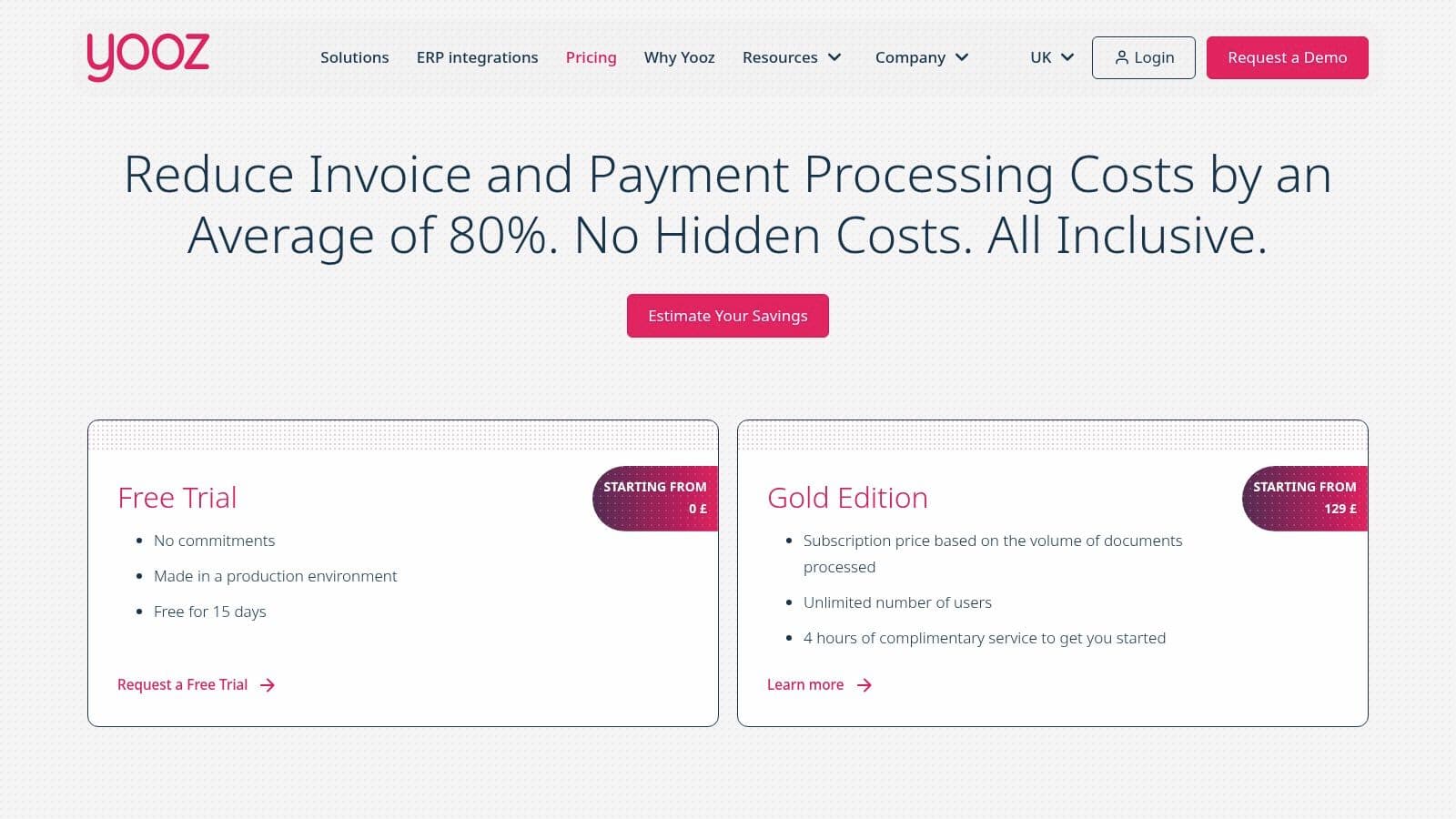

11. Yooz (UK)

Yooz is a cloud-based Accounts Payable (AP) automation platform specifically tailored for UK small and medium-sized enterprises (SMEs) seeking rapid implementation. Its core strength lies in its AI-powered optical character recognition (OCR) technology, which intelligently captures and processes invoice data, significantly reducing manual entry. The platform is designed for quick time-to-value, offering a streamlined onboarding process and features like automated approval workflows and payment processing, making it a powerful piece of invoice automation software for businesses ready to scale.

