That little pang of dread when a surprise charge hits your account for a service you completely forgot about? We’ve all been there. The subscription economy makes signing up a breeze, but remembering what you signed up for... not so much.

It's time to take back control.

Escaping the Subscription Trap for Good

7652ef10-2db8-45c0-9a46-637bfc1c87a9.jpg

This guide is your roadmap out of subscription hell. We're moving past the frustration and straight into action, showing you exactly how to cancel recurring payments across the platforms where they hide. The goal is to demystify the whole process, explain your rights, and give you the practical steps to stop unwanted charges for good.

A lot of people fall into what’s known as the 'direct debit trap'. In the UK, the sheer convenience of automatic payments means Brits are wasting an average of £61 a year on forgotten subscriptions. It's wild, but nearly half the population admits they put off cancelling simply because the payment method is so seamless.

To really get ahead, it helps to understand how the other side thinks. Businesses build their entire models around automated billing, often using things like SaaS affiliate programs that offer recurring revenue to lock in customers. Knowing this isn't just trivia; it helps you become a smarter, more proactive consumer.

By the end of this, you’ll be ready to:

- Confidently shut down payments in platforms like PayPal.

- Tell your bank exactly which charges to block.

- Talk to merchants to make sure a cancellation actually sticks.

How to Cancel Automatic Payments in PayPal

PayPal is the central hub for tons of our subscriptions, so it's usually the first place I look when I need to track down and cancel a recurring payment. Finding the right screen isn't always obvious, but once you know where to go, stopping a charge is just a few clicks away.

First things first, log into your PayPal account. You'll want to find the gear icon for Account Settings. From there, click into the 'Payments' tab. This is where you'll find the magic button: 'Manage automatic payments'. Clicking this takes you to a dashboard listing every single payment agreement you have, both active and old.

Here’s the dashboard you’ll see right after logging in. From this home screen, you'll need to find your settings.

Once you're in the right spot, you'll see the full list of all your payment authorisations.

Navigating Your Automatic Payments Dashboard

This dashboard is your command centre for subscriptions. On the left, you'll see a list of every company you have a payment agreement with.

- Active Status: This means the company has permission to charge you. These are the ones you're looking to cancel.

- Inactive Status: This shows a past agreement that’s no longer active. Nothing to do here, but it's a handy record of what you've cancelled before.

Find and click on the company whose payment you want to stop. You'll see all the details, like when the first payment was made and how much you're billed. To really get a handle on this, it's useful to understand how PayPal handles transactions behind the scenes.

Key Tip: Always scan this list for duplicates from the same company. I've seen it happen where a free trial and the paid plan that follows create two separate authorisations. If you only cancel one, you might still get charged.

Once you’ve selected the merchant, you can’t miss the big 'Cancel' button. Click it, and then confirm you want to cancel on the next screen. PayPal immediately flips the status to 'Inactive', and that's it—the company can no longer charge your account.

For a deeper dive into managing these kinds of charges, check out our detailed guide on the PayPal subscription payment model. You’ve now successfully cut off the payment right at the source.

Stopping Payments Directly Through Your Bank

e4db54b7-e983-4578-9f1e-9a12e797b5d0.jpg

Sometimes, the simplest path is the most effective. While platforms like PayPal have their own cancellation processes, going straight to your bank gives you the final word on who gets to dip into your account.

This is your ace in the hole, especially when you’re dealing with a difficult merchant or just need to cancel a recurring payment right now. Knowing how to give your bank the right instruction is a non-negotiable skill for managing your money.

In the UK, you’ll mainly deal with two types of recurring payments via your bank: Direct Debits and Continuous Payment Authorities (CPAs). They look similar, but they operate under different rules. Understanding the difference puts you back in control.

A Direct Debit is an instruction you give your bank, authorising a company to take money. A CPA, on the other hand, is when you hand over your debit or credit card number and let a company pull payments when they see fit.

