Let's be honest, accounting can feel like a completely different language, especially when you're in the SaaS world. But there's one principle that, once you grasp it, changes everything: SaaS revenue recognition.

In simple terms, it’s the rule of recording revenue only when you’ve actually earned it, not just when the cash lands in your bank account. For any business running on subscriptions, this means you can only recognise a slice of a contract's value each month as you deliver your service. You don't get to book the whole lump sum upfront. This single idea is the bedrock of a healthy, scalable SaaS financial model.

Why SaaS Revenue Recognition Is Different

53de4d1c-5449-4743-a7ef-36763314f568.jpg

Think about it like a gym membership. A customer walks in and pays £1,200 for a full year. The gym gets all that cash on day one, which feels great, but they haven't earned it all yet. They now have a 12-month obligation to keep the lights on and the treadmills running. With each passing month, they "earn" £100 of that initial payment by holding up their end of the bargain.

That's the exact same logic for your SaaS business. When a customer pays £1,200 for an annual software plan, you haven't earned the whole amount just by processing the payment. You've only earned the right to recognise £100 of revenue each month as you provide access to your platform. This is the crucial difference between cash in the bank and revenue on the books.

The Problem with Cash-Based Accounting

For many businesses, especially those built on the ever-popular subscription business model, just counting cash as it comes in can paint a dangerously misleading picture of your company's health. It can create the illusion of massive income spikes followed by scary droughts, even when the business is actually growing at a steady, predictable pace.

This cash-in, cash-out approach completely misses the point of the SaaS model: the ongoing delivery of a service. Investors, stakeholders, and even your own leadership team need a stable, clear view of performance. That’s precisely what proper revenue recognition delivers—it perfectly matches the revenue you report with the service you actually provided during that period.

Adhering to UK Accounting Standards

Here in the UK, this isn’t just a nice-to-have best practice; it’s a hard requirement. Accounting for your revenue properly means carefully applying the right standards, which can vary depending on your company's size. For instance, that £1,200 upfront payment for a 12-month subscription must be recognised as £100 per month as you deliver the service. If you want to dive deeper into the specific rules UK startups have to follow, the team at Friend & Grant breaks it down nicely.

Key Takeaway: The whole game is shifting your focus from when cash hits your bank to when value is delivered to your customer. This accrual method isn't optional—it's the only way to do accurate financial reporting in the subscription economy.

Getting this right isn't just about ticking a compliance box. It’s critical for a few big reasons:

- Accurate Financials: It gives you a true and fair view of how your company is really performing over time.

- Investor Confidence: Investors live and die by metrics like Annual Recurring Revenue (ARR). That metric is built on correctly recognised revenue, not lumpy cash payments.

- Strategic Decisions: It lets you make smart, informed decisions based on predictable revenue streams instead of being thrown off by volatile cash flow.

Nailing this concept is the first real step toward building a SaaS business that's not just growing, but is sustainable and valuable. It ensures your financial statements are accurate, compliant, and ready for any scrutiny that comes your way.

Navigating UK Accounting Standards: IFRS 15 and FRS 102

759c77d9-a2cc-48f5-8478-a8bc1fbaa039.jpg

For any SaaS business based in the UK, revenue recognition isn't the Wild West. There are rules. And those rules are called IFRS 15 and FRS 102.

Think of them less like rigid, scary regulations and more like a shared language for finance. They exist to make sure every company's numbers are transparent, comparable, and—most importantly—trustworthy. No smoke and mirrors.

While they might sound like something only your accountant needs to worry about, their core idea is actually pretty simple. Both standards are designed to make sure you recognise revenue in a way that truly reflects when you deliver your service to a customer. This single principle is the absolute heart of proper SaaS revenue recognition.

Understanding IFRS 15: The Global Gold Standard

IFRS 15, or 'Revenue from Contracts with Customers', is the big one. It’s the international benchmark that was brought in to create one single, solid framework for revenue recognition across every industry, including subscription models like SaaS.