297d8fbf-e581-45d7-8550-ee542dc868dc.jpg

A key differentiator is its transparent, volume-based pricing, which starts from £129 per month and includes unlimited users, a feature particularly beneficial for growing teams. This model allows businesses to predict costs accurately as they expand. While it may lack some of the complex, enterprise-grade compliance features found in larger suites, its focus on core AP automation and UK-based support makes it an excellent choice for businesses prioritising efficiency and ease of use. A free 15-day trial is available to test the functionality.

- Best for: UK SMEs and growing businesses needing a fast-to-implement, all-in-one AP automation solution.

- Key Feature: AI-assisted invoice capture with transparent, volume-based pricing that includes unlimited users.

- Access: Subscription-based service with a free 15-day trial.

- Website: https://getyooz.com/en-gb/pricing

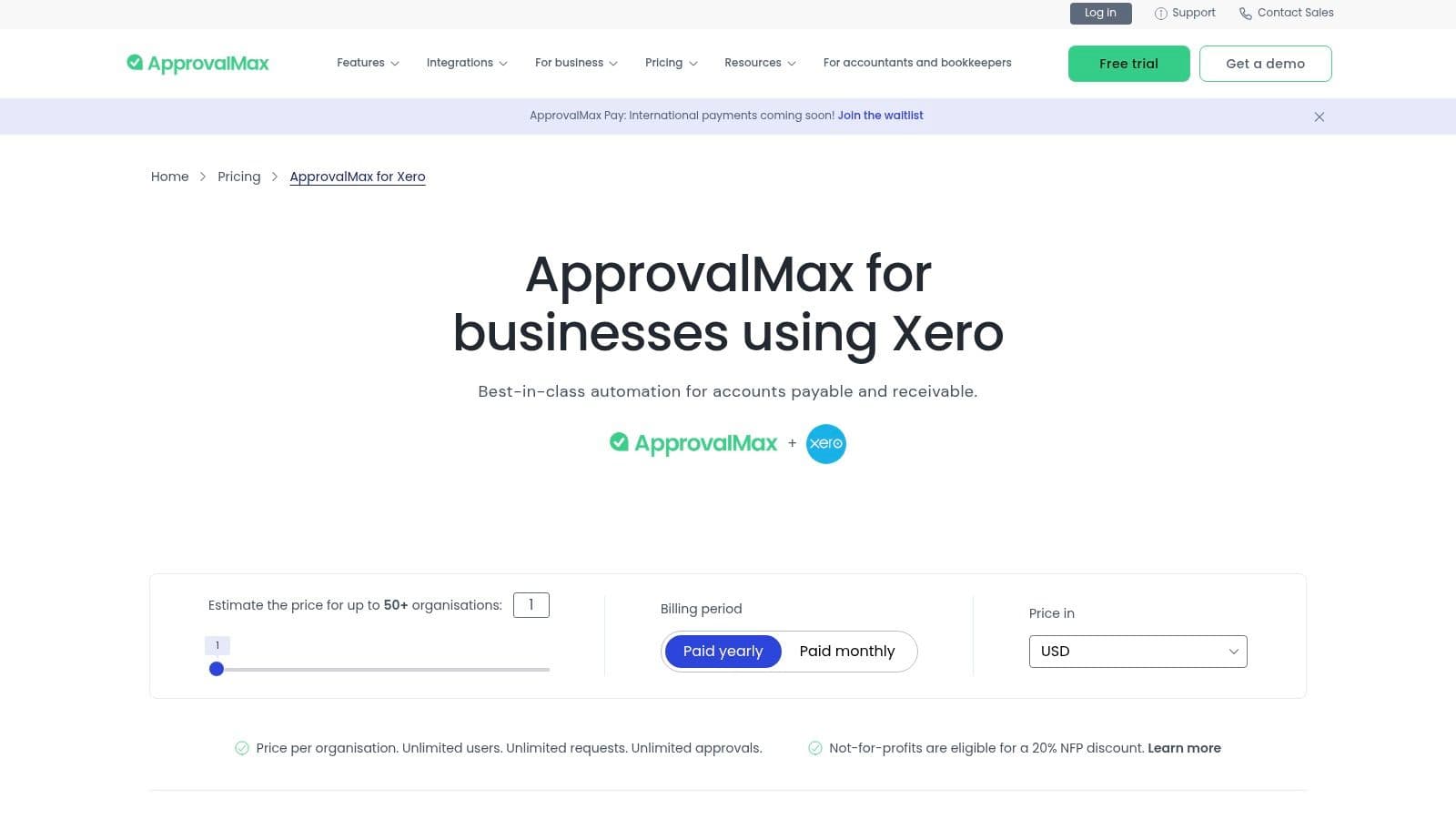

12. ApprovalMax (for Xero/QuickBooks)

For small businesses and finance teams using Xero or QuickBooks Online, ApprovalMax serves as a powerful layer of control for your accounts payable process. It isn’t an all-in-one accounting system, but a specialised invoice automation software focused entirely on creating robust, multi-step approval workflows. This tool allows you to define granular rules for who needs to authorise bills, purchase orders, and credit notes before they are approved for payment in your core accounting platform, significantly reducing the risk of fraud or error.

55ee5887-816b-4446-b43b-1df494b457a2.jpg