Your Rights with Direct Debits

Cancelling a Direct Debit is surprisingly easy, all thanks to the Direct Debit Guarantee. Think of this as your safety net. It lets you cancel a payment instruction at any point, no questions asked.

You can do this right from your banking app, through their online portal, or by giving them a quick call. Just tell them you want to cancel the Direct Debit for a specific company, and they are legally required to stop it immediately.

And it seems more people are doing just that. Amidst growing economic pressure, UK Direct Debit failure rates shot up to 2.7% in early 2025. That’s a massive 42% jump from the year before, showing just how many people are taking a harder look at their fixed outgoings. You can read more about these trends over on FastPay's blog.

Stopping a Continuous Payment Authority (CPA)

Killing a CPA used to be a headache. Some companies would incorrectly claim that only they could cancel it. That’s just not true. You have the absolute right to pull your consent directly with your bank whenever you want.

When you contact your bank, use this exact phrase: "I am withdrawing my consent for [Company Name] to take any further payments from my account." This language is clear, direct, and legally binding.

Your bank must then block any future attempts from that company to take your money. If a payment does slip through after you've given this instruction, you are entitled to a full refund from your bank.

While this method is a surefire way to stop payments, it’s still a good idea to inform the company you're cancelling. It just helps avoid any messy contractual arguments down the line.

Of course, the steps can change depending on the payment processor. For a deep dive into another major platform, check out our guide on how to stop a recurring payment on PayPal.

What About Cancelling Directly With the Company?

Stopping payments via PayPal or your bank is a solid move, but it doesn't actually end your agreement with the company charging you. Think of it like this: you’ve stopped the money flow, but you haven't formally broken up.

To properly end the contract and make sure they don’t come after you later for “unpaid bills,” you have to go straight to the source.

It’s a common mistake to think payment processors like Stripe or GoCardless can cancel a subscription for you. They can't. They’re just the plumbing that moves the money from A to B. Your actual deal is with the business you signed up with, so they’re the only ones who can officially pull the plug.

Finding Your Way Through the Cancellation Maze

When you’re ready to cancel a recurring payment, your first stop should be the merchant’s website. Look for an “account,” “billing,” or “subscription” section. In a perfect world, you'd find a big, friendly “Cancel” button.

Yeah, right. Some companies make this intentionally painful.

You’re likely to run into a few tricks designed to make you just give up:

- Hidden Buttons: They bury the cancellation link under three layers of confusing menus.

- The Forced Phone Call: My personal favourite. They make you call and speak to a “retention specialist” whose entire job is to talk you out of leaving.

- Sneaky Notice Periods: Buried deep in the terms of service, you might find you have to give 30 or even 60 days’ notice. Brutal.

Thankfully, laws are starting to catch up. Rules similar to the FTC’s “click to cancel” regulation are popping up, forcing businesses that let you sign up online to also offer a simple online cancellation process. About time.

The Perfect Cancellation Email (Your Paper Trail)

If you can’t find a simple online option, your next best move is sending a clear, direct email. This creates a written record of your request, which is pure gold if you end up in a dispute later.

Pro Tip: Your email needs to be polite but firm. The goal is to give them everything they need to process your request in one go, leaving zero room for back-and-forth nonsense.

Here’s a simple template I’ve used that just works. Copy, paste, and adapt it.

Subject: Subscription Cancellation Request

Body:

Hi there,

Please take this email as my formal notice to cancel my subscription, effective immediately.

Here are my account details to make it easy for you:

- Full Name: [Your Name]

- Email Address: [Your Email Associated with the Account]

- Customer ID/Account Number: [If you have one, add it here]

Could you please process this cancellation and send me a quick confirmation once it's done? Thanks.

All the best,

[Your Name]

This approach is direct and leaves no space for them to claim they didn't understand. Once you hit send, save a copy. You now have the proof you need to escalate things if those pesky charges keep showing up.