It replaces guesswork with a clear, five-step model that acts as your roadmap. The goal? To ensure your financial statements show when and how revenue is actually earned, killing off the old, inconsistent practices that used to cause so much confusion.

For SaaS businesses, IFRS 15 is a game-changer because it tackles complex contracts head-on. A single deal might include software access, a one-off setup fee, and premium support. IFRS 15 gives you the framework to account for each piece correctly.

IFRS 15 forces you to dissect your customer contracts and identify distinct 'performance obligations'—basically, the specific promises you've made to the customer. This level of detail is fundamental for accurate financial reporting in the SaaS world.

This methodical approach gives investors, lenders, and your own team a crystal-clear picture of your company's financial health. Everyone works from the same set of reliable figures.

What Is FRS 102? The UK's Go-To Standard

While IFRS is the global player, many UK companies run on UK Generally Accepted Accounting Practice (UK GAAP). The main standard here is FRS 102, 'The Financial Reporting Standard applicable in the UK and Republic of Ireland'.

Here’s the good news: FRS 102 is built on the same principles as IFRS. The core concept of recognising revenue when it's earned, not just when the cash hits your bank, is virtually identical. So, if you get the logic behind IFRS 15, you’re already 90% of the way to understanding FRS 102.

FRS 102 is the standard for most small and medium-sized businesses (SMEs) in the UK. There are even stripped-back versions for small companies (Section 1A) and micro-entities (FRS 105), but the fundamental principles for revenue recognition don't change.

The Nitty-Gritty: Similarities and Differences

At their core, both standards want the same thing. They want you to recognise revenue as you hand over control of a service to your customer. For a typical SaaS business, that "handover" is happening continuously, every single day of the subscription period.

Here’s how they line up:

- Core Principle: Both demand that revenue is recognised as you satisfy your promises over time. This fits the subscription model like a glove.

- Multiple Elements: Both standards require you to break down a contract into its separate promises (e.g., software, setup, support) and split the total price between them.

- Variable Payments: Both have rules for handling things that can change the contract value, like discounts, usage credits, or performance bonuses.

The real differences are often in the fine print—the level of detail and disclosure required. IFRS 15 is generally more prescriptive and asks for more extensive notes in your financial statements. FRS 102 can be a little less detailed in certain areas, but the foundational approach to SaaS revenue recognition is the same.

For most ambitious UK SaaS companies, especially those eyeing up international investment or a future exit, getting aligned with IFRS 15 principles from day one is a smart, strategic move. Even if you're reporting under FRS 102 right now, adopting the five-step model from IFRS 15 gives you a rock-solid framework. It prepares you for growth and ensures your financials speak a language everyone, everywhere, can understand.

Putting The Five-Step Revenue Recognition Model To Work

Theory is one thing, but getting your hands dirty is where the real learning happens. Let’s walk through the IFRS 15 five-step model with a practical, everyday SaaS scenario. This process turns abstract accounting rules into a clear, repeatable workflow for your business.

Picture this: your SaaS company, "InnovateCRM," just signed a new customer. The deal is pretty standard: a £1,200 annual subscription for your software, which also includes a mandatory, one-time setup fee of £200.

Now, let's break this down step-by-step to see how proper SaaS revenue recognition works in the real world.

Step 1: Identify The Contract With The Customer

First things first, you need to confirm a formal contract actually exists. This doesn't always mean a 50-page document signed in ink. Under IFRS 15, a contract is legit if it ticks a few specific boxes.

It needs to be approved by both sides, spell out everyone's rights, detail payment terms, have real commercial substance, and make it probable you’ll actually collect the money you're owed.

In our InnovateCRM example, the customer agreed to the terms of service and handed over their payment details for the £1,400 total. Boom. A clear, enforceable contract has been created. That's our green light to move on.