Its key strength lies in automating complex internal controls, such as matching supplier invoices to purchase orders and checking them against budgets automatically. The system provides a complete, audit-ready trail of every approval decision. While the core platform is excellent for workflow management, essential features for end-to-end automation, like OCR data capture and direct payments, are available as UK-only add-ons at an additional cost. This makes it ideal for organisations prioritising financial governance but requires careful cost consideration for a fully automated solution.

- Best for: Businesses on Xero or QuickBooks needing robust, auditable approval workflows.

- Key Feature: Multi-step, rule-based approval workflows with bill-to-PO matching.

- Access: Integrates with Xero and QuickBooks Online; offers a 14-day free trial.

- Website: https://approvalmax.com/pricing/approvalmax-for-xero

Invoice Automation Software: Top 12 Feature Comparison

| Platform | Core Features & Integration | User Experience & Quality ★★★★☆ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Xero App Store (UK) | UK-focused apps, one-click trials, GBP pricing | Deep Xero integration, strong UK user reviews | Free trials, varies by app | UK SMEs, Xero users | Curated UK collections, 2-way sync |

| QuickBooks App Store (Global) | AP automation apps, native QBO support | Trusted brand, guided onboarding support | Mixed USD/GBP pricing, plan-dependent | Global & UK QBO users | Broad app choice, Intuit help content |

| Sage Marketplace (UK) | UK-relevant apps, cloud & desktop Sage support | Solid Sage product integration | Vendor-contact pricing | Sage users in UK | Feature comparisons, local support |

| Microsoft AppSource | MS 365/Power Platform integration | Familiar MS UI, security standards | Pricing on request/demos | Microsoft ecosystem users | Power Automate building blocks |

| Salesforce AppExchange | Native Salesforce AP apps, workflows | Strong ecosystem, ideal for Salesforce orgs | Quote-based pricing, login required | Salesforce customers | Vendor portals & flow automation |