Common Cancellation Mistakes and How to Avoid Them

Stopping a payment isn’t always as simple as hitting a button. To really cancel recurring payments for good and make sure they don’t sneak back onto your statement, you need to be a little defensive. The biggest mistake I see? Assuming the job's done after you click 'confirm'.

One of the most common traps is missing the cancellation deadline. Lots of services need notice—sometimes 30 days or more—before your next billing date. Cancel a day late, and you’ve probably just paid for another month you didn’t want. Always, always check the terms and conditions for their notice period.

Another classic error is walking away without written proof. Never end the cancellation process without some form of confirmation in your hands.

Document Everything Without Fail

This part is non-negotiable. If you cancel online, take a screenshot of the confirmation page. Make sure the date is clearly visible. If you cancel over email, save a copy of your sent message and their reply. This paperwork is your only real protection if a company tries to charge you again.

Without proof, it’s your word against theirs. That’s a frustrating battle you don’t want to fight. Your screenshot or saved email is the evidence you need to shut down disputes quickly with your bank or the merchant.

This is a huge issue, especially for younger people. Research shows almost one in four Gen Z consumers have been stung by missing a cancellation window, which is fuelling a lot of mistrust in traditional payment systems. It’s also why there’s a growing demand for clearer ways to manage subscriptions. You can read more about the shift in UK payment preferences here.