Step 2: Pinpoint The Performance Obligations

This is where SaaS accounting starts to get interesting. A performance obligation is just a fancy term for a specific promise you make to a customer. You have to look at the contract and ask, "What have we actually promised to deliver here?"

For InnovateCRM, the contract has two line items:

- Ongoing access to the CRM software for 12 months.

- A one-time professional setup service.

The critical question now is whether these are distinct promises. A service is distinct if the customer can benefit from it on its own or with other resources they could easily get. In almost all SaaS scenarios, a setup fee is not distinct. The setup service is worthless without the software subscription itself; it has no value on its own.

Therefore, we really only have one combined performance obligation: providing a configured, working CRM platform over the 12-month contract period.

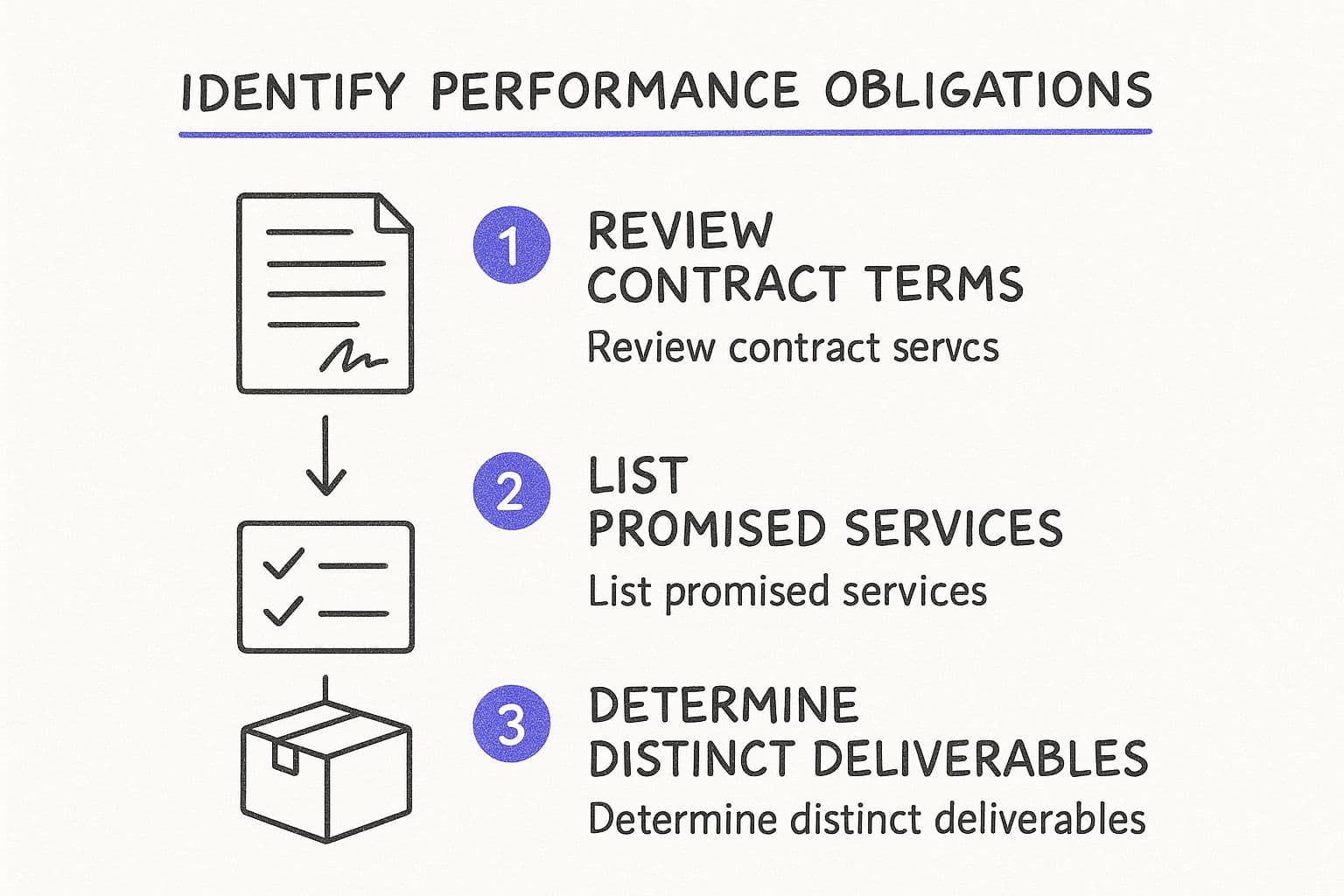

This handy visual breaks down how to spot these core promises in any contract.

902ae158-082b-4b7d-b30a-e142b56741e0.jpg

It highlights that identifying performance obligations is all about breaking a contract down to its fundamental deliverables. Get this right, and you’re on track to recognise revenue correctly.

Step 3: Determine The Transaction Price

This step is usually the easiest part of the whole process. The transaction price is the total amount of cash you expect to get from the customer for your services.

For our InnovateCRM deal, the calculation is dead simple:

- Annual Subscription: £1,200

- Setup Fee: £200

The total transaction price for this contract is £1,400. This is the number we'll work with for the next couple of steps.

Of course, this can get more complicated if you have discounts or variable fees, which can change the total price you expect to collect. The price you set is a huge part of a successful subscription pricing strategy and directly impacts these calculations.

Step 4: Allocate The Price To Performance Obligations

Now we need to take our £1,400 transaction price and spread it across our performance obligations. But wait—since we already figured out that the software access and setup are just one combined obligation, this step is a piece of cake.

The entire £1,400 gets allocated to that single obligation: delivering the configured software service over the 12-month term.