| Capterra UK | Comparative directory, UK filters | Neutral reviews, broad vendor coverage | Pricing info varies, may require lead capture | Early-stage researchers, SMEs | Detailed feature checklists |

| Tipalti (UK) | End-to-end AP automation, global payments | Scalable plans, strong UK pricing transparency | From £99/month, enterprise custom quotes | Mid-large UK/global companies | VAT validation, multi-entity support |

| SAP Concur Invoice (UK) | Invoice capture, approval workflows | Enterprise-grade, flexible subscription | Quote-based, usage pricing | Large enterprises | Compliance & audit trails, UK support |

| Medius | AI invoice capture, fraud detection | Mid-market/enterprise focus, compliance emphasis | Demo/quote only | Mid to large enterprises | AI-driven risk insights |

| Basware | AI/ML invoice capture, ERP integrations | Enterprise robustness, 40+ years experience | Quote-based, complex implementation | Large enterprises | 250+ ERP connectors, global VAT compliance |

| Yooz (UK) | AI OCR capture, invoice workflows | Fast onboarding, unlimited users on paid plans | From £129/month, volume-based pricing | SMEs UK | UK-focused support, ROI calculator |

| ApprovalMax (Xero/QuickBooks) | Rule-based approval workflows, OCR add-ons | Strong ratings, free 14-day trial | Transparent GBP plans + add-ons costs | UK Xero/QuickBooks users | Multi-step approvals, fraud alerts |

Making Your Final Decision on Invoice Automation

Navigating the landscape of invoice automation software can feel overwhelming, but the journey to finding the right fit is a crucial investment in your business's future. We have explored a wide spectrum of solutions, from expansive app marketplaces like the Xero App Store and Salesforce AppExchange to powerful, specialised platforms such as Tipalti, Medius, and Basware. The key takeaway is that there is no single "best" platform; the ideal choice is entirely dependent on your unique operational needs.

For creators, coaches, and small business owners, the decision often hinges on integration and simplicity. If you already rely on Xero or QuickBooks, a tool like ApprovalMax offers a seamless extension of your existing workflow, adding sophisticated approval layers without the complexity of a complete system overhaul. Conversely, if your primary goal is to discover and compare a wide array of options, resource hubs like Capterra UK provide an invaluable, vendor-neutral starting point.

Key Factors to Guide Your Choice

As you move from evaluation to implementation, keep these critical factors at the forefront of your decision-making process. Choosing the right invoice automation software is less about the features on paper and more about how it aligns with your real-world processes.

- Integration Capabilities: Your chosen software must communicate flawlessly with your existing accounting, CRM, and payment systems. A poorly integrated tool creates more manual work, defeating the purpose of automation. Check for native integrations with platforms you already use, such as Xero, QuickBooks, or Salesforce.

- Scalability and Growth: Consider where your business will be in two to five years. A solution that fits your current needs as a solo creator might not support a growing team or an expanding service offering. Look for a platform with tiered pricing and features that can scale alongside your success.

- Implementation and Support: How much time and technical expertise are required to get started? Some solutions offer a simple plug-and-play setup, while enterprise-level systems like SAP Concur may require a more involved implementation process. Evaluate the quality and availability of customer support, as it will be vital during the initial setup and for any future troubleshooting.

- User Experience (UX): A complicated or clunky interface will hinder adoption by you or your team. Take full advantage of free trials and product demos to get a genuine feel for the software's day-to-day usability. The goal is to reduce friction, not create it.

Ultimately, the right invoice automation software should feel like a natural extension of your business, freeing up your valuable time and mental energy. By carefully assessing your current workflows, future ambitions, and the practical considerations of integration and usability, you can confidently select a tool that empowers you to focus on what truly matters: serving your clients and growing your brand.

Ready to automate payments and subscriptions for your community without the complexity? MyMembers offers seamless integration with Telegram, handling everything from payment processing to member management so you can focus on creating great content. Discover how simple automation can be at MyMembers.