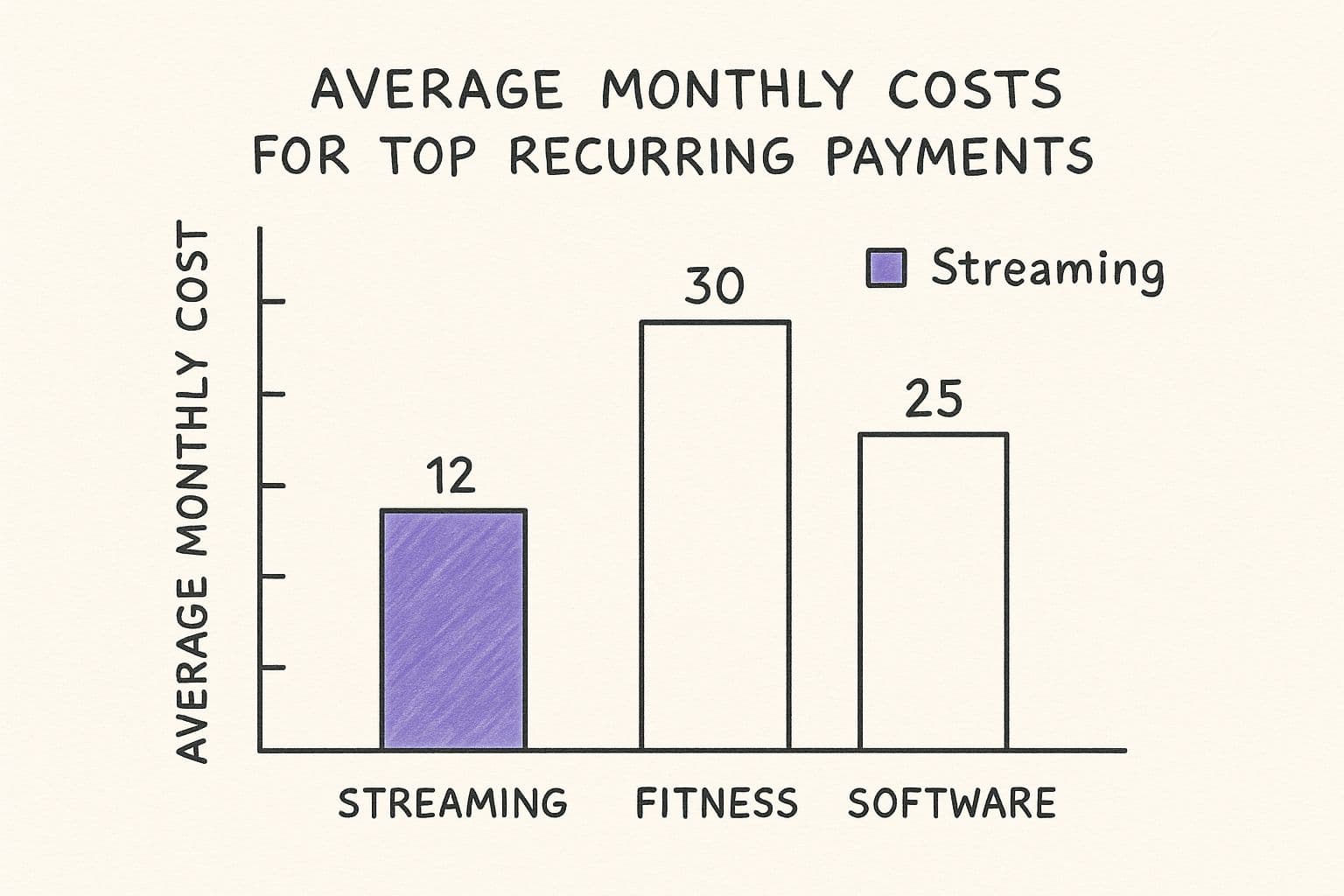

Getting a handle on your spending habits is the first step. This chart breaks down the average monthly costs for some common recurring payments.

1d217ce6-e041-4589-8846-3b2900e05ccb.jpg

As you can see, those small subscriptions for fitness apps and software add up fast, making it vital to manage them proactively.

For businesses on the other side of this, it's so important to stick to ethical billing, which is something we cover in our guide on subscription model best practices. By avoiding these simple mistakes, you can make sure that when you cancel a service, it actually stays cancelled.

A Few Common Questions About Cancelling Payments

eb374b14-ee0d-494a-b698-8b1e79d16d11.jpg

Even when you know the rules, things can get messy. Let's tackle some of the most common "what if" scenarios head-on. These are the awkward grey areas people get stuck in all the time.

Can a Company Just Refuse to Cancel My Subscription?

Short answer? No. A company can't legally ignore your request to cancel.

But—and this is a big but—they can force you to follow their official cancellation process. That might mean giving them a certain amount of notice, as laid out in the terms you agreed to when you signed up.

If you get frustrated and just cancel the payment directly with your bank, sure, the money will stop leaving your account. The problem is you might technically still be in breach of your contract with them. The best move is always to cancel with the merchant first and get it in writing.

What if They Take a Payment After I’ve Cancelled?

Don't wait. Act immediately.

If it was a Direct Debit, just call your bank. The Direct Debit Guarantee has your back completely, and you are entitled to an instant refund for any payment taken by mistake. Simple as that.

For a card payment (a CPA), the process is a bit different. You need to tell your bank it was an unauthorised charge because you’d already withdrawn permission. This is where your proof comes in handy—forward them the cancellation email or a screenshot to back up your claim.

Key Takeaway: A paper trail is your best friend. Always, always save confirmation emails or grab a screenshot of that final "You've successfully cancelled" screen. This evidence is gold if you ever need to dispute a charge.

Will Cancelling a Payment Mess Up My Credit Score?

Just cancelling a payment method itself, like a Direct Debit, won't directly hit your credit score. The act of stopping a payment isn't reported to credit agencies.

However, the consequence of stopping it might. If cancelling the payment means you default on a credit agreement—think loans, finance plans, or credit cards—that missed payment could absolutely be reported. That's what does the damage to your score.

Ready to build your own recurring revenue stream, but want to do it the right way? With MyMembers, you can manage your Telegram community subscriptions without the headache, giving your members a seamless experience from the moment they sign up to the day they (might) cancel. Build your business, not your admin workload. Get started with MyMembers today.