Key Insight: If the setup service was a distinct service (a very rare scenario), you'd have to split the transaction price based on the standalone selling price of each item. But because it's all integrated, the full contract value is treated as one big bundle.

This is a crucial distinction. It stops you from making the common mistake of recognising the £200 setup fee immediately, which would incorrectly pump up your revenue in the first month.

Step 5: Recognise Revenue As Obligations Are Satisfied

This is the final and most important step. We recognise revenue as (or when) we actually satisfy our promise to the customer. Since our obligation is to provide continuous access to the InnovateCRM platform, we satisfy it over time—not all at once on day one.

We have a total of £1,400 to be recognised over a 12-month period. The maths is straightforward:

£1,400 / 12 months = £116.67 per month

So, for each month that InnovateCRM provides its service, it will recognise £116.67 in revenue. The rest of the cash sits on the balance sheet as deferred revenue—a liability that represents the service we still owe the customer.

Here’s how the first few months would shake out:

- Month 1: Recognise £116.67. Deferred Revenue is £1,283.33.

- Month 2: Recognise another £116.67. Deferred Revenue is £1,166.66.

- ...and so on, until...

- Month 12: Recognise the final £116.67. Deferred Revenue is £0.

By sticking to this five-step model, InnovateCRM ensures its financial statements are accurate, compliant, and actually reflect the health of the business. It gives everyone, from your internal teams to your investors, a true picture of performance.

Of course. Here is the rewritten section, crafted to sound completely human-written and natural, following the style of the provided examples.

Handling Complex SaaS Revenue Scenarios

A simple annual contract is clean. It’s a great place to start.

But let’s be real—running a SaaS business is almost never that simple. Customers upgrade mid-year. They downgrade. They get special discounts. All these curveballs can create massive headaches for your SaaS revenue recognition if you aren't ready for them.

Nailing these complexities is what separates a finance team that’s in control from one that’s always putting out fires. Get it wrong, and your financial reports become a work of fiction, leading to some seriously bad business decisions.

Let's break down how to handle the messy stuff, one scenario at a time.

Accounting for Mid-Contract Upgrades and Downgrades

Contract changes are just part of the game. A customer on your basic plan suddenly needs more features six months in. Or a bigger client decides to scale back. Each move requires a precise tweak to your recognised and deferred revenue.

It’s not as scary as it sounds.

Imagine a customer is three months into a £1,200 annual plan (£100/month). They love it and decide to upgrade to your premium plan, which costs £1,800 a year. You now have to account for the remaining nine months at the new, higher rate.

Here’s the maths:

- Original Contract Value: £1,200

- Revenue Recognised (3 months): £300

- Remaining Term: 9 months

- New Prorated Value (9 months): £1,800 / 12 * 9 = £1,350

- New Revenue Recognition (per month): £150

From that point on, you’d adjust your deferred revenue and start recognising £150 each month for the rest of the contract. Downgrades work exactly the same way, just in reverse. This usually means you’ll issue a credit or simply recognise a smaller amount each month.

Key Takeaway: The simplest way to think about it is this: a contract modification kills the old contract and creates a new one for the remaining term. This keeps your books perfectly aligned with the actual value you're delivering.

Tackling Usage-Based and Consumption Billing

For businesses billing on usage—think API calls, data storage, or active users—revenue recognition gets a lot more dynamic. You can’t just divide an annual fee by twelve and call it a day.

Instead, you recognise revenue as the customer actually consumes the service.

Let’s say you run a cloud storage company that bills £0.10 per gigabyte stored. A customer chews through 500 GB in January and 700 GB in February.

- January Revenue: 500 GB * £0.10 = £50

- February Revenue: 700 GB * £0.10 = £70

In this model, your recognised revenue is a perfect mirror of the value delivered each month. It gives an incredibly accurate financial picture, but you absolutely need rock-solid tracking and billing systems to pull it off.

The Debate on One-Time Setup Fees

Ah, the one-time setup fee. This is easily one of the most misunderstood parts of SaaS accounting. It’s so tempting to see that cash hit the bank and book it as revenue right away.

Don’t do it. Under IFRS 15 and FRS 102, that's almost always the wrong move.

The rule is actually pretty straightforward: if the setup service has no value to the customer on its own—without the ongoing software subscription—it’s not a distinct performance obligation. That means the fee has to be deferred and recognised smoothly over the entire contract term.

- Scenario: A customer signs a £2,400 annual contract and pays a £600 setup fee.

- Total Contract Value: £3,000

- Monthly Recognised Revenue: £3,000 / 12 = £250

You can't book that £600 in month one. It gets rolled into the total contract value and spread out, reflecting the fact that its value is only realised over the life of the subscription.

Navigating Promotions and Discounts

Promotional offers like "50% off for the first three months" also throw a spanner in the works. You can't just apply the discount to the first few months of recognised revenue. Instead, you have to allocate the total discounted contract value over the entire term.

Let’s use a £100/month plan with that 50% off deal:

- First 3 Months Payment: £50 x 3 = £150

- Next 9 Months Payment: £100 x 9 = £900

- Total Contract Value: £1,050

- Monthly Recognised Revenue: £1,050 / 12 = £87.50

You’d recognise £87.50 every single month for the full year, even though the cash collection is lumpy. This approach smooths out your revenue and gives a much truer picture of the contract's economic value.

In the UK, this isn't just good practice; it’s critical. Investors scrutinise metrics like Annual Recurring Revenue (ARR) to death, and it’s a cornerstone of how businesses are valued. You can learn more about how UK SaaS valuations are calculated to see why getting these numbers right is so important.

Why Accurate Revenue Recognition Drives Company Value

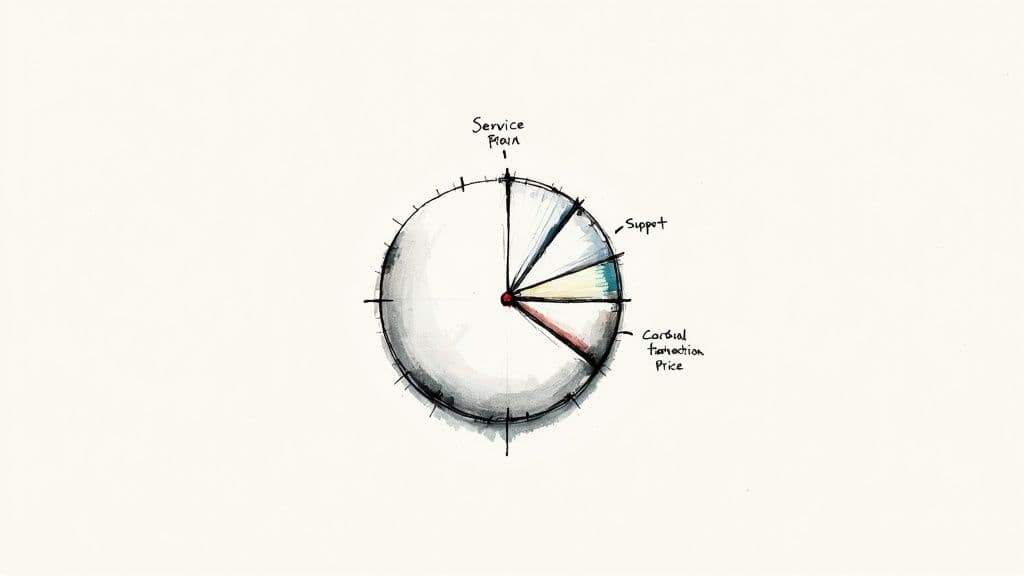

67357fff-56f2-4133-80df-b508dadc5c60.jpg

It’s easy to dismiss SaaS revenue recognition as a chore. Just another box-ticking exercise for the finance team to keep auditors happy, right? Wrong. That view completely misses the bigger picture.

Accurate revenue recognition isn’t just about compliance; it's the engine that builds a valuable, sustainable business.

Think of it like the foundation of a house. If it’s shaky, everything you build on top—your growth plans, valuation, investor reports—is at risk of collapse. Get it right, and you’ve built a stable base for whatever comes next.

Building Trust with Clean Financials

Investors, lenders, and potential buyers aren’t just glancing at your top-line growth. They’re digging deeper. They want to see clean, predictable, and compliant financial statements that tell the real story of your company’s health.

When your revenue is recognised correctly, it signals discipline and transparency. It builds an unbreakable layer of trust, proving that your success is genuine, not just a mirage created by lumpy cash collections. That confidence is a tangible asset that directly pumps up your company's valuation during fundraising or an exit.

Key Insight: Clean financials prove operational maturity. They tell stakeholders you have real control over your business and are building a company based on predictable performance, not just hopeful projections.

The Bedrock of Essential SaaS Metrics

Key SaaS metrics like Annual Recurring Revenue (ARR) and customer churn are the vital signs of your business. They tell you where you’re strong and where you’re vulnerable. But here’s the kicker: these metrics are completely dependent on accurate revenue recognition.

Your ARR isn't a measure of total bookings or cash collected. It’s a direct reflection of the recurring revenue you have earned and recognised over a specific period. Mistakenly recognising one-time fees as recurring revenue, for instance, will dangerously inflate your ARR and mislead everyone from your team to your investors.

Similarly, calculating churn and retention requires a stable revenue baseline. The UK is home to around 1,800 SaaS companies, so in a market this competitive, keeping churn low is a matter of survival. Even a tiny 5% improvement in customer retention can boost long-term company value by 25% to 95%—a massive impact that highlights why your data has to be spot-on.

Strategic Planning and Forecasting

Without a reliable historical baseline, understanding how to forecast sales and leverage data for growth is basically impossible. When your revenue data is clean, you can actually:

- Forecast with Confidence: Predict future performance based on solid trends, not guesswork.

- Allocate Resources Smartly: Make informed decisions about hiring, marketing spend, and product development.

- Identify Growth Levers: Pinpoint which customer segments or product tiers are driving the most value.

This isn’t just about looking backwards; it’s about using a clear view of the past to chart a smarter course for the future. And as your business scales, managing payments gets more complex. You might find our guide on https://mymembers.io/blog/automated-payment-reconciliation helpful for simplifying that process.

Ultimately, mastering revenue recognition is a strategic move. It takes a back-office chore and turns it into a boardroom-level competitive advantage that drives real, measurable company value.

Still Got Questions About Revenue Recognition?

Even with a solid grip on the five-step model, the real world always throws a few curveballs. Applying proper SaaS revenue recognition is full of little puzzles, especially when you're trying to square accounting theory with the messy reality of a subscription business.

We’ve pulled together some of the most common questions that pop up for founders and finance teams. Think of this as your go-to cheat sheet for clearing up confusion and getting this stuff right.

What’s the Difference Between Bookings, Billings, and Recognised Revenue?

It’s incredibly easy to mix these up, but they tell completely different stories about your company’s health. Getting them wrong gives you a dangerously warped view of your performance and is a massive red flag for any investor worth their salt.

Here’s the simple breakdown:

- Bookings: This is the total value of a contract the moment a customer signs on the dotted line. A customer commits to a £12,000 annual deal? That's a £12,000 booking. It shows commitment, but it’s not money you’ve earned yet.

- Billings: This is what you’ve actually invoiced the customer for. If you bill for the full year upfront, your billing for that contract is £12,000. It's cash in (or on its way), but still not fully earned.

- Recognised Revenue: This is the slice of the pie you have genuinely 'earned' by delivering your service. For that £12,000 annual contract, you’d only recognise £1,000 each month. This is the number that reflects your true performance.

How Should I Account for One-Time Implementation Fees?

Ah, the classic SaaS accounting riddle. It feels so natural to just bank that one-time setup fee the moment the cash hits your account. But under IFRS 15, that’s almost always the wrong move.

The big question you have to ask is: does the setup service give the customer any real value on its own, without the main software subscription?

In pretty much every SaaS scenario, the answer is a hard no. What good is a brilliant setup if you don’t have the software to use it with? Because of this, the fee isn't a separate performance obligation. You have to record it as deferred revenue and then recognise it smoothly over the life of the contract, not all in one lump.

Can Our Small Startup Just Use Cash Accounting?

The simplicity of cash accounting is tempting, I get it. But for a subscription business, it’s a non-starter and isn’t compliant with UK GAAP (FRS 102/105) or IFRS. You absolutely must use accrual accounting, where you record revenue when it's earned and expenses when they're incurred. It’s the only way to provide a "true and fair view" of your financial performance.

Using the accrual method isn't just about compliance; it's about making smart decisions. It ensures your financials actually reflect the ongoing value you deliver to customers, which is the entire point of the SaaS model. Without it, you're flying blind.

Sticking to cash accounting might feel easier today, but it will create massive compliance headaches and strategic blind spots as you start to grow.

How Does This Impact Key Metrics like ARR?

Getting revenue recognition right is the absolute bedrock of all your important metrics. Your Annual Recurring Revenue (ARR) must only include the annualised value of the recurring revenue you have properly recognised.

Mistakes here create an immediate ripple effect. If you wrongly lump one-time fees into your ARR calculation, you’re just inflating the number and misleading your team and investors. It creates a false sense of security and completely hides the true health of your recurring revenue engine. Inaccurate recognition leads directly to bogus ARR and churn numbers, giving you junk data for making critical decisions.

Managing subscriptions and getting payments right is the first step toward accurate revenue recognition. MyMembers automates the entire process, from creating custom landing pages to handling member invitations and processing payments seamlessly through Stripe. Turn your Telegram community into a predictable income stream without the administrative headache. Start monetising your audience today with MyMembers.